Return to flip book view

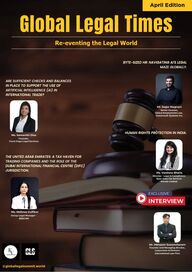

Message @globallegalsummit.worldGlobal Legal TimesRe-eventing the Legal WorldApril EditionARE SUFFICIENT CHECKS AND BALANCESARE SUFFICIENT CHECKS AND BALANCESIN PLACE TO SUPPORT THE USE OFIN PLACE TO SUPPORT THE USE OFARTIFICIAL INTELLIGENCE (AI) INARTIFICIAL INTELLIGENCE (AI) ININTERNATIONAL TRADE?INTERNATIONAL TRADE?Ms. Mehnaz ZulfikarMs. Mehnaz ZulfikarGroup Legal ManGroup Legal Manager -ager -RESCOMRESCOMMs. Samanthi DiasMs. Samanthi DiasFounder,Founder, Front-Page Legal ServicesFront-Page Legal ServicesMr. Metapon SuwancharernMr. Metapon SuwancharernFounder and Managing director,Founder and Managing director,Lawyerman & PartnersLawyerman & PartnersInternational Law FirmInternational Law FirmBYTE-SIZED HR: NAVIGATING AI'S LEGALBYTE-SIZED HR: NAVIGATING AI'S LEGALMAZE GLOBALLY.MAZE GLOBALLY.THE UNITED ARAB EMIRATES: A TAX HAVEN FORTHE UNITED ARAB EMIRATES: A TAX HAVEN FORTRADING COMPANIES AND THE ROLE OF THETRADING COMPANIES AND THE ROLE OF THEDUBAI INTERNATIONAL FINANCIAL CENTRE (DIFC)DUBAI INTERNATIONAL FINANCIAL CENTRE (DIFC)JURISDICTION.JURISDICTION. Mr. Sagar MagnaniMr. Sagar MagnaniSenior Counsel,Senior Counsel,Global Employment Law,Global Employment Law, Commvault Systems Inc.Commvault Systems Inc.Ms. Vandana BhatiaMs. Vandana BhatiaDirector - Legal & Compliance,Director - Legal & Compliance,Ryan India Tax ServicesRyan India Tax ServicesPrivate LimitedPrivate LimitedHUMAN RIGHTS PROTECTION IN INDIA.HUMAN RIGHTS PROTECTION IN INDIA.

CEONote from the02Dear Readers of Global Legal Times,I trust this message finds you well. It's my privilege to extend a warmwelcome to you as readers of our esteemed publication, Global Legal Times.At the heart of our mission at the Global Legal Summit is the aspiration to fosterknowledge-sharing, promote networking, and recognize excellence within the legalcommunity on a global scale. Our aim is to create a platform where legalprofessionals can come together, exchange ideas, and inspire one another. Global Legal Times serves as an integral part of this vision. This magazine is notjust a periodical but a conduit through which we aim to achieve these objectives.It's a space where we bring you the latest legal news updates, offering insights intothe ever-evolving legal landscape. We delve into international judicialdevelopments and emerging trends, providing you with a panoramic view of thelegal world.Our commitment to excellence extends to our interviews with legal personalitieswho have left an indelible mark on the profession. These candid conversationsdelve into their personal journeys, challenges faced, and insights gained,allowing you to learn from the best in the field.Each edition of Global Legal Times features a cover story that delves deep into acurrent legal topic or issue of global significance. We strive to provide you with acomprehensive understanding of the subject matter, allowing you to stay ahead ofthe curve in the legal arena.In essence, this magazine is designed to be your trusted companion in the legalrealm, offering you the knowledge and perspectives needed to thrive in today'sdynamic legal landscape. We invite you to immerse yourself in the content, engagewith the ideas presented, and be an active part of the global legal conversation.Thank you for joining us on this journey. Your readership and engagement areinstrumental in making Global Legal Times a vital resource for legal professionalsworldwide.Warm regards,Bharti SinghCEO, Global Legal SummitGlobal Legal TimesAssistant In-chiefPublishing DirectorReasearch AnalystCirculation Managed bySenior Projects & EventsChief of ProductionAll rights reserved around the world.Production in any manner is prohibited.Printed and published by Bharti Singh on behalfof Evenement Investiture Private LimitedContact Us-gls@evenement.worldSonia ChaudharyVivek DasAman ChaudharyPrachi SinghRaima BanikArt and PhotographyDirectorKrishna Singh

News UpdatesByte-Sized HR: Navigating AI's Legal Maze GloballyExclusive Interview with Mr. Metapon Suwancharern -Founder and Managing director, Lawyerman & PartnersInternational Law Firm.The United Arab Emirates: A Tax Haven for TradingCompanies and the Role of the Dubai InternationalFinancial Centre (DIFC) JurisdictionHuman Rights Protection in IndiaAre Sufficient Checks And Balances In Place ToSupport The Use Of Artificial Intelligence (AI) InInternational Trade?061012142023TABLE OF CONTENTSGlobal Legal Times 03

