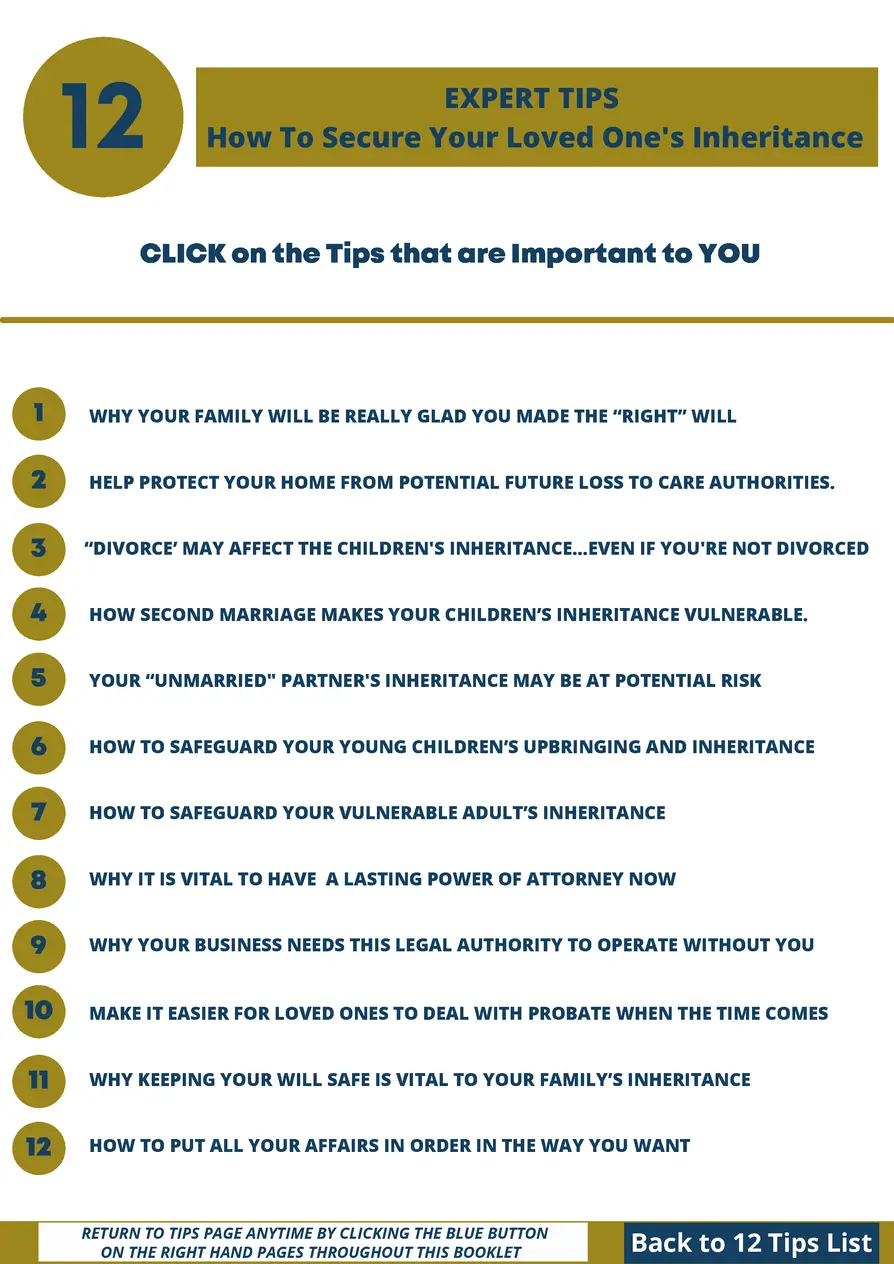

How To Help Secure

Your Loved One's

Inheritance

12

Valuable Tips

from our experts

Why it is important to make your Will Now

We all want to live a long and happy life and whilst we don't want to think about it,

we do know that one day our time on this planet will come to its natural end through

old age, or even unexpectedly through accident or illness.

Throughout our life’s journey, we see the value and importance of protecting our

assets, our income, and even our lives. Yet, when it comes to planning for what

happens to everything we have worked for all our lives when we are gone, we can be

a bit prone to procrastination, putting it off and, sometimes, even leaving it too late.

“One million people lost part of their inheritance to others,

all because there was no Will”

National Consumer Council report on Wills

You could leave it all to chance and let the strict government Rules of Intestacy

decide what happens to everything you have worked for all your life…or you can let

Secure Inheritance Legal Services help you ensure it goes to the loved ones that

you choose, and not to “unintended” others.

