Return to flip book view

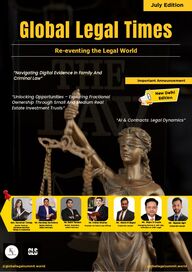

Message @globallegalsummit.world globallegalsummit.worldGlobal Legal TimesRe-eventing the Legal WorldImportant AnnouncementImportant AnnouncementJuly EditionNew DelhiNew DelhiEditionEditionAdv. Kanchan TalrejaAdv. Kanchan TalrejaSenior Partner,Senior Partner,Advocate Advocate KanchanKanchanTalreja & AssociatesTalreja & AssociatesMr. Hardeep SachdevaMr. Hardeep SachdevaSenior Partner,Senior Partner,AZB & PartnersAZB & PartnersMr. Sahil TandonMr. Sahil TandonSenior Associate,Senior Associate,AZB & PartnersAZB & PartnersMr. Vishal KhattarMr. Vishal Khattar Founder at Patine Law OfficesFounder at Patine Law OfficesMr.Mr. Alankrit BajpaiAlankrit BajpaiCorporate LawyerCorporate LawyerMr.Mr. Rajan D GuptaRajan D GuptaManaging Partner & Ashi Jain,Managing Partner & Ashi Jain,Associate at CHRI LegalAssociate at CHRI LegalMr.Mr. Rajveer AgriRajveer AgriCorporate LawyerCorporate Lawyer“Navigating Digital Evidence In Family And“Navigating Digital Evidence In Family AndCriminal Law”Criminal Law”“Unlocking Opportunities – Exploring FractionalOwnership Through Small And Medium RealEstate Investment Trusts”“AI & Contracts: Legal Dynamics”

CEONote from the02Dear Readers of Global Legal Times,I trust this message finds you well. It's my privilege to extend a warmwelcome to you as readers of our esteemed publication, Global Legal Times.At the heart of our mission at the Global Legal Summit is the aspiration to fosterknowledge-sharing, promote networking, and recognize excellence within the legalcommunity on a global scale. Our aim is to create a platform where legalprofessionals can come together, exchange ideas, and inspire one another. Global Legal Times serves as an integral part of this vision. This magazine is notjust a periodical but a conduit through which we aim to achieve these objectives.It's a space where we bring you the latest legal news updates, offering insights intothe ever-evolving legal landscape. We delve into international judicialdevelopments and emerging trends, providing you with a panoramic view of thelegal world.Our commitment to excellence extends to our interviews with legal personalitieswho have left an indelible mark on the profession. These candid conversationsdelve into their personal journeys, challenges faced, and insights gained,allowing you to learn from the best in the field.Each edition of Global Legal Times features a cover story that delves deep into acurrent legal topic or issue of global significance. We strive to provide you with acomprehensive understanding of the subject matter, allowing you to stay ahead ofthe curve in the legal arena.In essence, this magazine is designed to be your trusted companion in the legalrealm, offering you the knowledge and perspectives needed to thrive in today'sdynamic legal landscape. We invite you to immerse yourself in the content, engagewith the ideas presented, and be an active part of the global legal conversation.Thank you for joining us on this journey. Your readership and engagement areinstrumental in making Global Legal Times a vital resource for legal professionalsworldwide.Warm regards,Bharti SinghCEO, Global Legal SummitGlobal Legal TimesEditor In-chiefPublishing DirectorReasearch AnalystCirculation Managed bySenior Projects & EventsChief of ProductionAll rights reserved around the world.Production in any manner is prohibited.Printed and published by Bharti Singh on behalfof Evenement Investiture Private LimitedContact Us-gls@evenement.worldVansh DhallVivek DasAman ChaudharyPrachi SinghRaima BanikArt and PhotographyDirectorKrishna Singh

The Impact Of RERA On The Indian Real EstateIndustry: A Transformative JourneyNCDRC Ruling on Panchsheel Greens II: Relief for FlatBuyersAI & Contracts: Legal DynamicsNavigating Digital Evidence In Family And CriminalLawExit Strategies: Planning For Successful Exits InPrivate Equity Investments In India And DubaiImportant Announcement061214172023 TABLE OF CONTENTGlobal Legal Times 03Unlocking Opportunities – Exploring Fractional OwnershipThrough Small and Medium Real Estate Investment Trusts07

GLOBAL LEGAL TIMESGLOBAL LEGAL TIMES04Global Legal Times is your dependablemonthly guide to the ever-evolving worldof law. Within each edition, weundertake a thorough exploration of themany facets of the legal landscape,offering a wealth of knowledge,expertise, and insights.Our magazine serves as a reliable sourcefor staying informed about the dynamiclegal realm. We provide the latest legalupdates, ensuring you are well-versed inlegislative changes, significant courtdecisions, and evolving regulations. Thisknowledge equips you to navigate theintricacies of the legal field confidently.However, Global Legal Times goesbeyond mere news reporting. It is aplatform for in-depth exploration. Ourexpert analyses and commentaries offernuanced perspectives on trending legaltopics. We engage legal luminaries,scholars, and thought leaders to sharetheir wisdom, providing a well-roundedview of critical issues affecting the legalcommunity.Central to our magazine are exclusiveinterviews with legal personalities whohave made enduring contributions to theprofession. These conversations delveinto their personal journeys, thechallenges they've encountered, and theinsights they've gathered. It's anopportunity to glean wisdom from someof the most prominent figures in thefield.We take pride in our global perspective. The legallandscape extends beyond borders, and so doesour coverage. We offer insights into cross-jurisdictional matters and global legal trends,ensuring you are well-informed aboutinternational legal affairs.Our interactive content, including videos,infographics, and interactive tools, simplifies eventhe most complex legal topics, making themaccessible and engaging. You can activelyparticipate in our content through comments,questions, and discussions, fostering a dynamicreading experience.Beyond the courtroom, we explore the legallifestyle, offering wellness tips tailored to legalprofessionals, career development insights, bookreviews, and more. These features are designed toenrich your personal and professional life.As the official publication of the Global LegalSummit, Global Legal Times providescomprehensive coverage of this prestigious event.You can delve into speaker profiles, sessionhighlights, and behind-the-scenes glimpses,ensuring your active participation in this global legalphenomenon.Join us on this informative journey through the legaluniverse. Whether you're a legal professional,enthusiast, or simply curious, Global Legal Times isyour trusted companion, providing impactfulinsights and a deeper understanding of the legalworld with every read. Welcome to the future oflegal enlightenment with us.