GLOBAL LEGAL TIMESGLOBAL LEGAL TIMES04Global Legal Times is your dependablemonthly guide to the ever-evolving worldof law. Within each edition, weundertake a thorough exploration of themany facets of the legal landscape,offering a wealth of knowledge,expertise, and insights.Our magazine serves as a reliable sourcefor staying informed about the dynamiclegal realm. We provide the latest legalupdates, ensuring you are well-versed inlegislative changes, significant courtdecisions, and evolving regulations. Thisknowledge equips you to navigate theintricacies of the legal field confidently.However, Global Legal Times goesbeyond mere news reporting. It is aplatform for in-depth exploration. Ourexpert analyses and commentaries offernuanced perspectives on trending legaltopics. We engage legal luminaries,scholars, and thought leaders to sharetheir wisdom, providing a well-roundedview of critical issues affecting the legalcommunity.Central to our magazine are exclusiveinterviews with legal personalities whohave made enduring contributions to theprofession. These conversations delveinto their personal journeys, thechallenges they've encountered, and theinsights they've gathered. It's anopportunity to glean wisdom from someof the most prominent figures in thefield.We take pride in our global perspective. The legallandscape extends beyond borders, and so doesour coverage. We offer insights into cross-jurisdictional matters and global legal trends,ensuring you are well-informed aboutinternational legal affairs.Our interactive content, including videos,infographics, and interactive tools, simplifies eventhe most complex legal topics, making themaccessible and engaging. You can activelyparticipate in our content through comments,questions, and discussions, fostering a dynamicreading experience.Beyond the courtroom, we explore the legallifestyle, offering wellness tips tailored to legalprofessionals, career development insights, bookreviews, and more. These features are designed toenrich your personal and professional life.As the official publication of the Global LegalSummit, Global Legal Times providescomprehensive coverage of this prestigious event.You can delve into speaker profiles, sessionhighlights, and behind-the-scenes glimpses,ensuring your active participation in this global legalphenomenon.Join us on this informative journey through the legaluniverse. Whether you're a legal professional,enthusiast, or simply curious, Global Legal Times isyour trusted companion, providing impactfulinsights and a deeper understanding of the legalworld with every read. Welcome to the future oflegal enlightenment with us.

We are a premier event-designing organization, passionately committed tocrafting unforgettable experiences for our esteemed clients. Backed with a teamof young, dynamic and skilled individuals, we take immense pride in ourunwavering dedication to excellence in successfully planning and executingcorporate events around the country.Our team of seasoned professionals possesses a wealth of experience thatenable us to meticulously identify, design and deliver exceptional results thatalign with our clients’ distinctive needs and goals. We are driven by a strongorganizational belief that every event is unique, and thrive to make it a truereflection of the cause it seeks to disseminate. Our services range from adetailed pre-conference planning to flawless onsite management and a hassle-free post-conference wrap-up.In addition to our focus on corporate events, we are thrilled to announce that wewill be hosting three prestigious global summits: the Global Legal Summit, theGlobal Fintech Summit, and the Global Realty Summit. These high-profilegatherings will bring together industry leaders on a single stage, exchangingideas and celebrating remarkable impressions in their respective fields.We are not just an organization doing business, we are a growing family ofpeople who love curating lasting experiences for everyone. With our strongfocus on values, we are poised to re-event your imagination into reality.Evenement Investiture05

Why do we need resolutions?However, to achieve the above outcome, there arechallenges that require immediate attention. Theabove outcomes could create unevenness ininternational trade among countries with stableand developing or underdeveloped economies.Further to the above, the largest economies onlyaccount for the research and development tofacilitate the use of AI. Another major pressingissue is the data governance and prevention ofdigital trade barriers. In this view, there could bean obstacle to ensuring a smooth transition ofcross-border data as data is pivotal to train AImodels. The WTO report states that if alleconomies fully restricted their data flows, thiscould result in a 5 percent reduction in global GDPand a 10 percent decrease in exports. At the sametime, if data is allowed to flow freely, it couldexacerbate AI trustworthiness, raising concernsabout reliability, security, privacy, safety,accountability, and data quality. Another aspectwould be the protection of AI algorithms andownership of AI- generated materials.ARE SUFFICIENT CHECKS AND BALANCES IN PLACE TO SUPPORT THE USE OF ARTIFICIAL INTELLIGENCE (AI)IN INTERNATIONAL TRADE?06The use of AI in International tradeAI has become an inevitable support system for anydiscipline or workforce. This article discusses whetherthere is a comprehensive regulatory framework tofacilitate the use of AI in international trade.Like in many other streams, AI can unlock unprecedentedeconomic and social upliftment in international trade. TheWorld Trade Organization (WTO) report on “Trading withIntelligence” (WTO report) outlined that AI can be used toleverage the trade cost associated with trade logistics,supply chain management, and regulatory compliance.AI could boost productivity in many sectors, including theentire supply chain ecosystem, and as per the WTOreport, it is forecasted that with the AI adoption and withhigh productivity growth until 2040, the global real tradegrowth could to be increased by 14 percentage points.In contrast, with uneven AI adoption and low productivitygrowth, projected trade growth could be under 7percentage points.International trade also can be considered a major sourceto foster AI by complementing each other. For example,the global market for AI chips was valued at US$ 61.5billion in 2023 and is projected to reach US$ 621 billion by2032.Article by -Ms. Samanthi DiasFounder/ Attorney-at-law,Front-Page Legal Services