Your family will be glad you made the "Right" Will for them

Here at Secure Inheritance Legal Services we don’t just “do” Wills, we get to know

what is important to you and the outcome that you want for your family.

Experts in Wills, Trusts and Estate Planning, our legal team then set about creating

the “Right” Will and planning strategy for you to help ensure your loved ones inherit

in the way you want in total accordance with your wishes... so that you can get on

with living your life with full peace of mind.

Over the years our dedicated team has helped thousands of families make it easier to

secure their children's inheritance and we will be delighted to do the same for you and

your family.

We can visit you at your home or via Zoom, Facetime or Phone.

Call 07584 502 545 and let us help secure Your family's inheritance

Secure your loved one's inheritance

more easily and effectively

Call 07584 502 545 www.secureinheritance.co.uk

People you wanted to inherit may not.

Others you didn’t want to inherit may do

so. Others may inherit more or less than

you wanted them to inherit. There is no

clear certainty for anybody left behind.

Some people may be happy, some others

disappointed which could lead to family

tensions and disputes. Leaving things to

chance is probably not ideal.

With the “Right” Will and Professional Planning

you can help ensure loved ones inherit as per your wishes

1

Without A Will - Government Rules

decide who inherits what

With A Basic Will – You can have a say

in who inherits what.

This gives much more certainty as your

chosen loved ones are named in your Will.

A basic Will is much better than having no

Will, but it has limitations in that it cannot

offer flexibility or protection to your

beneficiaries or estate. If any claims are

made then, after all the claims are

deducted, this may reduce what's left to

go to those named in your Will.

The "Right" Will for you is tailored to meet your family’s personal needs and your

wishes. It can help ensure that as much as possible of everything you have worked hard for

all your life goes to those you have chosen and not to “unintended” others such as care

authorities, tax departments, future spouses and their children, and, in some cases, even a

potential ex-daughter or son-in-law. (See valuable tip numbers 2, 3 and 4).

Why your family will be really glad you made the “Right” Will

When our life comes to its natural end, or in some cases unexpectedly early through

accident or sudden illness, then everything we have (our Estate) is now going to go to

others (your Beneficiaries). But to who exactly, and in what way?

Valuable

Tip

You have probably worked hard all your life for everything you have

Why leave it all to chance when you can leave it to those you love

Call 07584 502 545

www.secureinheritance.co.uk

Your house is more than just bricks and mortar

Valuable

Tip

Help

prevent

and

manage

unnecessary

potential

loss

of

your

home

to

future

care

fees

It is estimated that between 40,000 and 70,000 people a year are forced

to sell their homes to pay for nursing care fees

2

With A Basic Will –

you say who you want

to inherit your home

The Right Will and

appropriate planning

Whilst this gives some certainty of who

inherits, a basic Will cannot offer any

protection and your home may still be

100% vulnerable to care fee means-

testing. This could significantly reduce

the inheritance value your loved ones

ultimately receive.

With the right Will and suitable planning

strategies, it is possible to reduce your

home's vulnerability to the impact of

care fees. This has the potential to help

ensure that your children's inheritance

is better protected should the surviving

spouse ever go in to care in the future.

Despite numerous government promises over the years, thousands of people are still

being forced to sell their homes to pay for their care fees. Should you ever need long-term

care in the future, this could significantly affect the inheritance your children receive.

Your house is likely to be the most valuable asset you have and you probably want to

see it ultimately pass down to your children. But also, your house is not just "a house"...

it is your home , the place you raised your children , perhaps where your grandchildren

come to visit and stay with you. Your home is full of memories and you may want a choice

about what happens to your home rather than authorities determining the outcome.

Under current Care means testing rules it is possible for your

children to be left with as little as £14,500 to inherit.

Call

07584502545

mailplus.co.uk 23rd November 2021

www.secureinheritance.co.uk

You may not want that inheritance to go to others

Valuable

Tip

3

How "divorce" could impact your children's inheritance

...even if You are Not divorced

If you are divorced and a financial settlement has taken place then it is highly unlikely

your divorced spouse can make any claim to your estate when you die. However, if you are

separated BUT not divorced, your “separated” spouse could make a claim on your estate.

"I have never been divorced or separated so

how could this apply to me and my children's inheritance?

Indirectly, “divorce” could impact the

inheritance you leave to your child.

Your ex- daughter/son -in-law end up

with part of your child's inheritance

You leave an inheritance such as your

house, savings or both to your adult son

(or daughter). Sometime after receiving

that inheritance your son and his wife

get divorced, it could even be his wife

who instigates the divorce leaving your

son devastated.