EvenementInvestitureWe are a premier event-designing organization,passionately committed to crafting unforgettableexperiences for our esteemed clients. Backed with ateam of young, dynamic and skilled individuals, wetake immense pride in our unwavering dedication toexcellence in successfully planning and executingcorporate events around the country.Our team of seasoned professionals possesses awealth of experience that enable us to meticulouslyidentify, design and deliver exceptional results thatalign with our clients’ distinctive needs and goals.We are driven by a strong organizational belief thatevery event is unique, and thrive to make it a truereflection of the cause it seeks to disseminate. Ourservices range from a detailed pre-conferenceplanning to flawless onsite management and ahassle-free post-conference wrap-up.In addition to our focus on corporate events, we arethrilled to announce that we will be hosting prestigious global summits: the Global Legal Summit,the Global Education Summit. These high-profilegatherings will bring together industry leaders on asingle stage, exchanging ideas and celebratingremarkable impressions in their respective fields.We are not just an organization doing business, weare a growing family of people who love curatinglasting experiences for everyone. With our strongfocus on values, we are poised to re-event yourimagination into reality.

GLOBALR e - e v e n t i n g t h e w o r l dLEGAL SUMMIT15-16 November’24Brace yourselves, India! The Global Legal Summit is making its granddebut, promising a symphony of legal luminaries, groundbreakinginsights, and a celebration of excellence. Get ready to witness thefuture of legal convergence!CONTACT US+91 8447 692430www.gloabllegalsummit.worldgls@evenement.worldFirst time in IndiaINDIAN EDITION IS HERENew Delhi, India

UNLOCKING OPPORTUNITIES – EXPLORING FRACTIONAL OWNERSHIPTHROUGH SMALL AND MEDIUM REAL ESTATE INVESTMENT TRUSTS07With over 29 years of experience, Mr. Hardeep Sachdeva, Senior Partner atAZB & Partners, advises Indian andmultinational clients, earning recognitionas India’s leading corporate and M&Alawyer. He works across various sectors,including real estate, retail, e-commerce,and technology, and has been involved inlandmark M&A and private equitytransactions. Hardeep also advises oninvestment strategies, transactionstructures, and India entry strategies forcompanies and foundations.Mr. Sahil Tandon, a Senior Associate atAZB & Partners, is an experienced lawyerwith a demonstrated history in the legalservices industry. He is skilled in bankingand finance, litigation, dispute resolution,infrastructure, and legal due diligence.BACKGROUNDIn the past few years, there has been mushrooming of "web-based" and other platforms & schemes offering fractionalownership of real estate assets and properties ("FOPs").These FOPs provide investors an option to invest inbuildings, office spaces and other commercial real estateassets, etc. The underlying real estate assets offered onsuch FOPs are similar to real estate or property as definedunder the Securities Exchange Board of India (Real EstateInvestment Trusts) Regulations, 2014 ("REIT Regulations").Some of the prominent FOPs in India include Property Share,Hbits, Strataprop, Asset Monk and Myre Capital, amongstothers. Then there are very many unorganized set-ups whichmay lack transparency, governance and shall pose real riskof a potential deception of the investors. Given theincreasing value of real estate investments and the largecustomer & investor base seeking investments into FOPs, theSecurities Exchange Board of India ("SEBI"), to safeguardthe interest of investors, has sought to regulate and bringsuch FOPs as part of the existing REIT (as definedhereinafter) regulatory framework, in order to bring about,inter alia, uniform operating and accounting standards,disclosure practices, ensuring liquidity by way of listing orsimilar measures, investor redressal mechanism, etc. in thefunctioning of such FOPs.With the objective to seek comments, views and suggestionsfrom the public on the proposals for regulating FOPs, SEBIpublished its Consultation Paper dated May 12, 2023, titled'Regulatory Framework for Micro, Small & Medium REITs'("Consultation Paper"). Subsequently, SEBI in its 203rdboard meeting held on November 25, 2023 ("SEBI BoardMeeting"), approved amendments to the REIT Regulationsaiming to bring a separate framework for such FOPs as Smalland Medium REITs ("SM REIT") in terms of the REITRegulations.

NEED FOR REGULATIONPrior to the 2024 Amendment (as defined hereinafter), the Consultation Paper highlighted that some FOPsmay have registered themselves as 'real estate agents' under the provisions of the Real Estate (Regulationand Development) Act, 2016 ("RERA"). However, SEBI noted that while RERA lays down responsibilities of thereal estate agents, including maintaining books of accounts, etc., such responsibilities do not adequatelysafeguard investor concerns, as the context in which RERA operates is completely different from the natureand extent of operations of FOPs.It may also be noted that Special Purpose Vehicles ("SPVs") established by such FOPs are generallyconstituted as a private limited company and are governed by the provisions of the Companies Act, 2013("Companies Act"). This structure of FOPs meant that the SPVs would be able to restrict transferability of theunit shares. Further, the Companies Act restricts the number of investors in a private limited company to 200and given how FOPs obtain interest of participation from the members of public, SEBI noted the possibilitythat such SPVs may undertake a deemed public issue ("DPI") without attendant compliances of issuingprospectus or the necessary filings with SEBI. FOPs may also be organizing investors interested in the samereal estate into more than one SPV to remain below the threshold of DPI.AMENDMENTS TO THE REGULATIONSSEBI on March 08, 2024, notified amendments to the REIT Regulations ("2024 Amendment"). Initially, thefocus of the REIT Regulations was on regulating large REITs with minimum real estate assets of at least Rs500 crore. However, SEBI has widened the definition of "REIT" under the REIT Regulations as amended perby the 2024 Amendment, a REIT shall mean 'a person that pools rupees fifty crores or more for the purposeof issuing units to at least two hundred investors so as to acquire and manage real estate asset(s) orproperty(ies), that would entitle such investors to receive the income generated therefrom without givingthem the day-to-day control over the management and operation of such real estate asset(s) orproperty(ies).'Pursuant to the 2024 Amendment to the REIT Regulations, Chapter VIB has been inserted in the REITRegulations which regulates FOPs and brings them within the ambit of the REIT Regulations as SM REITs.In this article we highlight some of the key considerations for inter alia registration, investment and othergovernance norms prescribed by the 2024 Amendments for SM REITs.08

