Return to flip book view

Message

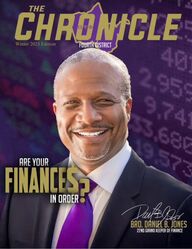

The 4th District Chronicle/ Winter 2025THE OFFICIAL PUBLICATION OF THE MIGHTY 4TH DISTRICT OF OMEGA PSI PHI FRATERNITY, INCPLEASE EMAIL ALL EDITORIAL QUESTIONS, & CONCERNS TO: BROTHER JASON B. WARD 4TH DISTRICT DIRECTOR OF PUBLIC RELATIONSGRAPHIC DESIGN TEAMBROTHER DONTE LUCKIEBROTHER TERRANCE AUSTER JR.ASSISTANT 4TH DISTRICT DIRECTOR OF PUBLIC RELATIONSBROTHER REG ADAMS ON THE COVERA PHOTOGRAPH OF BRO Daniel B. Jones22nd Grand Keeper of FinanceDEADLINES FOR CHRONICLE SUBMISSIONSFALL ISSUE- SEPTEMBER 15WINTER ISSUE- JANUARY 15DISTRICT ISSUE- MARCH 15OFFICIAL WEBSITE: OMEGA4THDISTRICT.ORGFACEBOOK & INSTAGRAM: Omega4thdistrictX/TWITTER: Omega4thD4th DISTRICT DIRECTOR OF PUBLIC RELATIONS Brother Jason B. WardEmail: 4thDinfo@oppf.orgphone: 937-422-4216District Public Relations Team Brother REG Adams Mu IotaBrother Damon Scott Zeta Omega Brother Greg White Eta Nu NuBrother Ashton Hood Delta Alpha Brother Keith Jordan Xi TauBrother Carl "CJ" Terrell Xi Aplha Brother Damon Burman Xi AlphaBrother Nick Williams Mu IotaBrother Christopher Cooper Jr Delta AlphaBrother Adam Ward Sigma PsiBrother Donovan McWilson Psi OmicronBrother Jeremie Thomas Theta PsiBrother Josiah Brown Delta EpsilonBrother Reggie Ware Zeta OmegaBrother Romeo Reese Delta AlphaBrother Tayshawn Gaines UpsilonContributing WritersBrother Damon Scott Zeta Omega Brother Lamar Cole 34rd 4th District Representative Zeta Omega Brother Ashton Hood Delta Alpha Brother Jonathan Foster Eta GammaBrother Jason Lucas Zeta OmegaBrother Dr Odell Graves Mu ChiBrother Daniel B Jones 22nd Grand Keeper of Finance Xi AlphaBrother Floyd Howell Delta AlphaBrother Anonio Caffey Eta Nu NuBrother Dannel Shepard Beta IotaBrother Eric Thompson Beta IotaBrother Ronald Jackson Delta AlphaBrother Tayshawn Gaines UpsilonBrother Dr Christopher K Welch 31st 4th District Representative Delta AlphaBrother Christopher Cooper Jr Delta AlphaBrother Ronnie Walker Chi AlphaBrother Gaidi Nkruma Zeta Kappa KappaBrother Miles RiceZeta SigmaBrother Judson Judson Phd Eta Nu NuBrother Keith Jordon Xi TauBrother Elder Bobby Robinson 33rd 4th District Representative Xi AlphaBrother JT Thomas 1st Vice 4th District Representative Alpha Alpha AlphaBrother Jesse Turner Beta IotaBrother Chris Macklin Beta IotaBrother Toriano Franklin Beta Iota The 4th District Chronicle/Winter 2025

THE CHRONICLE TABLE OF CONTENTSomega4thdistrict.orgIN EVERY ISSUE4th DISTRICT OFFICERS4th DISTRICT HISTORYFORMER DISTRICT REPRESENTATIVEDDPR MESSAGEDISTRICRT REPRESENTATIVE MESSAGE4th DISTRICT CHAPTERSGRAND BASILUES MESSAGE2ND VICE DR MESSAGE051206080907111031416182024252729FEATURES30313233353637383941424344454758606163SAVINGS VS INVESTINGHISTORY OF OPPFFCUTHE RULE 72 SOCIAL SECRUITYBUYING VS RENTING UNDERSTANDING CLOSING COSTREFINANCING YOUR MORTGAGEBUYING A CARAN INPRESSIVE CAREER..RUFUS HEARDTHE IMPORTANCE OF LIFE INSURANCE..INSURANCE PLANNINGDARYL S. CAMERONJUNVENILE INSURANCE PROPERTY AND CASUALTY INSURANCEUNDERSTANDING 529 PLANSLAMAR T. COLEWHY DO I NEED A WILL?LONG TERM CARE INSURANCEPREPLANNING YOUR FUNERAL1443583917273620DANIEL JONES 22ND GKFDARYL S. CAMERONLAMAR T. COLE RUFUS HEARDBLACK WALLSTREETWHAT IS A MUTUAL FUNDUNDERSTANDING CLOSING COSTUNDERSTANDING YOUR CREDIT SCOREFEATURESBROTHER DANIEL JONES 22 GKF BLACK WALL STREET A BLUEPRINT FOR ..THE IMPORTANCE OF FINANCIAL LITERACYUNDERSTANDING CREDIT SCORESWHAT IS A TRUST?WHAT IS AN ANNUITY WHAT ARE MUTUAL FUNDSDRAWING MONEY OUT OF YOUR RETIREMENT