The inheritance you left your son could

become part of the divorce settlement,

which means your now ex-daughter-in-

law could benefit from the inheritance

you left your son. This may be a bitter pill

to swallow for your son and could create

ongoing tensions for some years.

Leaving an inheritance "directly" to your adult child can make it a potential target for

claims such as a divorce settlement or other unexpected creditors. An unprotected

inheritance gifted from your estate means that the value of that inheritance is owned 100%

by your adult child. Any potential claim against them by divorce lawyers or from any other

creditors could see that inheritance as a legitimate target.

If your adult child got divorced, part of the inheritance you left them

could end up going to your ex son/daughter-in-law

Call 07584 502 545

www.secureinheritance.co.uk

Valuable

Tip

4

Second marriage could put your children's inheritance at risk

People get divorced and a significant number of them marry again, some more than once.

“Around 40% of all weddings in the UK are second or subsequent marriages (and that

doesn't take into account cohabitations).” The Guardian

Divorce does NOT

invalidate your Will

Second Marriage DOES

invalidate your Will

If a couple gets divorced and a settlement

takes place then the ex-spouse is no

longer deemed a beneficiary of the other

spouse's Will (unless the other spouse still

wants them to be). The Will is still valid in

respect to all other named beneficiaries

which are often their children.

A divorced spouse may well choose to get

married again. In many cases, they will

bring children and assets from the first

marriage. In a second marriage, this often

results in a "blended family". This second

Marriage now automatically invalidates

any prior Wills.

How and why YOUR children's inheritance

can be at risk in a second marriage

If there’s no new Will, ultimately, the new second spouse will inherit all the "goods and

chattels" and the first £322,000 of the estate... the children receive part of whatever is left.

If there is a basic Will. Typically, when the first spouse dies the surviving spouse inherits

everything. When the second spouse dies, children inherit as per the wishes of each spouse.

However, if the surviving spouse decided to change his/her Will, (perhaps as a result of

a falling out with their stepchildren), the surviving spouse could end up leaving everything

to THEIR own children which means YOUR children could end up with little or nothing.

Second marriage can be a wonderful experience for many, but just

assuming your children will inherit can leave them at risk of loss

www.secureinheritance.co.uk

Without a Will your unmarried partner faces uncertainty

Valuable

Tip

You are living together in an “unmarried partnership”. When the first partner dies, you

may assume that the surviving partner will inherit all the deceased partner's assets. But

this is not necessarily the case. if there is no civil partnership and there's NO WILL, then

only joint assets will pass to the surviving partner. Any assets that are solely in the name

of the deceased partner will NOT automatically pass to the surviving partner.

5

Your "unmarried" partner's inheritance

may be at serious risk

Your unmarried partner is

NOT your legal next of kin

And, if there are no children

In an unmarried partnership, your partner

is not legally deemed your next of kin. If

the deceased partner has a child from a

previous relationship or a child with you,

they are deemed to be the next of kin and

everything solely in the deceased’s name

will pass directly to the children.

If there are no children and the deceased

partner has a parent alive then, under the

rules of intestacy, that parent will be

deemed the deceased's next of kin, and

everything would go to them. If there is

no parent alive then it would go to a

brother, sister and so on.

If there is no Will in an unmarried partner relationship then the outcome for the

surviving unmarried partner can be somewhat precarious, and they could be seriously

disadvantaged. Unless there is a valid Will in place naming them as a beneficiary and stating

what they are to inherit then, whatever their deceased may have wanted their partner to

receive could legally end up going to "unintended" others. This could create undue stress.

As an unmarried couple, your partner is not your next of kin

and could end up with little or even nothing from your estate

Call 07584 502 545

www.secureinheritance.co.uk

With a Will you can legally name the children's guardians

Valuable

Tip

How to safeguard your young children's upbringing

and their inheritance

We all hope to have a long and healthy life. Unfortunately, life is unpredictable and

accidents or sudden serious illnesses do happen... regrettably, there is no guarantee of

those later years. If you have young children and something happened to you what would

you want to happen to your young children left behind, and where does it legally say that?

Your Young Children

and No Will

Where does it say who YOU want

to raise your young children

Under Government Rules of Intestacy,

their inheritance would be required to

be managed until each child reached

the statutory age of 18 years old. They

would then have full access to their

inheritance money to spend how and

as they like… at 18 years of age!

If there is no Will stating guardianship

details then the Courts would need to

appoint guardians. In extreme cases,

your children may have to be put into

temporary care until a Court ruling is

made and the person(s) may not be who

you would have chosen yourself.