09REGISTRATION AND ELIGIBILITY CRITERIA1.Registration and Eligibility CriteriaThe 2024 Amendment has introduced the concept of "Investment Manager" for SM REITs, akin to theSponsor/ Manager of a typical REIT, which shall be a company incorporated in India having a minimum of 2years of experience in real estate industry or real estate fund management and having a net worth of not lessthan Rs. 20 Crore, which sets up an SM REIT and manages assets and investments of SM REITs andundertakes its operational activities. The SM REITs are required to launch a "Scheme" which shall be a distinct and a separate scheme of an SMREIT for owning of real estate assets or properties through SPVs. The units of a Scheme shall be offered to aminimum of 200 investors, apart from the Investment Manager and its related parties, and shall bemandatorily listed on the recognized stock exchange(s) having nationwide trading terminals. The offerdocument for the Scheme shall include all disclosures as specified under Schedule III of the REIT Regulationsand shall not offer any guaranteed returns to the investors.The Investment Manager will be required to submit an application for grant of certificate of registration onbehalf of the SM REIT as per Form-A of the REIT Regulations. It is pertinent to note that SEBI recognising thedifficulties for existing FOPs to migrate to the newly prescribed SM REIT structure, has introduced a provisionto accommodate existing individuals, entities, or structures holding real estate akin to an SM REIT, subject toan application being filed by the existing FOPs within 6 months from the 2024 Amendment. 2.Conditions for initial offer and mandatoryunitholding requirementsSEBI has prescribed inter alia the following conditions to beadhered to by Investment Managers for the initial offer ofunits of the SM REIT:identification of real estate assets or properties itproposes to acquire; 1.the minimum price of each unit of the scheme of the SMREIT shall be Rs. 10 Lakh; 2.the value of real estate assets or properties in eachscheme shall be at least Rs. 50 Crore; 3.the Investment Manager and the trustee shall ensurethat the assets of each scheme, the bank accounts,investment or demat accounts and the books ofaccounts of each scheme are segregated and ring-fenced; 4.the units shall only be issued in dematerialised form; and5.the investment manager and trustee must securely storeall title documents and related documents, in safe-deposit boxes at a commercial bank (which shall beinspected by the trustee on an annual basis).6.The minimum offer and allotment to the public in each Scheme of SM REIT shall be at least 25% of the totaloutstanding units of such Scheme. In the event that an SM REIT fails to make an initial offer of a Schemewithin 3 years from the date of registration with SEBI, it shall be required to surrender its certificate ofregistration to SEBI and shall cease to operate as an SM REIT.

INVESTMENT CONDITIONS, VALUATION AND DISTRIBUTIONS1.Investment conditionsPreviously, investments in FOPs were perceived as risky due to their involvement in projects whereconstruction had yet to commence or were stalled due to permit issues, however, to safeguard investorinterests, the 2024 Amendment mandates that a minimum of 95% of a scheme's assets must be invested incompleted properties and revenue generating properties, with the remainder 5% allocated to liquid assets.The 2024 Amendment also mandates the SPV to directly and solely own all the assets that are acquiredand/or are proposed to be acquired by the scheme of the SM REIT. 102.Valuation of assetsThe amended REIT Regulations also requires the Investment Manager to undertake and obtain acomprehensive report on the valuation of the assets and physical inspection of each property of every Schemethrough a valuer on an annual basis within 2 months from the end of the financial year. The InvestmentManager is required to disclose the valuation reports to the trustee, designated stock exchanges and theunitholders within 1 working day from the receipt of the report from the valuer.3.DistributionsInvestment Managers are also obligated to ensure that not less than 95% of the distributable cash flows ofthe SPV are distributed to the Scheme. The Investment Manager shall also ensure that 100% of the of the netdistributable cash flows of the Scheme shall be distributed to its unitholders. INVESTMENT INTO SM REITS AND RIGHTS OF UNITHOLDERS1.Modes of fund raisingThe Scheme may raise funds from Indian and foreign investors through issuance of units, subject to anyapplicable conditions or approval requirements pursuant to any guidelines for foreign investment prescribedby the Reserve Bank of India and, or, the Government of India.The Scheme and the SPVs established by the SM REIT may raise capital only through issue of units andthrough equity, respectively. Additionally, SPVs are also permitted to borrow funds from the Scheme.The Scheme and the SPVs may additionally also utilise leverage either through external borrowings or throughissuance of debt securities under applicable SEBI regulations, subject to making the prescribed disclosure inthe offer document of the Scheme.