omega4thdistrict.orgNATIONALLY MANDATED PROGRAMSDELTA ALPHA ACHIEVEMENT WEEKMU CHI ACHIEVEMENT WEEKXI IOTA IOTA ACHIEVEMENT WEEKETA NU NU ACHIEVEMENT WEEKETA NU NU SCHOLARSHIPBETA IOTA STEMMU IOTA HOST DRONE COMPETITIONZKK THE TREATS OF SWEETS CHI ALPHA A CHRISTMAS BLESSINGBETA IOTA TOY DRIVEMX FEED THE COMMUNITY DELTA ALPHA OP. SANTA CLAUSMU IOTA CELEBRATION OF SURVIVALBETA IOTA CPRDELTA ALPHA FALL 24ON THE YARDETA GAMM A & UPSILON VREMMY JOURNEY OF PUBLUC SERVICE..ETA GAMMA TEAMS UP WITH AKA (VREM)OE/DE FALL 24 INITATESZETA SIGMA PEARL LINEUPSILON WEEK OF UPLIFTTHE WEIRKICKZ PROJECTZKK INTERVIEW WITH REV PAUL SADLERVA HONORS BRO GEORGES WHITEHEADZKK INTERVIEW BRO JOHN CRAWFORD JRPURPLE PAGEBLACK WALLSTREET66697071737576777879808182 8392505152535456578587909417EXCLUSIVES666987717851DA ACHIEVEMENT WEEK MU CHI ACHIEVEMENT WEEK VA HONORS BRO WHITEHEAD HNN CHI ACHIEVEMENT WEEK CHI ALPHA A CHIRSTMANS BLESSINGMY JOURNEY OF PUBLIC SERVICE 4

The 4th District Chronicle/Winter 20255

The 4th District Chronicle/Winter 20256

The 4th District Chronicle/Winter 20257

The 4th District Chronicle/Winter 20258

The 4th District Chronicle/Winter 20259

The 4th District Chronicle/Winter 202510

The 4th District Chronicle/Winter 202511

The 4th District Chronicle/Winter 202512

The 4th District Chronicle/Winter 202513

BrotherDaniel Jones 22nd Grand Keeper of FinanceBrother Daniel B. Jones, Sr. was initiated into Omega Psi Phi Fraternity in 1989 through the Xi Alpha Chapter in the Fourth District, based in Charleston, WV. Over the years, he has held various leadership roles, including Basileus and Keeper of Finance at the Zeta Omega Chapter in Cleveland, Ohio, as well as numerous committee chairmanships and advisory positions. Notably, during his tenure as Basileus, he spearheaded initiatives that provided food assistance to over 500 families during the holiday season and developed a sustainable feeding program for residents in a financially distressed neighborhood in Cleveland.At the district level, Brother Jones has been elected to two terms as the Fourth District Keeper of Finance and served as Chief of Staff. His responsibilities as Chief of Staff included oversight of code of conduct matters, staff orchestration, and various initiatives to amplify the effectiveness of the District Representative.At the international level, Brother Jones has made significant contributions as the International Civic and Community Affairs Chairman. He worked to streamline efforts across multiple subcommittees, including Achievement Week, Talent Hunt, Social Action, Educational Development, Next Generation Leaders, and Katrina Relief. His efforts were particularly commendable following Hurricane Katrina, where he coordinated health professional outreach to provide dental, physical, and mental health services to the Gulf Coast region. Additionally, he collaborated with fraternity members to establish the International Talent Hunt Foundation (ITHF) to ensure the ongoing viability of local and international Talent Hunt competitions, where he currently serves as Director and Chairman. His role as International Budget Chairman under the 40th Grand Basileus led to the development and implementation of budget controls that generated profits for the fraternity, notably during the International Undergraduate Summit and the International Leadership Conference. Serving as the 22nd Grand Keeper of Finance (GKF) for Omega Psi Phi Fraternity, Inc., Brother Jones was elected during the 80th Grand Conclave in Las Vegas, NV, in a runoff election and was subsequently re-elected at the 81st Grand Conclave in New Orleans, LA. In this capacity, he successfully reduced operating expenses and craed an investment strategy that yielded a realized gain of $6 million for the fraternity. Professionally, he is a Senior Auditor in the Inspector General's Office at the Department of Justice and is also a Certified Fraud Examiner. His military career spans nearly 27 years in the United States Army, from which he retired at the rank of Lieutenant Colonel in 2011.The 4th District Chronicle/Winter 2025 Brother Jason Ward 4th Districtt Director of Public RelationsCONTINUED ON NEXT PAGE14