As parents of children under the age of 18 years, you may want to stipulate who you

would want to raise your children in such an event. You may also want to say how you

want their inheritance to be managed and used in their best interests until they reach the

age you decide they are mature enough to inherit in full. You may want that age to be older

than the statutory age of 18, perhaps 21 or 25 years old.

If something happened and you have not legally stated who you want

as guardians of your children, the courts may have to decide.

6

Call 07584 502 545

www.secureinheritance.co.uk

It is important to get good advice about the right Will

Valuable

Tip

As the parent of a vulnerable child with a disability, when it comes to leaving them an

inheritance you might have some concerns. You may feel that your child might not be able

to manage a significant sum; it could become a responsibility they find to be very stressful,

not to mention the possible "influence" of others on how they should spend it.

7

How to safeguard your vulnerable child's inheritance

Making Your Will around your

child's special needs

Assuming siblings will provide for

their vulnerable brother / sister

As the parent of a vulnerable child making

your Will probably requires some added

forethought. You want to provide comfort,

financial security as much as you can. At

the same time you need to be aware how

their inheritance may disadvantage them

when it comes to getting their state benefit

entitlements.

You may even consider leaving the whole

inheritance to your other child/children

assuming that they will ensure adequate

provision for their vulnerable sibling from

that inheritance. It's a risky strategy and

could create substantial anxiety and even

friction in what was previously a caring

sibling relationship.

It is the most natural thing for a parent to want to leave an inheritance to

their vulnerable child, yet it can also be quite a challenge trying to ensure your

Will is drafted in the absolute best interests of your child.

Leaving your vulnerable child an inheritance without protection

in place could impact their state benefits

Call 07584 502 545

www.secureinheritance.co.uk

Valuable

Tip

8

Why a Lasting Power of Attorney is a vital document

you should have NOW

Make your Will helps ensure that your family is looked after the way you want when you

are gone…but what about YOU…whilst you are still here? Who would look after your

affairs whilst you are alive, if you were ever unable to do so yourself in the future?

"My spouse could automatically

look after my affairs"

If at any time, you ever become unable to

make your own decisions, perhaps as a

result of an accident or serious illness,

then you may think your spouse, family

member or friend could AUTOMATICALLY

look after all your affairs for you…operate

your bank accounts, pay your bills, even

make decisions about your personal

welfare.... But could they?

Without the correct legal authority in place, family cannot automatically look after

your affairs. Your bank accounts may be restricted making it a very stressful time for your

family. The Court of Protection would have to appoint somebody to have that legal

authority. That can be costly, take months, and it may not be who you would have chosen.

A Lasting Power of Attorney (LPA) enables you

to choose and appoint somebody NOW

Call 07584 502 545

www.secureinheritance.co.uk

Making your Lasting Power of Attorney Now will give you

and your family peace of mind for the rest of your life

PLEASE WATCH THIS VIDEO

Why it's never too early

to Make Your LPA

... But why it can be too late

Valuable

Tip

9

Ensure somebody has the legal authority to operate your

business without you being there

As a business owner you may have considered who you would want to run your business if

ever in the future you were to become incapacitated; you may even have insurances in

place to cover the costs of you not being there. But,one thing often overlooked is this…

If your incapacity restricted your ability to make your own decisions e.g. you had a serious illness,

in a coma, or had a serious brain injury, then where does it LEGALLY say who has your authority

to run the bank accounts, pay staff, order stock, accept payments, make business decisions etc,

"My partner or spouse could

automatically look after my affairs"

Without the correct legal

authority in place they CAN'T

If you were ever unable to make your own

decisions you would be deemed to be a

vulnerable person. Not having in place the

legal authority required to act could result

in some serious consequences for your

business. In order to protect its own

interests, your bank may be quick to

restrict or freeze your accounts, halt

overdraft facilities, even call upon loans.

At that time, the Court of Protection

would have to grant somebody the legal

authority to act on your behalf. That can

take many months to establish and be a

costly process. Plus, the Court may well

appoint somebody you would not have

chosen yourself. Meanwhile, your staff

and your business could experience

significant disruption or much worse.

A Business Lasting Power of Attorney (BLPA)

is a vital legal document for your business.

Mak your BLPA NOW, while you still can. This enables you to choose and appoint a

person(s) who YOU want to be able to look after your business affairs if ever you were to

find yourself unable to do so at any time in the future.

Without a BLPA in place your family will need to go through the

stressful and costly experience of the Court of Protection process

Call 07584 502 545

www.secureinheritance.co.uk

Being an executor comes with important responsibilities

Valuable

Tip

10

Some people like to appoint a spouse or son/daughter as the executor on their Will,

perhaps to avoid having to pay a solicitor's fees or to maintain more control. Whilst being

an executor doesn't have to be complicated, often people can find it confusing, time

consuming, and stressful trying to follow unfamiliar rules and Probate Legal Procedures.