112.Rights and meetings of unitholdersTThe REIT Regulations require the Investment Managerto obtain approval of the unitholders for certain matters.Principally, an approval from the unitholders shall berequired if the Scheme intends to buy or sell a propertyexceeding 105% or falling below 95% of its assessedvalue by the valuer. Such decision may be taken by theunitholders after passing a resolution with at least 66%of the total votes cast.Further, the Investment Manager is required to conductan annual meeting of each Scheme at least once everyyear, within 120 days from the end of each financialyear and the time between two meetings shall notexceed 15 months. At the annual unitholders' meeting,the investment manager is also required to presentcertain key matters for approval of the unitholders,including: (a) the latest annual accounts, audit report,and scheme performance of the SM REIT; (b)appointment and fees of the auditor and valuer; and (c)the most recent valuation reports. These matters requireprior approval of the unitholders in terms of the REITRegulations.CONCLUSIONWith the 2024 Amendment, the FOPs shall be regulatedand Investors will now get some confidence whileinvesting in a regulated asset class, including luxuryresidences that were previously out of reach for someincome groups, according to SEBI's new regulation ofFOPs. As with traditional financial products, investorsshould still proceed with caution, be aware of the dangersinvolved, and consult a professional before making aninvestment.The 2024 Amendment marks a pivotal shift by enablingREITs which have a substantially smaller asset value toqualify as a distinct category of SM REITs. Further, thetransition to a SM REIT model for FOPs will allow retailinvestors to benefit from valuation and disclosurerequirements, minimum dividend distributionrequirements and asset categorization norms prescribedunder the REIT Regulations. Nonetheless, in our view, thethreshold of minimum 200 investors should have been, infuture at-least should be, lower to 100 or lesser.Watch this space for more as we continue trackingfurther developments on SM REITs.

13NCDRC RULING ON PANCHSHEELGREENS II: RELIEF FOR FLAT BUYERSIn a significant ruling, the National Consumer Disputes Redressal Commission (NCDRC) has provided much-needed relief to flat buyers of the Panchsheel Greens II project located in Sector 16, Greater Noida, GautamBudh Nagar. The class action complaint was filed under Section 12 (1) (c) of the Consumer Protection Act,1986, by a group of flat buyers who had been left in a lurch by the developer, Panchsheel Buildtech Pvt. Ltd.The flat buyers were represented by Mr. Vishal Khattar, Advocate of Patine Law Offices.Written by Mr. Vishal Khattar, Founder at Patine Law Offices. Heis also appointed as the Additional Advocate General for theState of Haryana at the Supreme Court of India. Mr. Khattarrepresents both domestic and international clients before variouscourts and tribunals in matters relating to civil and criminal laws,arbitration, employments laws and banking and finance law.Background of the CaseThe core issue in this case revolved around the delay in theconstruction and handover of flats in the Panchsheel Greens IIproject. The flat buyers had initially booked their units under asubvention scheme, a financial arrangement where thedeveloper promises to bear the interest cost on the buyer’shome loan for a specified period. However, once thesubvention period ended, the flat buyers found themselvesburdened by Equated Monthly Installments (EMIs) on loans forproperties they had not yet received. Despite the buyers nothaving taken possession of their units, banks and Non-BankingFinancial Companies (NBFCs) demanded payment of EMIs,which placed the buyers under severe economic distress.Builder's Failure to Meet CommitmentsPanchsheel Buildtech Pvt. Ltd. was found to have stopped making interest payments to the banks after thesubvention period ended. The flat buyers, many of whom were also paying rent for their currentaccommodations, faced immense financial pressure as they were compelled to pay both rent and EMIs. Thebuyers attempted to negotiate a settlement with the builder, but their efforts were in vain. The builder’s offerto refund the money with a deduction of 5% of the basic price of the flat, as per the allotment letter, was nothonored.12

13The NCDRC’s ObservationsThe NCDRC scrutinized the case and found that the builder had indeed failed to offer possession of the flatswithin the stipulated 24-month period. The commission noted that the letter of offer of possession issued inMarch 2017 was a clear misrepresentation. Evidence presented, including photographs, indicated that theproject was not completed and was not in a habitable condition at the time. Furthermore, the builder had notobtained the necessary lawful Occupancy Certificate, which was only received in 2018, making any offer ofpossession in 2017 invalid.Key Findings and RulingsThe commission found the delays to be entirely attributable to the builder, Panchsheel Buildtech Pvt. Ltd. Thisnegated any grounds for accepting a refund with forfeiture. The NCDRC highlighted the irrelevance of theforfeiture clause in this context and supported the complainants’ stance by referencing a previous order in asimilar case (CC No.2590 of 2017, Chandan Gupta Vs. M/s Supertech Ltd.).Directives from the CommissionIn its ruling, the NCDRC directed the builder to refund theentire amount paid by the complainants under the subventionscheme. Additionally, the commission ordered the builder topay interest at a rate of 9% per annum on the entire amountfrom the date of the respective deposits. The commissionstipulated that the amount must be paid within three months,failing which the interest rate would be enhanced to 12%.Implications of the RulingThis ruling by the NCDRC sets a significant precedent for flatbuyers facing similar issues with delayed possession andfinancial distress due to subvention schemes. It underscoresthe accountability of builders in adhering to theircommitments and the protection of consumer rights under theConsumer Protection Act. The decision reinforces theimportance of lawful compliance, including obtainingnecessary occupancy certificates before offering possession tobuyers.ConclusionThe NCDRC’s judgment in favor of the flat buyers ofPanchsheel Greens II highlights the crucial role of consumerprotection laws in safeguarding the interests of homebuyers.The ruling provides much-needed relief to the complainantsand serves as a warning to builders against making falsepromises and delaying project completions. With this landmarkdecision, the commission has reaffirmed its commitment toensuring justice for consumers and upholding the principles offairness and accountability in the real estate sector.