BrotherDaniel Jones 22nd Grand Keeper of FinanceAt the organizational level, Brother Jones is also a Board Member and Treasurer at the Omega Psi Phi Fraternity Federal Credit Union. He previously held a directorial position on the Friendship Foundation Board of Directors, overseeing the Omega World Center and the Omega Corporate Residence, valued collectively at over six million dollars. Additionally, he served as a Director for Omega Charities, focusing on upliment initiatives aimed at empowering the Black community—particularly male youth—in economically distressed areas, while providing humanitarian assistance during crises.Brother Jones has dedicated his career to enhancing community welfare, particularly in children's mental health, through his role as President of the Board of Directors at the Children and Youth Behavioral Health Center in North Central West Virginia. He led a multidisciplinary team to deliver essential mental health services to over 200 adolescents in underserved areas, significantly impacting their trajectories.In terms of community outreach, he is affiliated with the Southern Baptist Church in Baltimore, Maryland as a former member and trustee, and is currently an attendee at Bethlehem Church in Triangle, Virginia.His military accolades include multiple awards, such as the Meritorious Service Medal with two oak leaf clusters, the Army Commendation Medal with two oak leaf clusters, and several others, reflecting a distinguished service history.On the civilian front, he has held multiple board positions, including with the Council of the Inspectors General on Integrity and Efficiency and the Federal Audit Executive Council Contracting Committee. His commendations include the 2015 IG Award for the Equal Employment Opportunity Diversity Award for the Mentoring Program and the IG Special Act Award for exemplary leadership and effective execution of his duties.Brother Daniel B. Jones, Sr. exemplifies the values of leadership, dedication, and service within the Omega Psi Phi Fraternity and the broader community. His extensive contributions at various organizational levels, coupled with his professional expertise and commitment to enhancing the welfare of others, have made a significant impact on countless lives. Through his initiatives, he has not only addressed immediate needs but has also fostered long-term growth and development, particularly in underserved populations. Brother Jonesʼs legacy continues to inspire those around him, demonstrating the profound effect one individual can have on community upliment and support.The 4th District Chronicle/Winter 202515

Black Wall StreetA Blueprint for Our Future By Brother James "JT" Thomas 1st Vice 4th District RepresentativeBrothers, imagine this: two years before the founding of our beloved Omega Psi Phi Fraternity, there was a remarkable oasis in Tulsa, Oklahoma—a community known as Black Wall Street. In the Greenwood District, Black Americans defied the odds of segregation to build a vibrant, thriving hub of commerce, connection, and culture. They owned businesses, supported one another, and proved that unity and vision could create abundance, even in the most challenging of times.The success of Black Wall Street wasn’t just an accident. It was the result of intentional efforts to create a community where dollars stayed within, circulating among barbershops, restaurants, tailors, banks, and more. It was a place where Black professionals and entrepreneurs flourished, providing jobs and hope to their neighbors. Despite systemic challenges, they thrived because they believed in each other and were committed to lifting as they climbed.Now, I may sound ambitious, but I firmly believe we, the brothers of the Fourth District, have the power to create our own ecosystem of value. We’ve already planted the seeds of progress through efforts like Project 1911, where brothers pledge $19.11 per giving period, Project Uplift, and other district initiatives that reflect our collective strength and commitment. These projects show that when we come together, we can achieve remarkable things. But I ask: what more can we do?Our future depends on our willingness to invest in one another—not just financially, but in spirit, time, and action. Imagine the possibilities if we worked together to keep our resources, talents, and support circulating within our community for longer. Studies show that in other communities, their dollar circulates three to four times more than in ours. If we can change that, we can transform our district, our chapters, and our neighborhoods.Black Wall Street taught us the power of collective economics, of standing shoulder to shoulder to build something greater than ourselves. We can channel that same energy to build what I’ll call "Purple Wall Street." This isn’t just about money; it’s about creating a thriving and self-sustaining community where brothers support each other’s endeavors, where we create opportunities and uplift those around us.What does this look like in practice? It starts with supporting our district and local chapters. If you can’t attend an event, buy a ticket. If a brother is running a business, become a customer or help spread the word. If a chapter needs help with a fundraiser or service project, lend your time or resources. These small actions, when multiplied across our district, can have a monumental impact.The 4th District Chronicle/Winter 2025CONTINUED ON NEXT PAGE16

We must also think bigger and bolder. Could we create a Fourth District business directory, connecting brothers who own businesses or provide professional services? Could we form investment groups within our chapters, pooling resources to support startups or scholarships? Could we mentor young entrepreneurs within our communities, ensuring the next generation has the tools they need to succeed?Brothers, the possibilities are endless when we come together with a shared vision and purpose. Let’s not allow doubt or division to hold us back. Instead, let us embrace the spirit of hope and collaboration that has always been a cornerstone of Omega Psi Phi. Together, we can achieve what may seem impossible.This is our call to action. Let’s build something extraordinary, something that future generations of Omega men will look back on with pride. Let’s prove that the strength of our brotherhood goes beyond words—that it is rooted in action, in sacrifice, and in unwavering support for one another.Our history teaches us that we are capable of greatness when we stand together. Let’s honor that legacy by creating a future that reflects our highest aspirations. Black Wall Street was built on a foundation of resilience and unity. Purple Wall Street will be no different.Brothers, the time is now. Let’s unite, uplift, and create a legacy that will inspire not just our district, but all of Omega Psi Phi. Together, we can build the future we deserve—a future where every brother thrives, and every chapter prospers. Purple Wall Street isn’t just a dream; it’s our destiny.Black Wall StreetA Blueprint for Our FutureThe 4th District Chronicle/Winter 202517

