Return to flip book view

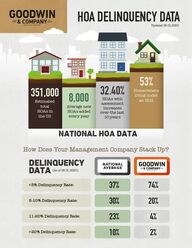

<5% Delinquency Rate:5-10% Delinquency Rate: 11-20% Delinquency Rate:>20% Delinquency Rate:DEINUNCDAA (As of 09.01.2020)NATIONALAVERAGE37% 74%30% 20%23% 4%10% 2%HOA DELINQUENCY DATAUpdated 09.01.2020NAINA HO DAA32.40%HOAs with assessment increases over the last 10 years53%Homeowners living under an HOA351,000Estimated total HOAs in the US8,000Average new HOAs added every yearHow Does Your Management Company Stack Up?

TO 1 MOT OPLAEDHO SATAlabamaAlaskaColoradoConnecticutDelawareDistrict of ColumbiaFloridaHawaiiIllinoisMarylandMassachusettsMinnesotaMissouriNevadaNew HampshireNew JerseyOregonPennsylvaniaPuerto RicoRhode IslandVermontWashingtonWest VirginiaFlorida*48,250CommunitiesCalifornia48,150CommunitiesTexas20,050CommunitiesGeorgia10,700CommunitiesIllinois*18,700CommunitiesNorth Carolina18,700Communities3Arizona9,625Communities1021Washington*10,450Communities98New York13,875Communities6Massachusetts*11,000Communities745*SUER IN TAESHOA Lien has priority over first-mortgage holder

goodwintx.comHOCMUNISB ER50% of HOAs have INCREASEDtheir ASSESSMENTS40% of HOAs have REDUCED CONTRIBUTIONS to their reserve accounts39% of HOAs have REDUCED theirLANDSCAPING services38% of HOAs have DEFERRED MAINTENANCE of their common areas38% of HOAs have POSTPONED planned CAPITAL IMPROVEMENTS28% of HOAs have REDUCEDMANAGEMENT FEES22% of HOAs have REDUCED their reserve CASH BALANCE20% of HOAs have LEVIED a SPECIAL ASSESSMENTAssessment delinquency ratestripled between 2005 to 201170% of bank-backed mortgages areNOT ON TIME with their assessment payments (failure to pay when assessments are due)FALOT OF20 REESIN(Based on data collected in 2011)197019902010201836,000 HOAs29.6 million Residents822 Residents per Community10,000 HOAs2.1 million Residents210 Residents per Community347,000 HOAs73.5 million Residents212 Residents per Community311,000 HOAs62 million Residents199Residents per Community