14THE IMPACT OF RERA ON THE INDIAN REAL ESTATEINDUSTRY: A TRANSFORMATIVE JOURNEYThe Real Estate (Regulation and Development) Act, commonly known as RERA, was enacted by the IndianParliament in 2016 and came into force on May 1, 2017. This landmark legislation was introduced to addresslong-standing issues in the real estate sector, such as lack of transparency, delays in project completion, andunfair practices by developers. Since its launch, RERA has had a profound impact on the real estate industryin India, ushering in a new era of accountability, transparency, and consumer protection.Written by Mr. Alankrit Bajpai, Corporate Lawyer. He has extensive experience as an in-house counsel forseveral of the multinational corporations and specializes inlegal and regulatory compliance, contract management, realestate laws, corporate advisory and others.Transparency and AccountabilityOne of the most significant impacts of RERA hasbeen the enhancement of transparency andaccountability in the real estate sector. Prior toRERA, homebuyers often faced difficulties inobtaining accurate information about projects.Developers frequently altered plans, failed todeliver on promises, and delayed projectcompletion without any substantial penalties.RERA mandates that all real estate projects andagents be registered with the Real EstateRegulatory Authority. Developers are required toprovide detailed information about the project,including layout plans, approvals, timelines, andthe status of ongoing projects. This informationmust be updated regularly on the RERA website,making it accessible to all stakeholders. Thistransparency has empowered buyers to makeinformed decisions and has significantly reducedthe chances of being misled by unscrupulousdevelopers.

15Timely Project CompletionDelayed project completion was a chronic issuein the Indian real estate market, causingimmense financial and emotional distress tohomebuyers. RERA has introduced stringentregulations to address this problem. Developersare now required to deposit 70% of the projectfunds in a separate escrow account, ensuringthat the money collected from buyers is usedexclusively for the construction of that project.This provision has curtailed the diversion offunds to other projects, thereby reducingdelays. Moreover, RERA imposes heavypenalties on developers for failing to completeprojects on time. This has instilled a sense ofurgency among builders to adhere to deadlinesand deliver projects as per the committedtimelines. The fear of penalties and thepotential loss of credibility have pusheddevelopers to be more disciplined and efficientin their operations.Consumer ProtectionRERA has been a game-changer for consumerprotection in the real estate sector. The act hasestablished a robust grievance redressalmechanism, allowing homebuyers to filecomplaints against developers for any violationsof the act. The establishment of Real EstateRegulatory Authorities in each state and unionterritory has ensured that grievances areaddressed in a timely and efficient manner.Under RERA, if a builder fails to deliver theproperty on the agreed date, the buyer has theright to withdraw from the project, in whichcase the developer is liable to refund the entireamount paid along with interest. Alternatively,the buyer can choose to stay invested in theproject and receive compensation for the delay.This provision has provided a significant senseof security to homebuyers, knowing that theirinvestments are protected by law.Standardization of PracticesRERA has played a crucial role instandardizing practices in the real estateindustry. It has introduced a uniform set ofguidelines for all stakeholders, includingdevelopers, agents, and buyers. For instance,developers are now required to sell propertiesbased on carpet area, which is clearly definedunder the act. This has eliminated theambiguity surrounding super built-up areaand other misleading terminologies that wereoften used to inflate property prices.Additionally, RERA mandates that alladvertisements and project brochures containaccurate and comprehensive information. Anyfalse or misleading claims can result in severepenalties for the developer. This has broughtabout a paradigm shift in the marketingpractices of real estate companies, promotinghonesty and integrity.

19Challenges and Future OutlookWhile RERA has brought about significantpositive changes, it has also faced severalchallenges. The implementation of the act hasbeen uneven across different states, with somestates lagging in establishing the necessaryregulatory authorities and frameworks.Additionally, there have been instances ofdevelopers finding loopholes in the regulationsto bypass certain provisions of the act.Despite these challenges, the future of RERAlooks promising. Continuous efforts are beingmade to strengthen the implementation of theact and address any shortcomings. The centralgovernment, along with state authorities, isworking towards ensuring that RERA isuniformly enforced across the country. As theregulatory framework matures, it is expectedthat the act will become even more effective insafeguarding the interests of homebuyers andpromoting sustainable growth in the real estatesector.Boosting Investor ConfidenceThe real estate sector in India has traditionally been perceived as high-risk, primarily due to issues like projectdelays, legal disputes, and lack of transparency. RERA has played a pivotal role in changing this perception.By enforcing strict regulations and ensuring accountability, the act has restored confidence among investors,both domestic and international.Foreign investors, who were previously wary of investing in Indian real estate due to the lack of regulatoryoversight, are now showing increased interest. The enhanced transparency and standardized practices havemade the sector more attractive for institutional investors and private equity firms. This influx of investment iscrucial for the growth and development of the real estate industry, leading to the creation of betterinfrastructure and housing projects.16ConclusionIn conclusion, RERA has had a transformative impact on the Indian real estate industry since its launch. Byintroducing transparency, accountability, and consumer protection, the act has addressed many of the long-standing issues that plagued the sector. While challenges remain, the positive changes brought about by RERAhave laid a strong foundation for a more transparent, efficient, and investor-friendly real estate market in India.As the industry continues to evolve, RERA will play a crucial role in shaping its future, ensuring that theinterests of all stakeholders are safeguarded.

17AI & CONTRACTS: LEGAL DYNAMICSWritten by Mr. Rajan D Gupta, Managing Partner & Ashi Jain,Associate at CHRI Legal. Mr. Gupta is also a CharteredAccountant and a licensed Insolvency Resolution Professionalwith over 25 years of professional experience in Corporate andCommercial Laws, M&A Transactions, Restructuring,Infrastructure projects and Taxation. Ms. Jain is a transactionallawyer specializing in M&A, Private Equity and Venture Capital.The advent of Artificial Intelligence (AI) hasushered in a new era of technologicaladvancement, significantly impacting varioussectors, including the legal domain. In India,the integration of AI into the legal system is stillat a nascent stage, but recent developmentsindicate a promising future. This article delvesinto the evolution of AI law in India, recentdevelopments, and the profound impact theseadvancements are poised to have on the legallandscape.Recent years have seen a surge in legislative and regulatory efforts aimed at addressing the legalchallenges posed by AI. The European Union has been at the forefront of these efforts, proposing theAI Act, which seeks to establish a comprehensive legal framework for AI, focusing on high-riskapplications and ensuring transparency, accountability, and respect for fundamental rights. In theUnited States, the National Institute of Standards and Technology (NIST) has released a frameworkfor managing risks associated with AI, emphasizing the importance of trustworthiness and ethicalconsiderations. These developments reflect a growing recognition of the need for legal frameworksthat can adapt to the rapid pace of AI innovation while safeguarding public interests.In India, the NITI Aayog, a policy think tank of the Government of India, released a discussion papertitled "National Strategy for Artificial Intelligence" in 2018. This document outlines the vision toposition India as a leader in AI for social and inclusive economic growth. It emphasizes leveraging AIfor societal needs, such as healthcare, education, and agriculture, while also addressing legal andethical issues. The Ministry of Electronics and Information Technology (MeitY) also issued guidelinesin the advent of emergence of AI in India for responsible AI, emphasizing transparency, fairness, andaccountability.