Make it easier for your loved ones to deal with Probate

when the time comes

The legal duties of

your executor include

Your executor is legally

responsible and liable

Registering the death and getting certified

copies required by all relevant institutions.

Arrange the funeral. Though a duty of the

executor, often this is done by the family.

Obtain the Will. Ensure you understand the

Will, particularly any unfamiliar clauses.

Apply for a Grant of Probate.

Open a personal representatives bank

account for the estate monies.

Inform relevant persons, banks, insurance

companies, employers, benefits agencies,

tax authorities, etc.

Arrange an estate evaluation. List all of

the deceased's assets, house, contents,

shares, life insurance and personal goods.

Draw up a schedule of debts to be paid

by the estate, mortgage, loans, credit

cards, taxes etc.

Complete the mandatory tax forms.

Establish if Inheritance Tax is payable

which must be paid first before any others.

Distribute the estate as per the Will

Keep all records for any queries as the

executor is personally responsible and liable.

Probate and Will Administration is an official legal process. Whilst it can be in the

realms of family members to perform, it is also a new and unfamiliar experience for most

people, and is a responsibility that comes to them at what is often a sad and difficult time.

Your executors are personally responsible and liable for the

duties they perform at what is usually a most difficult time

Call 07584 502 545

www.secureinheritance.co.uk

We can make it easier to keep your Will safe and up to date

Valuable

Tip

11

Why keeping your Will safe and up to date is the vital key

to your family's inheritance

So you make your Will that you feel is totally the right one for you and can relax knowing that,

when the time comes, everything will pass down smoothly to your chosen loved ones. Well,

that SHOULD be the case, subject to one very important condition….that, when the time comes,

your Will is definitely found, correctly signed, dated and witnessed and in good condition.

If your Will cannot be found

when it is needed

A copy Will is NOT your original

valid legal Will

Everything that was stated in your Will,

who you wanted to inherit, and what you

wanted them to receive, together with

any Protective Trusts that may be in your

Will are now legally ineffective. Because

your Will is unable to be found when it is

needed, you are now deemed to have

died without a legally valid Will.

If you have a signed copy of the Will, any

attempt to legally authorize the copy can

be stressful, expensive, time consuming,

with no guarantee the Court will uphold it.

If that is the case, everything you have

worked for all your life will be distributed

according to the strict rules of Intestacy.

Making your Will has all been for nothing.

When you make your Will you may feel that’s all done, that's it. However, over time

circumstances can change. Your financial situation may improve or may deteriorate;

personal relationships can change too and you may feel that you want to re-assess things.

Keeping your Will up to date ensures people inherit according to your most current wishes.

If your Will can't be found then your loved ones may not inherit

as per your wishes and unintended others may inherit

Call 07584 502 545

www.secureinheritance.co.uk

Valuable

Tip

12

Put ALL Your affairs in order and just

enjoy getting on with living your life

A basic Will gives you a say in who inherits what.

The “Right” Will and Good Planning can give the added flexibility and protection YOU want.

You know you want a Will

But what IS the "right" Will for You ?

Putting ALL your affairs in

order with Good Planning

Yes you know you should have a Will, but

you want more than just "a Will." You want

to know that the Will and Planning you have

can help ensure your family will receive the

maximum possible. You also want to know

you have done as much as you can to cover

all the eventualities that are important to

you and your family.

The right Will for you is the legal document

that provides the framework to give you the

outcome you want for you and your family.

Professional lifetime planning is the strategy

that complements your Will to help ensure

that, as your circumstances change, and as

the various rules and regulations change, the

outcome you want is always kept on track.

Have the Right Will for you with professional personalised planning around your Will.

Put in place flexible and protective measures needed to ensure the outcome for you and your

family, whilst you are still here, when you're no longer here, and for many years after you're gone.

Make your LPA now so that somebody you have chosen can automatically look after your affairs

on your behalf should you ever lose the ability to do so for yourself, at any time in the future.

Ensure your Will is safely stored, so it can be easily found when needed and is up to date with

your most current wishes.

Provide our Executors with the professional help and guidance that makes carrying out their

duties much easier and safer for them when the time comes.

THAT is putting ALL your affairs in order

for Your complete peace of mind

Call 07584 502 545

www.secureinheritance.co.uk

Dont leave it to chance...

Leave it to those you love

Call

07584 502 545

www.secureinheritance.co.uk

john.kelly@secureinheritance.co.uk

Helping Protect Your Loved One's Inheritance