In light of the above, the present rules, regulations, and international standardsconcerning the traditional flow of goods and services will not be sufficient to regulateand bring AI trustworthiness to achieve the above outcomes to enhance internationaltrade.Present regulatory framework to optimise the use of AI to uplift internationaltrade.According to Stanford University's 2024 "AI Index," 25 AI-related regulatory measureswere adopted in the United States in 2023, while the European Union has passedalmost 130 AI- related regulatory measures since 2017.In the absence of a definitive policy or a regulatory framework in place, the manner inwhich AI sharpens international trade has become a question of policy. Accordingly,there is an emergence of the Preferential Trade Agreements (PTA), i.e. the DigitalTrade Agreements between countries that has endeavour to address this issue.According to United Nations Economic and Social Commission for the Asia and Pacific’s“Asia- Pacific Trade and Investment Trends 2024/25”, the Asia Pacific Trade Agreementbetween China and Mauritius was the first to introduce provisions pertinent to AIeducational exchange. Up until December 2024, there are 14 global PTAs of focus inplace. The specific AI-focused PTAs deal by and large with respect to the recognition ofemerging technologies that could offer social and economic benefits, the internationallyaligned governing framework of technologies, including safe and responsible use of AItechnologies, and the provisions pertinent to cooperation to research industry relatedpractices and commercial opportunities and exploitation.For example, the Singapore and the United Kingdom Digital Economy Agreement (SG-UK DEA) endeavours to amend the Singapore-UK free trade agreement by replacing theelectronic commerce segment with the SG-UK DEA. Per SG-UK DEA, the contractingnations will be required to align their legal framework governing electronic transactionsconsistent with theprinciples of the UNCITRAL Model Law on Electronic Commerce 1996 or the UnitedNations Convention on the Use of Electronic Communications in International Contractsdone at New York, 23 November 2005 to maintain uniformity and consistency.It is also interesting to see the definition of algorithm which is defined as sequence ofsteps, taken to solve a problem or obtain a result and cryptographic algorithm whichmeans method of transforming data using cryptography is a definite improvement inIndustry 4.0. This could be considered as a progressive outcome to the issue whetherAI systems are considered as a traditional good as per General Agreement Trade inServices (GATS).Whilst the SG-UK DEA outlines a framework to remove customs duties, and enableelectronic transmission, electronic contracts and authentication, invoicing and paperlesstrade, the countries also have progressed to highlight a risk management framework byundertaking to introduce conformity and assessment criteria.While a few countries have taken and maintained a positive outlook, regulatoryfragmentation is an inevitable outcome if we leave the checks and balances to beregulated by PFAs. It’s worth noting that TBT Agreement is essentially the driving forcefor harmonization and coordination of trade barriers at a global scale and the alignmentof national legislation. Whilst the WTO TBT obligations may not necessarily focus oncross-border data flows, there are products that have embedded sensors that collect,transmit and exchange information.In light of the above, while measures have been taken at national and regional levels toregulate AI frameworks, regulatory fragmentation, and uniformity have created and willcontinue to create imbalances in international trade. Therefore, it would be important tosee the future measures unfolded by the WTO to optimise the role of AI in internationaltrade and how the same could be achieved by the TBT framework.07

Bibliography• Witada Anukoonwattaka, Yann Duval and Natnicha Sutthivana. (n.d.). Inter Press Services News Agency. Retrieved February 25, 2025, from https://www.ipsnews.net/2025/02/shaping-ai-rules-trade- agreements/#google_vignette• Preferential trade agreements trends and developments in Asia and the Pacific 2024/2025. (2024). ESCAP.https://www.unescap.org/kp/2024/preferential-trade- agreements-trends-and-developments-asia-and-pacific-20242025• Trading with intelligence. (n.d.). https://www.wto.org/english/res_e/booksp_e/trading_with_intelligence_e.pdf• Qing, P., Fan, G., & Jie, L. (2025). CHINA WATCH 4 An Invisible Digital Wall: Digital Service Trade Barriers and Cross-border M&A. https://china-cee.eu/wp- content/uploads/2025/01/China_Watch_Peng-Qing-Gao-Fan-Li-Jie_2025_01.pdf• (2027, February 27). International treaty UK/Singapore: Digital Economy Agreement [Review of International treatyUK/Singapore: Digital Economy Agreement]. Gov.Uk.https://assets.publishing.service.gov.uk/media/6229f350e90e0747aa8eb6ad/CS_Singapore_1.2002_UK_Singapore_Dig• Stanford University. (2024). Artificial Intelligence Index Report 2024https://aiindex.stanford.edu/wp-content/uploads/2024/05/HAI_AI-Index-Report- 2024.pdf08

Share your enquiries at raima@evenement.worldINTRODUCING THEMOST IMPACTFULINTERESTED IN BEING FEATURED?INTERESTED IN BEING FEATURED?Scan the code to fill our quick interest form!Connect with usLegal PodcastAre you a Lawyer or Legal Professional passionate aboutthought leadership, innovation and making your voice heard?