FINANCIAL LITERACYTHE IMPORTANCE OFBY BROTHER LAMAR COLE 34TH 4TH DISTRICT REPRESENTIVE The 4th District Chronicle/Winter 2025Financial literacy is an essential life skill that empowers individuals to make informed and effective decisions regarding their financial resources. In a world increasingly driven by complex economic systems, understanding the basics of money management, investing, and financial planning is more critical than ever. Unfortunately, many African Americans lack the knowledge and commitment needed to navigate their financial lives effectively, leading to poor financial health and missed opportunities savings over time.What is Financial Literacy?Financial literacy refers to the ability to understand and use various financial skills, including budgeting, investing, saving, and managing debt. It encompasses knowledge of financial principles and concepts such as compound interest, the time value of money, and the risks and rewards associated with investments.1. Improved Money ManagementFinancial literacy equips individuals with the tools to create budgets, track expenses, and manage income effectively. By understanding where their money is going, people can allocate resources to meet their needs and goals.2. Reduced Debt LevelsWith financial knowledge, individuals can avoid common pitfalls like high-interest loans, credit card debt, and predatory lending practices. Learning how to manage and repay debt effectively ensures financial stability.3. Preparation for EmergenciesA strong financial foundation enables individuals to build an emergency fund, providing a safety net in case of unexpected expenses such as medical emergencies or loss of income.4. Better Retirement PlanningFinancial literacy helps individuals understand the importance of long-term saving and investing. Planning for retirement early can ensure financial security in their later years.5. Increased Economic ParticipationA financially literate population contributes to a healthier economy. Individuals who understand how to manage their finances can invest in businesses, purchase homes, and contribute to economic growth.CONTINUED ON NEXT PAGE18

FINANCIAL LITERACYTHE IMPORTANCE OFThe 4th District Chronicle/Winter 2025Key Components of Financial Literacy:1. BudgetingCreating and maintaining a budget is the cornerstone of financial literacy. It involves tracking income and expenses to ensure spending aligns with financial goals.2. Saving and InvestingSaving for short-term needs and investing for long-term growth are critical aspects of financial health. Understanding concepts like interest rates, inflation, and diversification can SIGNIFICANTLY impact financial outcomes.3. Debt ManagementKnowing how to handle debt responsibly, including understanding credit scores and repayment terms, is vital for maintaining financial stability.4. Understanding Financial ProductsFrom insurance policies to retirement accounts, being aware of the benefits and drawbacks of various financial products can help individuals make more informed choices.How to Improve Financial Literacy:1. EducationTake advantage of online courses, workshops, and seminars on personal finance. Many resources are free and accessible to everyone.2. Practical ApplicationApply financial principles in everyday life, such as setting a budget and reviewing bank statements.3. Seek Professional AdviceConsulting with a financial advisor can provide personalized guidance tailored to your goals and financial situation.4. Read and ResearchBooks and reputable financial websites offer valuable insights into personal finance. Financial literacy is not just a skill; it is a necessity in today’s fast-paced, ever-changing economic environment. By equipping themselves with the knowledge and tools to manage their finances effectively, individuals can achieve financial independence, reduce stress, and build a secure future. All organizations (Business, Government, School, etc.) must prioritize financial education to create a society where EVERYONE has the opportunity to thrive financially.19

Understanding Credit Scores and Debt-to-Income Ratios: A Guide for Black MalesIn today's financial landscape, understanding credit scores and debt-to-income ratios is crucial for anyone looking to achieve financial stability and success. For Black males, who often face systemic barriers to financial literacy and access to credit, it is essential to gain a comprehensive understanding of these concepts. This article aims to demystify credit scores, explain the significance of debt-to-income ratios, and provide actionable steps to improve both. By empowering individuals with this knowledge, we can help create a more equitable financial future.A credit score is a numerical representation of an individual's creditworthiness, calculated based on their credit history and financial behavior. Typically ranging from 300 to 850, a higher score indicates better credit health and makes it easier to secure loans and credit at favorable interest rates. Credit scores are primarily used by lenders to assess the risk of lending money to a borrower.Several key factors influence your credit score. The most significant is your payment history, which accounts for about 35% of the score. Consistently making on-time payments demonstrates reliability and responsibility. Next is credit utilization, which makes up around 30% of your score; this refers to the ratio of your current credit card balances to your total credit limits. Keeping this ratio below 30% is generally recommended.The length of your credit history (15%) also plays a role; longer histories can positively impact your score. Additionally, the types of credit accounts you have (10%) and the number of recent inquiries into your credit (10%) can affect your score. Understanding these components is crucial for anyone looking to improve their credit score and secure better financial opportunities.The 4th District Chronicle/Winter 2025By Brother Daniel B. Jones, Sr.Omega Psi Phi Fraternity Federal Credit UnionTreasurerCONTINUED ON NEXT PAGE20