The integration of AI into various products and services has profound implications for technologycontracts recently. These agreements must now address a range of issues specific to AI, includingdata usage rights, algorithm transparency, and performance guarantees. As AI systems rely heavilyon data to learn and make decisions, contracts must clearly delineate the rights and responsibilitiesrelated to data provision, processing, and protection. Moreover, the dynamic nature of AI,characterized by continuous learning and adaptation, poses challenges for traditional contract clausesrelated to performance and warranties. Contracts involving AI technologies must account for thepossibility of evolving system capabilities and the potential need for updates and maintenance toensure continued performance in accordance with agreed-upon standards. The confluence of AI with intellectual propertylaw introduces complex legal quandaries,particularly in determining the ownership ofAI-generated creations. Indian jurisprudenceis yet to explicitly address the authorship ofAI-generated works and inventions as theIndian government is still exploringamendments to copyright and patent laws toaccommodate AI-generated works andinventions. The potential amendments to theCopyright Act, 1957, and the Patents Act,1970, to include AI-generated outputsnecessitate explicit provisions in technologyagreements regarding the allocation of IPrights, licensing arrangements, and theexploitation of AI-generated innovations. Thisalso includes addressing the authorship of AI-generated content and the patentability of AIinventions, ensuring that the legal frameworkkeeps pace with technological advancements.Indian contract law, under the IndianContract Act, 1872, necessitates cleararticulation of liability clauses in technologyagreements. These clauses should addressthe allocation of risk, indemnificationobligations, and limitations of liabilityconcerning the performance of AI systems.The principle of strict liability may be invokedin cases where AI actions result inunforeseeable harm, making it imperative forcontracts to specify the scope of liability andindemnity provisions.18

19The new Digital Personal Data Protection Act also underscores the legal obligations of entitiesprocessing personal data through AI systems. Technology agreements involving AI must incorporatecomprehensive data processing clauses that adhere to the principles of legality, consent, andtransparency. These agreements must delineate the responsibilities of data controllers andprocessors, ensuring compliance with data localization requirements, cross-border data transferrestrictions, and the rights of data subjects. Another critical aspect of technology contracts in thecontext of AI is the allocation of liability. Given the potential for AI systems to act in unpredictableways or make erroneous decisions, contracts must carefully consider how liability is shared betweenparties. This includes addressing scenarios where AI systems may cause harm or fail to perform asexpected, ensuring that contracts provide clear guidance on recourse and remedies.As India moves towards a more regulated AI environment, the interplay between law and technologywill become increasingly significant. By anticipating legal developments and embracing best practices,stakeholders can navigate the challenges of AI integration, ensuring that tech contracts are bothinnovative and compliant. The evolution of AI law in India represents a pivotal moment for the legalcommunity, offering an opportunity to redefine the foundations of contracts in the digital age.20

As a corporate lawyer specializing in private equity and venture capital, you understand that the realchallenge in private equity investments lies not only in identifying high-potential opportunities but alsoin executing successful exit strategies. The Indian and Dubai markets, each with their distincteconomic, regulatory, and cultural landscapes, offer unique challenges and opportunities for privateequity investors. This article delves into advanced considerations for planning and executing successfulexits in these markets, focusing on the nuanced strategies and legal frameworks that can enhanceinvestor returns.20Exit Strategies: Planning for Successful Exits inPrivate Equity Investments in India and DubaiWritten by Mr. Rajveer Agri, Corporate Lawyer. Mr. Agri has expertise in strategising and executing M&A andVenture Capital transactions including issues relating toIntellectual Property, technology, due-diligence, disputeprevention and others.For seasoned investors and legal professionals, the intricacies of exit strategies extend beyond thebasic routes of IPOs, strategic sales, secondary sales, and buybacks. In India, market volatility andregulatory complexities necessitate a more sophisticated approach. One effective strategy involvesstaggered exits through Initial Public Offerings (IPOs) followed by follow-on public offerings (FPOs). Byinitially floating a portion of the equity and gradually selling off remaining stakes as market conditionsimprove, investors can better manage risk and optimize timing. Additionally, structuring strategic saleswith earn-out provisions can bridge valuation gaps and align incentives with the acquiring entity,ensuring better post-transaction outcomes. Leveraged recapitalization, which involves raising debtagainst the company’s equity, allows investors to extract value without a full exit, providing partialliquidity while retaining a stake in the business. This approach is particularly effective in capital-intensive sectors such as infrastructure and real estate.