Interview with - Mr. Metapon SuwancharernExclusive Interviews with Legal Titans!As the founder and managing director of Lawyerman &Partners International Law Firm, has extensive experience inassisting clients in significant international cases, particularly incriminal litigation. The firm is renowned for helpingmultinational clients worldwide who encounter legal issues inThailand. With meticulous case strategy skills, meticulousplanning, and the ability to anticipate potential futurescenarios, clients can confidently prepare and plan for theirfuture and achieve their desired outcomes. The firm's corepolicy is to continuously develop its litigation skills, aiming tobecome a leading firm in the country and promote Thai lawfirms to international recognition.𝘈𝘯𝘴𝘸𝘦𝘳 - I had the opportunity to participate in a case that made headlines in many countries around theworld (the Daniel Sancho Case). As the attorney for the deceased (co-plaintiff) in the case of Mr. DanielSancho (defendant), who was accused of murdering Colombian surgeon Mr. Edwin Arrieta Arteaga onKoh Phangan, Thailand, and subsequently dismembering the body, disposing of the remains in a garbagedump and the sea. I meticulously planned the litigation strategy in advance, thoroughly examining allevidence and identifying inconsistencies and arguments to counter the defense's evidence. We alsoanticipated various possible scenarios to select the most appropriate strategy, aiming to convince thecourt that the defendant had indeed planned the murder in Thailand. We faced numerous challenges inproving the defendant's guilt, as the police recovered only some body parts (incomplete remains),preventing a complete forensic reconstruction of the crime. However, through persistent testimony incourt for nearly a month, we were ultimately able to prove that the defendant had planned the murderand concealment of Mr. Edwin Arrieta's body. The court found the defendant guilty of premeditatedmurder and ordered him to pay compensation to the victim's family, achieving justice for the deceased'sfamily.1. As the recipient of the Leading Leader in International Litigation and Cross Border Disputesaward, what international case have you found particularly challenging and complex, and inwhich you were able to achieve an outstanding result?102. What advice would you give to foreigners facing legal issues in another Country?𝘈𝘯𝘴𝘸𝘦𝘳 - I Strongly advise that the most important step is to seek local legal counsel in the countrywhere they are facing legal issues. Each country has its own unique laws, and many countries prohibitforeigners from practicing law within their borders. Therefore, hiring a local lawyer is the best and mostappropriate option. Choose a lawyer with knowledge, experience, and the ability to provide structuredand reasonable legal opinions, including predicting possible case outcomes, to enable clients to preparefor various situations in advance.

𝘈𝘯𝘴𝘸𝘦𝘳 - Yes, I have worked on several other significant international cases. For example, the case of theRussian rock band Bi-2, which tours the world, encountered difficulties when they performed in Phuket,Thailand, without work permits, which is illegal under Thai law and would have resulted in their deportationto their home country (Russia). They were requested by Russia to extradite the band members with Russiancitizenship back to Russia. Reports indicated that Bi-2, a Russian rock band, opposed Russia's specialmilitary operation in Ukraine, and the Russian Foreign Ministry accused them of supporting terrorism due totheir anti-Russian and pro-Ukrainian stance. Human rights activists were concerned that some bandmembers with Russian citizenship might be sent back to Russia and face danger. As their lawyer, I assistedin coordinating with embassies in several countries to temporarily accommodate the band members andprepared documents to request the transfer of Bi-2 members to a third country, not Russia, to protect themand prevent human rights violations. Ultimately, we successfully sent the Bi-2 members to a third country.3. Besides the Daniel Sancho Case, have you had the opportunity to work on other significantcases with international implications?𝘈𝘯𝘴𝘸𝘦𝘳 - We firmly believe that lawyers mustpossess structured thinking skills, proactiveplanning, and a commitment to thoroughly examinefacts, evidence, and relevant laws in every case.Particularly in cases involving multiple countries,lawyers must study domestic laws, internationallaws, and relevant conventions and treaties. Thisenables lawyers to identify the most appropriatelegal strategy and accurately predict caseoutcomes. From my experience, over 90% of casesproceed as predicted. Therefore, if lawyers candevelop professional case strategies in advance,they are more likely to achieve favorable outcomesand greater success in their cases. Ultimately, thisleads to client trust, satisfaction, and referralsbased on their successful track record.4. What do you believe is crucial for success in handling complex and challenging legal caseswith international implications?11

Byte-Sized HR: Navigating AI'sLegal Maze Globally12Recruitment: Unmasking Hidden BiasAI tools are streamlining recruitment through resumescreening, skills assessments, and even candidate predictions.Usage of AI in leading interviews of candidates, predictingcompensation have also been heard off however, these toolsoften replicate historical biases embedded in the datasetsused for their training, leading to potential legal risks.In the United States, Title VII of the Civil Rights Act prohibitsemployment discrimination based on race, color, religion, sex,or national origin. Article 22 of the General Data ProtectionRegulation (GDPR) in European Union (EU) states individualshave the right not to be subjected to decisions based solelyon automated processing that significantly affects them, suchas recruitment decisions. UK’s Equality Act, Australia’s SexDiscrimination Act, and Singapore’s Tripartite Guidelines onFair Employment Practices also provide for similar regulations.These risks are often elevated as theend AI algorithm used in such toolsremain confidential. For instance, AItrained on male-dominated industrydata may filter out female candidates,perpetuating gender bias. This lack oftransparency complicates verifyingfairness, particularly on protectedcharacteristics of an individual.Article by -Mr. Sagar MagnaniSenior Counsel, Global Employment Law,Commvault SystemsArtificial Intelligence (AI) isreshaping Human Resources (HR)practices globally, promising greaterefficiency, reduced biases, andenhanced employee experiences. AItools are increasingly automatingrecruitment, performancemanagement, and payroll processes.However, this usage of AI raisessignificant legal challenges, rangingfrom discrimination to privacyrequiring compliance with diverselaws across jurisdictions.Organizations must rigorously test, monitor and update AI tools to prevent bias, ensuring human oversightin hiring decisions. Legal compliance is critical, as outcomes—not intentions—determine liability.