Understanding Debt-to-Income RatioThe debt-to-income (DTI) ratio is a crucial financial metric that helps lenders assess an individual’s ability to manage monthly payments and repay debts. It is calculated using the formula: DTI=(TotalMonthlyDebtPaymentsGrossMonthlyIncome)×100\text{DTI} = \left( \frac{\text{Total Monthly Debt Payments}}{\text{Gross Monthly Income}} \right) \times 100DTI=(GrossMonthlyIncomeTotalMonthlyDebtPayments)×100This ratio expresses your total monthly debt payments as a percentage of your gross monthly income. A lower DTI indicates that you have a manageable level of debt compared to your income, making you a more attractive candidate for loans.DTI is essential in evaluating borrowing power, as lenders use it to gauge risk. Generally, an ideal DTI ratio is below 36%, but this can vary based on the type of loan. For example, most mortgage lenders prefer a DTI of 28% or lower for housing-related debts, while some allow higher ratios for personal loans. Maintaining a low DTI not only enhances your chances of loan approval but can also lead to better interest rates, ultimately saving you money over time. Understanding and managing your DTI is a key component of effective financial planning.The Impact of Credit Scores and DTI on Borrowing PowerUnderstanding how credit scores and debt-to-income (DTI) ratios affect borrowing power is crucial for anyone seeking a loan. These two factors significantly influence loan approval, interest rates, and overall borrowing terms.Credit Scores and Loan ApprovalCredit scores typically range from 300 to 850, with higher scores indicating lower risk to lenders. A strong credit score, usually above 700, can lead to quicker loan approvals and more favorable interest rates. Lenders view individuals with higher scores as responsible borrowers, often resulting in lower monthly payments and reduced total interest paid over the life of the loan. For instance, someone with a credit score of 750 might secure a mortgage at a 3.5% interest rate, while another borrower with a score of 620 could face a rate of 5.5%, significantly increasing the overall cost of borrowing.The 4th District Chronicle/Winter 2025CONTINUED ON NEXT PAGE21

DTI and Loan EligibilityThe DTI ratio, calculated by dividing monthly debt payments by gross monthly income, serves as a critical indicator of a borrower’s ability to manage monthly payments. A lower DTI—typically below 36%—is preferred by lenders, as it indicates that borrowers have a manageable level of debt relative to their income. If your DTI is too high, lenders may deny your application or offer less favorable terms.Real-Life ExamplesConsider two applicants seeking a mortgage of $300,000. Applicant A, with a credit score of 780 and a DTI of 28%, is offered a 3.5% interest rate. Their monthly payment would be approximately $1,350. Applicant B, with a credit score of 640 and a DTI of 45%, receives an offer at 5.5%, leading to a monthly payment of about $1,700. Over 30 years, Applicant A will pay nearly $170,000 less in interest than Applicant B.In summary, maintaining a high credit score and a low DTI is vital for maximizing your borrowing power and securing the best possible loan terms.Strategies to Control and Improve Your Credit ScoreMaintaining a good credit score is essential for securing loans and favorable interest rates. Here are some effective strategies to help you manage and improve your credit.Timely PaymentsConsistently paying your bills on time is one of the most significant factors influencing your credit score. Setting up automatic payments or reminders can help you stay on track.Reducing Credit Card BalancesAim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit limit. Paying down existing balances and avoiding high credit card debt can boost your score significantly.Minimizing Credit InquiriesLimit the number of new credit applications. Each inquiry can temporarily lower your score, so apply for credit only when necessary.Regularly Check Credit ReportsMonitoring your credit reports regularly is crucial. I encourage you to check your credit scores, annually, for instance, on your birthday and look for inaccuracies and dispute any errors, as they can negatively impact your score. You are entitled to one free report annually from each of the major credit bureaus. The most known credit reporting agencies are Experian, TransUnion, Equifax.The 4th District Chronicle/Winter 2025CONTINUED ON NEXT PAGE22

Building CreditConsider using secured credit cards or credit-builder loans. These options are designed to help individuals establish or rebuild their credit history, provided they make timely payments. By implementing these strategies, you can take control of your credit score and improve your financial future.Strategies for Reducing DebtStart by creating a budget that tracks your income and expenses. This will help identify areas to cut back, allowing you to allocate more towards debt repayment. Two popular methods for tackling debt are the debt snowball and debt avalanche strategies. The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment. In contrast, the debt avalanche method prioritizes high-interest debts, ultimately saving you more money over time.Increasing IncomeImproving your income is another effective way to enhance your DTI. Consider taking on a side job, freelancing, or selling unused items. Even small increases in income can significantly impact your overall financial picture.Seeking Financial EducationFinally, leverage financial education resources, such as workshops, online courses, and counseling services. These can provide valuable insights and strategies for managing debt effectively. With a proactive approach, you can reduce your debt load and improve your financial standing. Your Omega Psi Phi Fraternity Federal Credit Union is ready to provide assistance for free. Contact them atoppffcu.org. Take ControlUnderstanding credit scores and debt-to-income ratios is vital for Black males striving for financial empowerment. By taking control of their credit and managing debt effectively, individuals can enhance their borrowing power, secure better loan terms, and ultimately achieve their financial goals. Education and awareness are the first steps toward breaking down barriers and building a brighter financial future.The 4th District Chronicle/Winter 202523