21In Dubai, the market’s sensitivity to liquidity issues and the prevalence of family-owned businessesand conglomerates require tailored exit strategies. Staggered exits through IPOs can becomplemented by private placements to institutional investors post-listing, ensuring a steady exit flowwithout flooding the market. Strategic sales in Dubai often involve complex negotiations and earn-outprovisions coupled with management retention clauses can facilitate smoother transitions and highervaluations. Leveraged recapitalization is also a viable option in Dubai’s relatively nascent privateequity landscape, allowing investors to extract liquidity while maintaining a presence in the business.Given the regulatory environment, investors must navigate compliance with the Dubai FinancialServices Authority (DFSA) and local commercial laws to ensure successful exits.Planning for successful exits also involvesaddressing legal and regulatoryconsiderations specific to each market. InIndia, the regulatory framework for exits,particularly IPOs, has evolved significantly.The introduction of the Securities andExchange Board of India (SEBI) guidelineshas streamlined the process, but complianceremains a critical factor. Investors mustnavigate these regulations diligently to ensurea smooth exit. Additionally, the CompaniesAct, 2013, and various sector-specificregulations impose compliance requirementsthat can impact exit strategies. Understandingthese legal frameworks and incorporatingthem into exit planning is essential forminimizing risks and maximizing returns.Dubai presents its own set of regulatorychallenges and opportunities. The DubaiFinancial Market (DFM) and the DubaiInternational Financial Centre (DIFC) providedifferent regulatory environments for exits.The DIFC, with its common law framework,offers a more flexible and investor-friendlyregulatory landscape. However, navigatingthe dual regulatory frameworks of the DIFCand local laws requires careful planning andlegal expertise. Additionally, the market’srelatively small size and higher sensitivity toliquidity issues necessitate innovative exitstrategies that can provide steady andpredictable returns.20

Post-investment monitoring and governance are crucial for ensuring successful exits. Activeinvolvement in the company’s strategic decisions, robust financial oversight, and effective riskmanagement can enhance the company’s performance and attractiveness to potential buyers. InIndia, leveraging board positions and management rights can provide investors with the necessaryinfluence to drive value creation and ensure alignment with exit goals. In Dubai, maintaining strongrelationships with key stakeholders and understanding local business practices are essential fornavigating the market and achieving successful exits.In both markets, planning for successful exits also involves preparing for potential challenges anduncertainties. Economic fluctuations, regulatory changes, and market dynamics can impact exittimelines and valuations. By conducting thorough due diligence, stress-testing exit scenarios, andmaintaining flexibility in exit planning, investors can mitigate risks and capitalize on opportunities.Additionally, building a network of potential buyers, including strategic acquirers, financial investors,and institutional buyers, can provide multiple exit options and enhance bargaining power.In conclusion, planning for successful exits in private equity investments in India and Dubai requires anuanced understanding of market dynamics, regulatory frameworks, and strategic considerations. Byemploying sophisticated exit strategies, addressing legal and regulatory requirements, and activelymonitoring post-investment performance, investors can maximize returns and achieve successfuloutcomes. As the private equity landscapes in these markets continue to evolve, staying ahead oftrends and adapting strategies to changing conditions will be key to realizing the full potential ofinvestments.22

23NAVIGATING DIGITAL EVIDENCE IN FAMILYAND CRIMINAL LAWIn the digital age, evidence no longer solely consists of physical items like documents, weapons, orphotographs. Digital evidence, which encompasses emails, text messages, social media posts, digitalphotographs, GPS data, internet browsing history, chat history, CDR (Call detail record) plays anincreasingly crucial role in legal proceedings. However, the complexities of navigating digital evidencesuch as collection, handling, preservation, verification, analysis and presentation present a hugechallenge. The collection of digital evidence is governed by strict legal standards to protect individuals' rights. In the U.S., the Fourth Amendment ensures protection against unreasonable searches and seizures,requiring law enforcement to obtain warrants based on probable cause. The process of obtainingdigital evidence must adhere to these legal standards to ensure its admissibility in court. The legal collection procedure of digital evidence in India is governed by a combination of laws,regulations, and guidelines aimed at ensuring the authenticity, integrity, and admissibility of suchevidence in court. It is crucial for law enforcement agencies to obtain search warrants for the searchof premises for the purpose of collection of digital evidence. In some cases, digital evidence can becollected with the consent of the owner of the electronic device or data. Challenges in Collection One of the primary challenges in collecting digital evidence is dealing with encryption and datadeletion. As individuals become more aware of their digital privacy, the use of encryption tools hasincreased, making it difficult for investigators to access data. Moreover, data can be easily deleted oraltered, necessitating advanced forensic tools and expertise to recover it. Preservation of Digital Evidence Written by Adv. Kanchan Talreja. Mr. Talreja is an Advocatepracticing before the Supreme Court of India, various High Courtsand District Courts in matters relating to Family Law, CriminalLaw, Testamentary Suits, Non-litigation Drafting, NegotiableInstruments Act and Consumer Law. She is also dedicated to pro-bono work to secure effective legal representation for theunderprivileged.

Chain of Custody Maintaining a clear and unbroken chain of custody is crucial to ensure the integrity of digitalevidence. Each step of handling the evidence must be documented meticulously to prevent anyclaims of tampering or contamination. Legal Considerations Improper preservation of digital evidence can lead to spoliation, which may result in the evidencebeing inadmissible in court. Legal professionals must be vigilant in preserving digital evidence to avoidcompromising their cases. Analysis of Digital Evidence Forensic Techniques Analyzing digital evidence requires specialized forensic techniques such as data recovery, metadataanalysis, and decryption. These techniques help extract valuable information from digital devices andinterpret it accurately. Expert Testimony Digital forensic experts play a vital role in court by explaining complex technical details and ensuringthat the evidence is understood correctly by the judge and jury. Their expertise can be critical inestablishing the credibility and reliability of digital evidence. Specific Considerations in Family Law Relevance in Custody and Divorce Cases In family law, digital evidence is often used in custody disputes and divorce proceedings. Emails, textmessages, and social media posts can provide crucial insights into a person's behaviour, financialstatus, and relationships. Privacy Concerns Accessing personal digital data raises significant privacy concerns. Legal professionals must balancethe relevance of the evidence with the need to protect individuals' privacy rights. Impact on Outcomes Digital evidence can be pivotal in family law cases. For example, text messages revealing abusivebehaviour or immoral behaviour or financial records showing hidden assets can dramatically affect thecase's outcome. Specific Considerations in Criminal Law Role in Criminal Investigations Digital evidence is essential in criminal investigations, including cybercrime, fraud, and other offenses.It can provide a trail of digital footprints that help investigators piece together events and identifyperpetrators. 24