Even unintentional biases can result in serious legalconsequences, as employers may face litigation, fines, orreputational harm, for discriminatory practices. For example,New York mandates annual bias audits for AI tools used inhiring and promotion while requiring disclosure and providingan option for alternative evaluation methods.Data Privacy: A Global ChallengeAI in HR relies on extensive personal data, posing privacyrisks. Regulations like the GDPR, California’s CCPA, andBrazil’s LGPD impose strict controls on data collection,processing and storage. Breaches or mishandling sensitivedata can lead to fines and reputational damage.HR teams must navigate complex regional laws and ensurecompliance, particularly for cross-border data transfers.Robust safeguards and transparent practices are essential tominimize legal exposure.Performance Management: Ensuring Fairness AcrossJurisdictionsAI tools promise objective evaluations and real-timefeedback but often lack human judgement. Global labourlaws emphasize fairness and due process in employmentdecisions. For instance, in Germany, the Works ConstitutionAct mandates consultation with works council beforeimplementing AI tools affecting employees. AI systemsdeemed intrusive or unfair may face resistance from bothworks council and employees.Employers must ensure that AI systems—while efficient, donot compromise fairness or violate labour protections.Regular reviews and a balance of human input are necessaryfor performance assessments.Disciplinary Action: Objectivity vs. FairnessAI tools monitor employee behaviour and flag policyviolations but raise concerns about fairness and employeerights. The GDPR prohibits decisions based solely onautomated processing if they significantly impact individuals.Australia’s Fair Work Act underscores procedural fairnesswhich AI may not guarantee.13Systems tracking productivity, policyviolations, may justify disciplinaryactions, however, claims of objectivitycan undermine employee rights,especially in unionized jurisdictionswith strong labour protections likeGermany, Netherlands, and France.While AI can be beneficial in easyidentification of disciplinary issueshowever, employers must avoid blindreliance on AI, ensuring manualreviews and due process in disciplinaryactions to avoid claim of unfairdismissals. Transparency andemployee recourse are critical tomaintaining trust and compliance.Accountability: A SharedResponsibilityDetermining liability for AI-drivendecisions is complex. Globally,employers are often held accountablefor discriminatory outcomes, evenwhen using vendor-provided AI tools.The EU’s proposed AI Act introduces arisk-based framework for AI systems,placing stringent requirements on“high-risk” applications, including HRtools. Organizations must demonstratecompliance through documentation,audits, and ongoing monitoring.Vendors share some liability,emphasizing collaborativeaccountability.Striking a BalanceAI’s potential in HR is vast butdemands proactive measures toaddress legal and ethical risks.Employers must proactively addressthese challenges by conducting biasaudits and impact assessments,ensuring transparency and humanoversight in decision-making processesand adhering to jurisdiction-specificlaws and best practices.Balancing innovation with complianceallows organizations to leverage AI’spower while safeguarding employeerights and fostering trust.

Human Rights Protection in India14Advancement of Backward Classes: The State can make special provisions for the advancementof socially and educationally backward classes, including Scheduled Castes and Scheduled Tribes.Educational Reservations: The State can make special provisions for the admission of sociallyand educationally backward classes, including Scheduled Castes and Scheduled Tribes, toeducational institutions, with a maximum of ten percent of total seats reserved for these groups.Economically Weaker Sections: The State can make special provisions for the advancement ofeconomically weaker sections, including reservations in educational institutions, up to ten percent oftotal seats.Let's delve into how the Indian Constitution defines some of these fundamental rights:Article 14. Equality before law —The State shall not deny to any person equality before the law orthe equal protection of the laws within the territory of India.Article 15. Prohibition of discrimination on grounds of religion, race, caste, sex or place of birth —Non-Discrimination: The State must not discriminate against any citizen based on religion, race,caste, sex, or place of birth.The Protection of HumanRights Act, 1993 safeguardsthe rights of every individualagainst any violation of humanrights.Human Rights means the rightsrelating to life, liberty, equalityand dignity of the individualguaranteed by the Constitutionor embodied in theInternational Covenants andenforceable by courts in India.Article by -Ms. Vandana BhatiaDirector – Legal & Compliance - Ryan IndiaTax Services Private LimitedEqual Access: Citizens must not face discrimination in accessing public places, such as shops,restaurants, hotels, entertainment venues and facilities maintained by the State.Special Provisions for Women and Children: The State can make special provisions for thebenefit of women and children.