WHAT IS A TRUST?Brother Jason B. Ward 4th District Director of Public RelationsGrantor: This is the person who puts assets (like money or property) into the trust for someone else to manage. Trustee: This can be an individual or an organization responsible for taking care of those assets. They manage the trust for the benefit of the person or group receiving the assets.Beneficiary: This is the individual or organization that ultimately receives the assets from the trust.Trusts can serve many purposes, such as:- Giving assets to family members or charities - Helping to lower taxes - Protecting property from legal claims or during a divorce - Providing a steady income for a particular time frame There are two main types of trusts:1. Revocable Trust: Also known as a living trust, the grantor can change or end this type of trust while they are still alive.2. Irrevocable Trust: Once this trust is set up, it cannot be changed or canceled.Setting up a trust involves ongoing management. This includes putting assets into the trust, picking a trustee, and making updates to the trust agreement as needed.Establishing a trust can offer several advantages, such as:Avoiding Probate: Trusts often help skip the probate process, which is the legal procedure for distributing assets and can be time-consuming and public. This enables quicker and more private transfers of property.Asset Protection: Trusts can shield assets from creditors and legal challenges. Reducing Estate Taxes: Putting assets into an irrevocable trust means they are no longer counted as part of your estate, which can lower taxes owed after you pass away.Flexibility: Trusts can offer more options than a will. For instance, a grantor can modify a revocable trust while they are alive.Privacy: Trusts help keep your financial situation confidential by allowing you to control your property and how it is passed on to beneficiaries.Control: Trusts give you the ability to decide how and when beneficiaries receive their share of the assets, such as specifying an age requirement.Charitable Legacy: You can create a lasting impact by setting up a charitable trust to support causes important to you.Overall, trusts are powerful tools for managing and protecting your assets both during your life and after you’re gone.Understanding what is a trust.A trust is a legal arrangement that involves three key players: the grantor, the trustee, and the beneficiaryThe 4th District Chronicle/Winter 202524

What is an Annuity?By Brother Jason B. Ward 4th District Director of Public RelationsIndexed Annuities: These annuities offer a mix of security and growth potential. They tie your investment to the performance of stock market indexes, similar to how the stock market does. They often provide a guaranteed minimum payout, like fixed annuities, but there may be limits on how much you can earn if the market does really well.Immediate Annuities: Perfect for those who want to start receiving payments right away, immediate annuities allow you to get payouts shortly after making a significant initial payment. This is ideal for people needing a quick source of income.Deferred Annuities: Unlike immediate annuities, deferred annuities let you save money for a while before taking any payouts. Your money grows without being taxed during this waiting period, and you can contribute either a single large sum or a series of smaller payments.An annuity is a type of financial product provided by insurance companies, intended to give people a steady income, especially when they retire. You can think of an annuity like a personal pension plan that helps you save and manage your money for the future. One of the great things about annuities is that there are different types, allowing you to choose the one that best meets your needs and goals.Different Types of AnnuitiesFixed Annuities: These are a good option for those who want a stable and predictable income. Fixed annuities promise a set payout and provide a fixed interest rate, which means they are not affected by the ups and downs of the stock market. Depending on your plan, you can get your money all at once or in scheduled payments over several years.Variable Annuities: If you don’t mind market changes, variable annuities let you invest your money in different portfolios. The payout you receive can vary based on how well these investments perform. If they do well, you could see bigger payouts; if not, your payouts might be smaller.The 4th District Chronicle/Winter 2025CONTINUED ON NEXT PAGE25

Types of FeesRate Spreads and RidersAnnuities can come with a lot of fees. These might include:Surrender charges: Fees for withdrawing money early, which can be quite high in the first few years.Administrative costs: Ongoing expenses for managing the annuity.Mortality charges: Costs related to insurance coverage provided within the annuity.Investment fees: Costs associated with managing the investments in variable annuities.Generally, fixed annuities have lower fees than variable annuities, which often come with higher management costs.Some variable and indexed annuities may have something called "rate spreads." This means the insurance company keeps part of your earnings before paying you the interest. On average, these spreads are around 2%, which can affect your overall returns.Riders are optional features you can add to your annuity that may offer extra benefits or guarantees, but they usually come with additional costs.Before choosing an annuity, it's wise to compare it to other retirement savings options and fully understand all the fees involved to ensure you’re making the best choice for your financial future.What is an Annuity?The 4th District Chronicle/Winter 202526