25Rights of the Accused The accused have the right tochallenge the digital evidencepresented against them.Ensuring that the evidence waslawfully obtained andpreserved is crucial forprotecting the accused's rights. Precedents Several landmark cases haveshaped the use of digitalevidence in criminal law. Thesecases provide legal precedentsand guidelines for handlingdigital evidence in futureproceedings. Ethical and Legal Issues Legal Issues faced due toemerging technology As technology evolves, newlegal issues related to digitalevidence emerge. Courts andlegal professionals must stayinformed about thesedevelopments to addresschallenges such as the use ofartificial intelligence in forensicanalysis and the implications ofnew privacy laws. 20Conclusion Navigating digital evidence in family and criminal law matters requires a deep understanding of thelegal standards and best practices for its collection, preservation, analysis, and presentation. Astechnology continues to advance, legal professionals must remain adaptable and informed toeffectively leverage digital evidence in their cases. The future of legal proceedings will undoubtedlysee an increasing reliance on digital evidence, making it essential for those in the legal field to masterits complexities.

A split ICSID tribunal has refused jurisdictionover TC Energy's $15 billion claim against the USfor revoking the Keystone XL pipeline permitpost-NAFTA. Tribunal chair Alexis Mourre andJohn Crook sided with the US, citing USMCA'stransition rules. Canadian arbitrator Henri Alvarezdissented. TC Energy expressed disappointment,while the US and Mexico supported the ruling.The case, filed in 2021, marks TC Energy’ssecond arbitration over Keystone XL.26JUDICIAL UPDATESICSID Tribunal Rejects TCEnergy’s $15 Billion NAFTA ClaimOver Keystone XL CancellationC ur r en t A f fa i rs

The Amsterdam Court of Appeal has enforced a$134 million award requiring Ghana to payTrafigura's subsidiary, Ghana Power GenerationCompany (GPGC). The award, issued by a LondonUNCITRAL tribunal in 2021, resulted from a contracttermination dispute over gas power plants. Ghana’schallenge to the award was dismissed in London,with partial payments still leaving $109 millionowed. The court ruled in GPGC's favor despiteGhana’s non-appearance, allowing enforcement inthe Netherlands.A Belgian court has frozen $32 million in revenues owedto Spain’s state-owned air traffic control company,Enaire, following a request by Blasket Renewables, acreditor holding multiple Energy Charter Treaty awardsagainst Spain. The ruling, based on a €28 million ICSIDaward to Infrared Capital, orders payments fromEurocontrol to Enaire to be redirected to Blasket. Spainplans to appeal, citing EU state aid laws. Blasket is alsopursuing enforcement in the UK and US.27Amsterdam Court Enforces $134 MillionAward Against Ghana in Favor ofTrafigura SubsidiaryBelgian Court Freezes $32 MillionOwed to Spain’s Enaire inRenewable Energy DisputeC ur r en t A f fa i rs

A HKIAC tribunal has ordered Hainan MeilanInternational Airport Company to pay $38 million toAero Infrastructure Holding, a Cayman affiliate ofChina’s Hopu Investments, for an aborted sharesale. Initially claiming nearly $900 million indamages, Aero reduced its claim to $379 million.The tribunal found Meilan liable for not using itsbest efforts to complete a 2019 subscriptionagreement. Meilan disclosed the ruling, highlightingdamages, arbitration costs, and interest.Libya’s Attorney General announced the arrest of aGhadames Air executive for illegally transportingmigrants from Libya to Nicaragua. The executive isaccused of activities harmful to Libya’s interests,violating national and international migration laws.Ghadames Air reportedly flew hundreds of East Asianmigrants intending to enter the US throughNicaragua. The airline, founded in 2021, facesscrutiny amid Libya's ongoing human rights andimmigration challenges post-Gaddafi.28HKIAC Tribunal Orders Hainan AirportOperator to Pay $38 Million Over FailedShare SaleLibyan Aviation Executive Arrestedfor Illegally Transporting Migrantsto NicaraguaC ur r en t A f fa i rs

The Parliament of Gambia has decisively rejected abill seeking to legalize female genital mutilation(FGM), maintaining the country's 2015 ban on thepractice. Introduced in March 2024, the Women’s(Amendment) Bill faced strong opposition fromhuman rights groups and international bodies.Despite initial concerns, MPs voted against the billbefore its final reading, citing concerns overwomen’s rights and the protection of girls fromharmful practices. The decision has been praised byglobal women’s rights advocates and reaffirmsGambia’s commitment to human rights and genderequality.Azerbaijan has enacted a comprehensive arbitrationlaw, effective from January 25, largely based on theUNCITRAL Model Law. The new law, consisting of59 articles, covers arbitration agreements, tribunalcomposition, interim measures, proceedingsconduct, and award enforcement. It includesprovisions for establishing permanent arbitralinstitutions, which must meet specific criteria. Thelaw applies to both domestic and internationalarbitrations but excludes current foreign awardenforcement proceedings before the SupremeCourt. Legal experts commend the law for itsarbitration-friendly framework and anticipate it willenhance arbitration's role in Azerbaijan.29Gambia Parliament Upholds Ban onFemale Genital Mutilation (FGM) AmidControversial Legislative DebateAzerbaijan Enacts New ArbitrationLaw, Setting Foundation forArbitral InstitutionsC ur r en t A f fa i rs

In-HouseCounselLawStudents &ScholarsLaw FirmsAttorneysLegalTechExpertsJudgesGLOBAL LEGALSUMMIT15-16 November 2024 | Indiagls@evenement.world+91 8447692430www.globallegasummit.world