Reservation for Scheduled Castes and Tribes: The State can make provisions for reservation,including in matters of promotion, for Scheduled Castes and Scheduled Tribes that areunderrepresented in services under the State.Unfilled Vacancies: The State can consider unfilled reserved vacancies of a year as a separateclass to be filled up in succeeding years, not affecting the 50% ceiling on reservations.Religious Offices: Laws requiring the incumbent of an office related to religious institutions tobelong to a particular religion or denomination are not affected by this article.Reservation for Economically Weaker Sections: The State can make provisions for reservingappointments or posts for economically weaker sections of citizens, with a maximum of ten percentof the posts in each category.Article 21. Protection of life and personal liberty — No person shall be deprived of his life orpersonal liberty except according to procedure established by law.Article 21A. Right to education — The State shall provide free and compulsory education to allchildren of the age of six to fourteen years in such manner as the State may, by law, determine.Article 22. Protection against arrest and detention in certain cases – Right to Information and Legal Counsel: Anyone arrested must be informed of the grounds fortheir arrest and allowed to consult and be defended by a legal practitioner of their choice.Timely Production before Magistrate: Arrested individuals must be produced before the nearestmagistrate within 24 hours, excluding travel time, and cannot be detained beyond this periodwithout a magistrate's authority.Exceptions: Right to Information and Legal Counsel and Timely Production before Magistrate donot apply to enemy aliens or those detained under preventive detention laws.Preventive Detention Limits: Preventive detention beyond three months is not allowed unless anAdvisory Board, consisting of qualified judges, reports sufficient cause for the detention. Parliamentcan set the maximum detention period and procedures for such cases.Article 16. Equality of opportunity in matters of public employmentEquality of Opportunity: All citizens must have equal opportunities for employment orappointment to any office under the State.Non-Discrimination: No citizen can be deemed ineligible or discriminated against in employmentor office under the State based on religion, race, caste, sex, descent, place of birth, or residence.Residence Requirements: Parliament can make laws prescribing residence requirements forcertain classes of employment or office under the State or local authorities.Reservation for Backward Classes: The State can make provisions for reserving appointments orposts for any backward class of citizens that is underrepresented in services under the State.1315

16Communication of Grounds for Preventive Detention: Authorities must promptly communicatethe grounds for preventive detention and provide an opportunity for representation against the order.Public Interest Exception: Authorities are not required to disclose facts against the public interestwhen communicating grounds for preventive detention.A Parliamentary Prescriptions: Parliament can prescribe circumstances, classes of cases,maximum detention periods, and procedures for Advisory Boards related to preventive detention.Article 23. Prohibition of traffic in human beings and forced labour -Prohibition of Human Trafficking and Forced Labor: Trafficking in human beings, begar (a formof forced labor), and other similar forms of forced labor are prohibited, and violations are punishableby law.Compulsory Public Service: The State may impose compulsory service for public purposes, butmust not discriminate based on religion, race, caste, or class when doing so.Article 24. Prohibition of employment of children in factories, etc - No childbelow the age offourteen years shall be employed to work in any factory or mine or engaged in any other hazardousemployment.

17Who promotes and protects Human Rights inIndia? National Human Rights Commission, India (NHRC):The NHRC works to promote and protect humanrights in India.What are the Issues on which complaints canbe registered. (Source:https://nhrc.nic.in/complaints/promotion-and-protection-human-rights-through-csc) For not taking lawful action by police, administrationand other departments in the matter as below:Illegal detention, false implication, custodialviolence, or police excesses.Deaths in police or prison custody.Atrocities on SCs and STs.Denial of benefits of social welfare schemes andbasic amenities.Issues related to child labor, bonded labor, andchild marriage.Exploitation and sexual harassment of women.Abduction, rape, or murder.Environmental violations.Inaction on complaints regarding communalviolence or public unrestComplaints which are not entertained.Incidents which happened a year before filingthe complaintMatter which are sub judice or before any othercommission or with any court/tribunalComplaints which are vague, anonymous orpseudonymous, frivolous in natureService matter other than pension and familypensionProperty and other civil disputes.Allegation not against any public servantIssues relating to labor/industrial disputesMatter outside the purview of the commissionMatter which is covered by judicialverdict/decision by commission Manner of filing ComplaintComplaints can be filed free of cost by the victim oron their behalf:By Post: National Human Rights Commission,Manav Adhikar Bhawan, Block C, GPO Complex,INA, New Delhi - 110023.Online: Through the NHRC website(www.nhrc.nic.in).Through Common Service Centers: Complaintscan also be filed for a fee of Rs. 30 at CommonService Centers.International Human Rights CovenantsIndia is a signatory to several internationalhuman rights covenants that aim to protect andpromote human rights. Here are some of the keycovenants that are applicable in India:International Covenant on Civil andPolitical Rights (ICCPR): Ratified by India onApril 10, 1979, this covenant ensures theprotection of civil and political rights, includingthe right to life, freedom of speech, and equalitybefore the law.International Covenant on Economic,Social, and Cultural Rights (ICESCR): Alsoratified on April 10, 1979, this covenant focuseson the protection of economic, social, andcultural rights, such as the right to work,education, and an adequate standard of living.Convention on the Rights of the Child(CRC): Ratified by India on December 11, 1992,this convention aims to protect the rights ofchildren, including their right to education,health, and protection from exploitationConvention on the Elimination of All Formsof Discrimination against Women(CEDAW): Ratified on July 9, 1993, thisconvention focuses on eliminating discriminationagainst women and promoting gender equality.Convention against Torture and OtherCruel, Inhuman or Degrading Treatment orPunishment (CAT): Although India has signedthis convention, it has not yet ratified it.Convention on the Rights of Persons withDisabilities (CRPD): Ratified by India in 2007,this convention aims to protect the rights anddignity of persons with disabilities.This overview highlights the key human rightsprotections in India, emphasizing the role of theNHRC and India’s commitment to internationalhuman rights standards.Disclaimer: The information providedabove is sourced from the IndianConstitution and the NHRC Website, and isintended solely for general informationalpurposes. It does not constitute legaladvice nor serve as a substitute forprofessional legal consultation. It isrecommended that you seek independentlegal advice before taking any action basedon the content of this article.