What are MUTUAL FUNDS?A fund's success relies heavily on its managers, such as Adam Benjamin for FSPTX, who make key investment decisions. Mutual funds are open-ended, available for trading at any time, and usually come in dierent share classes:Class A Shares: Front-end load shares with priority for dividends.Class B Shares: Back-end load shares that charge a fee upon selling, decreasing over time.Class C Shares: Level-load shares with minimal sales charges, but carrying ongoing fees.A mutual fund is a security oered by an Open-End Investment Company and is popular among investors for its diversification, aordability, liquidity, and professional management. The SEC mandates that mutual funds have a defined investment objective, which can only change with a majority shareholder vote.Investors buy shares in mutual funds, allowing them to indirectly invest in multiple companies within a sector, unlike purchasing individual company stocks. This diversification helps manage risk, as dierent stocks within the fund may perform variably.For instance, the Fidelity Select Technology Portfolio (FSPTX) has a market size of $15.917 billion and includes companies like Nvidia, Apple, and Microsoft, with a share price of $37.70. A well-composed fund can mitigate risks and enhance value, especially if one or more companies significantly outperform expectations.The 4th District Chronicle/Winter 2025By Brother Christtopher Cooper JrCONTINUED ON NEXT PAGE27

There are various types of mutual funds for investors, including index funds and target date funds. Many 401(k) providers oer these options to help build wealth for retirement and other goals. Index funds track specific market indices like the S&P 500, providing diversification by spreading investments across all companies in that index. Conversely, target date funds adjust their asset allocation over time, becoming more conservative as the retirement date approaches.Employees often invest part of their paycheck in an index fund matching their expected retirement year. For example, a new employee in 2024 might select a “Target Date 2054” fund, which shifts to a more cautious approach as the date nears, combining stocks and bonds for stability.Both fund types allow for fractional investments, enabling systematic contributions that start working immediately. Mutual fund shares are key to an investment portfolio and are best held for the long term, usually experiencing modest growth without drastic fluctuations.Investors often buy mutual funds with the aim of selling later at higher prices, ideally years down the line. A common strategy is Dollar Cost Averaging (DCA), where a fixed amount is invested regularly, helping to smooth out price volatility and reduce the average cost per share over time.In conclusion, mutual funds serve as a valuable investment vehicle for individuals seeking to diversify their portfolios while benefiting from professional management and liquidity. With various types available, including index and target date funds, investors can tailor their choices to align with their financial goals and risk tolerance. The ability to invest steadily through methods like Dollar Cost Averaging further enhances the potential for long-term growth. By understanding mutual fund structures and strategies, investors can harness their advantages and work toward building a robust financial future.What are MUTUAL FUNDS?The 4th District Chronicle/Winter 2025Brother Christopher Cooper Jr(614) 746-355728

When is the Right Time to Withdraw From Your Retirement Account?Determining the optimal time to withdraw funds from your retirement account is a crucial decision that hinges on several factors, including your financial needs, tax consequences, and personal circumstances related to age and retirement planning.Typically, individuals can begin making penalty-free withdrawals from their retirement accounts at age 59½. However, postponing withdrawals until at least age 70½, or 73 for those born in 1960 or later is often advantageous. This delay allows your investments to grow further through the power of compound interest, which can significantly enhance your overall retirement savings.It's essential to be aware of Required Minimum Distributions (RMDs), which are mandatory withdrawals that must commence at a specified age, usually 72 years. Failing to take these distributions can result in severe penalties, often amounting to 50% of the amount that should have been withdrawn. Therefore, planning for RMDs is critical to avoid unexpected tax burdens.When considering withdrawals, you should evaluate various factors. These include your current income needs, as accessing your retirement funds could impact your lifestyle and financial security. Additionally, closely monitor the performance of your investments within the retirement account; withdrawing during a market downturn may not be prudent if it can diminish your long-term growth potential.Tax strategy is another vital consideration. Withdrawals from retirement accounts can be taxed as ordinary income, so understanding how this will impact your tax bracket is essential for eective financial planning. For instance, large withdrawals in a particular year may push you into a higher tax bracket, resulting in increased tax liability.In light of these complexities, consulting a financial advisor is highly recommended. A professional can help you devise a withdrawal strategy that aligns with your overall financial goals, optimizes tax implications, and enables you to preserve your hard-earned savings for the long term. Through careful planning and professional guidance, you can make informed decisions that support your retirement lifestyle while ensuring the longevity of your retirement resources.By Brother Dr. Odell A GravesThe 4th District Chronicle/Winter 2025Brother Dr. Odell A. GravesInvestment Advisor RepresentativePrimerica(513) 550-1683 Ograves@primerica.com29

