Return to flip book view

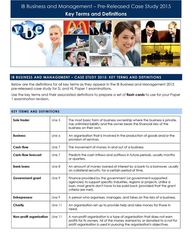

IB Business and Management Pre Released Case Study 2015 Key Terms and Definitions IB Business and Management www IBBusinessandManagement com IB BUSINESS AND MANAGEMENT CASE STUDY 2015 KEY TERMS AND DEFINITIONS Below are the definitions for all key terms as they appear in the IB Business and Management 2015 pre released case study for SL and HL Paper 1 examinations Use the key terms and their associated definitions to prepare a set of flash cards to use for your Paper 1 examination revision KEY TERMS AND DEFINITIONS Sole trader Line 5 The most basic form of business ownership where the business is private has unlimited liability and the owner bears the financial risks of the business on their own Business Line 6 An organisation that is involved in the production of goods and or the provision of services Cash flow Line 7 The movement of money in and out of a business Cash flow forecast Line 7 Predicts the cash inflows and outflows in future periods usually months or quarters Bank loans Line 8 An amount of money loaned at interest by a bank to a borrower usually on collateral security for a certain period of time Government grant Line 9 Finance provided by the government or government supported agencies to support specific industries regions or projects Unlike a loan most grants don t have to be paid back provided that the grant criteria are met Entrepreneur Line 9 A person who organises manages and takes on the risks of a business Charity Line 11 An organisation set up to provide help and raise money for those in need Non profit organisation Line 11 A non profit organisation is a type of organisation that does not earn profits for its owners All of the money earned by or donated to a not for profit organisation is used in pursuing the organisation s objectives

IB Business and Management Pre Released Case Study 2015 Key Terms and Definitions Mission statement Line 11 A short specific written statement of the reason a business exists and what it wants to achieve Wage Line 13 An amount of money paid to an employee at a specific rate per hour worked Training Line 13 An organisation s planned efforts to help employees acquire job related knowledge skills abilities and behaviors with the goal of applying these on the job Fringe benefits Line 13 Incentives received in addition to a base salary or wage such as medical insurance company car etc Profits Line 14 A financial gain especially the difference between the amount earned and the amount spent in buying operating or producing a good or a service Contract Line 27 A written or spoken agreement especially one concerning employment sales or tenancy that is intended to be enforceable by law Negotiation Line 28 A mutual discussion and arrangement of the terms of a transaction or agreement the negotiation of an employment contract Agent Line 28 A person who acts on behalf of another in particular a business manager Targeting Line 32 A strategy in which marketers evaluate the attractiveness of each potential segment and decide in which of these groups they will invest resources to try to turn them into customers Market Line 32 An actual or nominal place where the trade in goods and services between customers and suppliers takes place Promotion Line 32 A marketing function needed to communicate information about goods services images and or ideas to achieve a desired outcome Marketing element referring to the various types of communications that marketers use to inform persuade or remind customers of their products Income Line 34 A gain measured in money that derives from capital or labour also the amount of such gain received by an individual or an organisation in a given period of time Copyright Line 34 A grant of exclusive rights to sell a literary musical or artistic work Royalties Line 35 Payment to the holder of a patent or copyright or resource for the right to use their property Accountant Line 35 A person who plans summarises analyses and interprets accounting information Final accounts Line 35 The annual financial statements that all limited companies are legally obliged by the authorities to report including the Balance Sheet and