18Global Legal Summit was established with an intent of bringing together Leaders from theInternational Legal Fraternity to felicitate Law Firms, Legal Tech and In-House Counsels all underone roof.Reasons to attend - The Global Legal SummitThe Global Legal Summit will feature Speakers who are experts in their respective fields and willoffer valuable insights and perspectives on relevant Legal issues. Our focus is to hear differentviews on diverse topics and to engage in dynamic discussions.The platform offers countless opportunities for networking amongst Lawyers, Judges, Academicsand other legal experts resulting in building relationships and expanding your professionalnetwork.Global Legal Summit has curated a platform where the best of Legal minds will be recognized fortheir outstanding achievements and tremendous hard work. Our distinguished Jury will beplaying an integral part in finalizing our Awardees.Global Legal SummitSeptember, 2025 -Dubai, UAEWHO ATTENDSAttorneysAttorneysLaw FirmsAcademicians JudgesIn-HouseCounsel

MEDIA PARTNERSORGANIZED BYSUPPORTING ASSOCIATIONEvenement InvestiturePrivate Limited19gls@evenement.world+91 8447692430www.globallegalsummit.world

The United Arab Emirates: A Tax Haven forTrading Companies and the Role of the DubaiInternational Financial Centre (DIFC) JurisdictionThe United Arab Emirates (UAE), a strategically located andbusiness-friendly jurisdiction, has increasingly emerged as apreferred destination for global trading companies. Itsprogressive policies, tax exemptions, and specialized legalframeworks have led to the UAE’s recognition as a tax haven,especially for trading and financial firms. Central to thistransformation is the establishment of the Dubai InternationalFinancial Centre (DIFC), which plays a critical role in fosteringbusiness activity within the region. By offering a sophisticatedlegal infrastructure, tax incentives, and a robust disputeresolution mechanism, the DIFC serves as the cornerstone ofthe UAE’s appeal as an international business hub.The concept of a "tax haven" refers to a jurisdiction with low or no taxes that provides a conduciveenvironment for foreign investment and business activities. The UAE, especially since the early 2000s, hasbeen synonymous with such a model, becoming one of the world’s most attractive destinations forinternational businesses. This status is largely attributed to the country's tax-friendly policies, which havebeen pivotal in fostering a thriving trading sector.Historically, the UAE was known for its near-zero tax rates, making it a paradise for foreign investors andmultinational companies. The introduction of a corporate tax at a rate of 9% in June 2023 was a notableshift, but it was limited to businesses with taxable income exceeding AED 375,000. This corporate tax isstill relatively low compared to global standards, positioning the UAE as an attractive jurisdiction fortrading companies. Importantly, the corporate tax does not apply to companies that operate within freezones, offering tax exemptions and other financial benefits. These free zones, including the DubaiInternational Financial Centre (DIFC), serve as sanctuaries for businesses wishing to benefit from taxexemptions, full foreign ownership, and repatriation of profits.UAE as a Tax Haven for Trading Companies20In addition to corporate tax exemptions, the UAE isalso known for its absence of personal income tax,wealth tax, and inheritance tax. This tax regime isfurther supplemented by favorable double taxationtreaties that the UAE has entered into with numerouscountries around the world. These treaties enhancethe UAE’s position as a jurisdiction conducive tointernational trade by reducing the tax burdens ofcompanies and individuals operating across borders.Companies in sectors such as trading, real estate,and financial services can thus optimize theiroperations by routing transactions through the UAE’stax-efficient structure.Article by - Ms. Mehnaz ZulfikarGroup Legal Manager - RESCOM

The Role of DIFC Jurisdiction in Supporting Trading CompaniesThe DIFC is an integral component of the UAE’s appeal as a tax haven. Established in 2004, the DIFCoperates as an independent financial free zone, with its own legal and regulatory framework distinctfrom the rest of the UAE. This special economic zone has been specificallydesigned to cater to businesses in the financial services and trading sectors. By offering acombination of legal certainty, tax benefits, and access to a global market, the DIFC has become anincreasingly attractive jurisdiction for trading companies.One of the primary advantages of the DIFC is its legal infrastructure. The DIFC has its own setof laws and regulations, which are based on common law principles, making it more familiar tointernational investors and traders who may be accustomed to jurisdictions like the UK or theUS. For example, the DIFC's Companies Law, Employment Law, and Commercial Law aretailored to meet international standards and provide an efficient legal framework for conductingbusiness. As part of this, businesses within the DIFC benefit from the jurisdiction's consistent andtransparent enforcement of laws, which enhances the confidence of international investor in operatingwithin the region.Additionally, the DIFC Courts provide a specialized judicial system for resolving commercial disputes.The DIFC Courts have jurisdiction over civil and commercial matters arising from transactions within theDIFC, and their legal proceedings are conducted in English, which is the global business language. TheDIFC Courts have also gained recognition for their efficiency and professionalism in handling complexfinancial and trading-related cases. This specialized dispute resolution mechanism enhances theconfidence of trading companies, offering them an independent and transparent avenue for resolvingany potential business disputes.21In recent years, the DIFC Courts have becomerenowned for handling cross-border legal disputes,particularly in the area of asset recovery. A notableexample is the case of NMC Health, one of the UAE'slargest healthcare providers. In 2020, the DIFC Courtsplayed a pivotal role in facilitating a major restructuringprocess following the company's financial difficulties.The DIFC Court’s ability to issue interim orders andcoordinate international asset recovery efforts enabledNMC Health to navigate complex financial restructuring,showcasing the DIFC's capacity to handle sophisticatedbusiness matters.Moreover, the DIFC provides a platform for businessesto select a governing law and jurisdiction for theircontracts. In the absence of such a selection, DIFC lawapplies, ensuring that disputes can be litigated under apredictable and consistent legal system. This flexibilityhas attracted a multitude of international tradingcompanies looking for a legal environment that alignswith their business operations. As an example, theDIFC serves as the legal base for a variety ofmultinational trading companies, including investmentbanks, asset managers, and global trading firms, whovalue the ease of conducting business in aninternationally recognized jurisdiction with minimalregulatory burdens.

Example: The Case of Investec Bank and DIFC’s RoleAn example of the DIFC’s growing role in facilitating international trading and finance is theestablishment of an office by South African investment bank, Investec, within the DIFC in 2024.The establishment of this office was part of Investec’s strategic decision to expand its presence in theMiddle East, capitalizing on the DIFC’s global reputation and legal infrastructure. This move aligns witha broader trend where financial services and trading companies are increasingly relying on the DIFC togain access to the UAE’s markets while benefiting from the DIFC’s regulatory framework and thestability provided by its independent legal system.ConclusionWhile the UAE’s tax regime has evolved, the country remains a competitive destination for internationaltrading companies. The DIFC’s role as a specialized jurisdiction with a common law framework, accessto a skilled workforce, and an efficient legal system makes it a cornerstone of the UAE’s attractivenessto foreign investors. The combination of low tax rates, a favorable business environment, and acomprehensive legal infrastructure provided by the DIFC continues to establish the UAE as a premierdestination for international trade and investment.In the coming years, the UAE is likely to continue its growth as a global business hub, and theDIFC will remain at the forefront of this development, supporting the needs of internationaltrading companies by offering a stable, reliable, and internationally recognized legalenvironment.Sources:https://nomadcapitalist.com/finance/are-uae-free-zone-companies-still-tax-free/https://www.hallmarkauditors.com/will-the-uae-lose-its-charm-as-a-tax-haven-with-the-introduction-of-corporate-tax/https://www.eversheds-sutherland.com/en/global/insights/difc-courts-expand-role-in-global-asset-recovery-with-landmark-decision?https://www.reuters.com/business/finance/south-african-lender-investec-opens-office-dubais-difc-2024-09-25/https://www.difccourts.ae/about/difc-courtshttps://www.difc.ae/business/laws-and-regulations2222

AES Corporation and other internationalinvestors have initiated ICSID arbitrationagainst Argentina over losses suffereddue to frozen electricity tariffs andunfavorable regulatory changes. Theclaimants argue these actions violatedArgentina’s obligations under the U.S.-Argentina Bilateral Investment Treaty.The dispute highlights long-standinginvestor concerns in Argentina’s energysector, especially related to thegovernment’s handling of economiccrises through retroactive policychanges impacting foreign-ownedutilities and infrastructure investments.NEWS UPDATES Argentina Faces $337M ArbitrationOver Energy Tariff DisputeC u r r e n t A f f a i r s23

Vodafone has reignited arbitrationproceedings against India under the India-Netherlands BIT, seeking compensationfor retrospective tax demands related toits acquisition of Hutchison Essar. Thetelecom giant contends that India violatedinternational investment protections byimposing backdated taxes despite aprevious favorable ruling. The casereflects broader investor unease regardingIndia’s tax regime and raises questionsabout its commitment to honoring globalarbitration outcomes and bilateralinvestment treaty obligations.A foreign oil exploration company has fileda new ICSID claim against Nigeria, allegingthat the government's abrupt revocation ofits oil license constitutes unlawfulexpropriation. The dispute, brought underthe Nigeria-Netherlands BilateralInvestment Treaty, involves claims ofpolitical interference, lack of due process,and economic harm. The claimant seekssubstantial damages and asserts thatNigeria’s actions undermine investorconfidence in the country’s regulatoryframework for the energy sector.Vodafone Revives ArbitrationAgainst India Over Tax DisputeNigeria Faces Fresh ICSID Claim OverOil License RevocationC u r r e n t A f f a i r s24

A European solar energy investor haslaunched ICSID arbitration against Italy,claiming €200 million in damages for thegovernment’s rollback of renewableenergy incentives. The claimant arguesthat Italy violated the Energy CharterTreaty by breaching legitimateexpectations and failing to provide a stableinvestment environment. This case adds toa growing number of disputes broughtagainst European nations over retroactivepolicy changes that affect clean energyprojects and investor returns.DA Canadian mining firm has initiatedICSID arbitration against Peru, allegingthat repeated delays in environmental andoperational permits for its mining projectamount to unfair treatment andexpropriation. The dispute is filed underthe Canada-Peru Free Trade Agreementand centers on claims of bureaucraticobstruction and shifting regulatorystandards. The company seekscompensation for lost revenues andinvestment damages, citing violations ofinternational norms for investor protectionand project transparency.Italy Sued for €200M Over RenewableEnergy Incentive CutsPeru Hit by Mining ArbitrationOver Permit DelaysC u r r e n t A f f a i r s25

In-HouseCounselLawStudents &ScholarsLaw FirmsAttorneysLegalTechExpertsJudgesGLOBAL LEGALSUMMITSeptember, 2025| Dubai, U.A.E.gls@evenement.world+91 8447692430www.globallegasummit.world