Saving vs InvestingKnow the DifferenceRonald Jackson rjackson1@ft.newyorklife.com 937-416-9406Saving and investing are both important concepts for building a sound financial foundation, but they’re not the same thing. While both can help you achieve a more comfortable financial future, consumers need to know the differences and when it’s best to save compared to when it’s best to invest.The biggest difference between savings and investing is the level of risk taken. Savings typically result in you earning a lower return with basically no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.How are savings and investing different?“When you use the words saving and investing, people — really 90-some percent of people — think it’s exactly the same thing,” says Ronald Jackson, Financial Services Professional at NYLife Securities LLC & New York Life.When you think of saving, think of bank products such as savings accounts, money markets, and CDs — or certificates of deposit. And when you think of investing, think of stocks, ETFs, bonds, and mutual funds, Jackson says.Factors to Consider When Deciding to Save or InvestBoth saving and investing involve setting aside money now for a future goal or expense. However, the time horizon, level of risk, and your most pertinent financial goals vary depending on whether you are looking at saving or investing your money.One of the biggest considerations when deciding whether to save or invest is the time horizon of your financial goals. Some goals have a limited scope or a definite endpoint. In these cases, it may make the most sense to keep your money easily accessible in a savings account (preferred when the time horizon for liquidity is 12 months or less) or similar vehicle, as you will not hold the money long enough for it to grow significantly in an investment (open ended or significant)setting .Another key factor when deciding about saving or investing is your risk tolerance. Risk tolerance refers to the degree of risk that you are willing to take on given the potential volatility of a financial decision.Lastly, laying out clear financial goals will help you to decide when it is appropriate to save or invest—or a combination of both. Financial goals may be large, such as preparing for a down payment on a home, a new vehicle, college tuition, or planning for retirement. They may also be more modest, such as saving for a small purchase or a short weekend trip.While they are different, they both can be valuable in creating a sound financial plan. By Brother Ronald Jackson30The 4th District Chronicle/Winter 2025

HISTORY OF OPPFFCUBy Brother Daniel B. Jones, Sr.Omega Psi Phi Fraternity Federal Credit UnionTreasurerIn December 1984 at the Louisville Conclave Meeting, a discussion between Jim Elam and Ken Taylor evolved into what is now known as the Omega Psi Phi Credit Union. On January 31, 1986, the National Credit Union Administration (NCUA) issued the Approval of Organization Certificate and Certification of Insurance to OMEGA PSI PHI FRATERNAL FEDERAL CREDIT UNION (OPPFFCU). The Credit Union was the first international fraternal credit union in the world. The charter was signed by ten of the original 18 members of the Credit Union. The original members were Walt Amprey, Ed Braynon, Kenny Brown, Charles Chambliss, Arnold Eagle, Jim Elam, Ted Greer, Rob Howard, Milt Johnson, Charlie Maker, Adam McKee, Moses Norman, Frankie Patterson, Ken Taylor, Mel Washington, Walt Wrenn, 2nd District and the 4th DistrictOPPFFCU was started by two $5,000 donations, one from Jim Elam, and another from the Second District. The Second District Representative was Andrew Ray. The original officers were Kenneth Taylor - President, Theodore Greer - 1st Vice President, Arnold Eagle - 2nd Vice President, Frank Patterson - Secretary, and Charles Maker - Treasurer. Former Presidents/Chairman of the Board were: Ken Taylor, Ted Greer, Arnold Eagle, Curtis Baylor, Walt Wrenn, Jim Elam, Stafford Thompson, Derrick Hostler, and Norris Middleton. The current President and Chairman is, Derrick Lowery who was elected in July 2024. Current and former Board members have been influential in the advancement and growth of the Credit Union: Barnie Barnwell, Joe Briggs, Connie Brown, Charles Bruce, Dyrren Davis, Ken Dollar, Mike Horsey, Daniel Jones, Bennie Lowder, Derrick Lowery, Bennie Marable, Walter Martin, Gerry McCants, Walter Munnings, Adam McKee, Neil Phillips, Mike Seals, Ken Terrell, Clinton Vaughn, Kermit Wardell, Walt Watkins, Garvey Wright, and Ken Younger. It should be noted that Board Members attend monthly meetings, perform other duties, and provide services without compensation. .The Omega Psi Phi Fraternity Federal Credit Union continues to provide financial avenues for the fraternity’s members, families and employees. With an excellent team of dedicated members of the Board, and Committees, we have a competitive, and a financially secure credit union. The Credit Union has grown to assets totaling over $5.0 million and provides full services to more than 2,200 members. In 1990, the credit union established Loans for Life, a program where brothers could borrow money for their Life Membership. This program has significantly contributed to the growth of Life Membership, which is now over 30,000 members. In addition to Life Memberships loans, we provide checking, savings, debt financial services, credit report review, student loan coaching, debt and budget coaching and journey to wealth webinar series. On the horizon are debit cards and credit cards projected for this summer. The Credit Union field of membership extends to fraternity members, family members of fraternity brothers, employees of the credit union and fraternity, and related organizations and businesses. We encourage you to join, save, borrow, and take advantage of all the services available to you. Omega Psi Phi Fraternity Federal Credit Union – Since 1986 Phone: 1-800-42-Omega. The 4th District Chronicle/Winter 202531

The Rule of 72: Why Savings Accounts Keep You BrokeBy Brother DR Odell GravesBrother Dr. Odell A. GravesInvestment Advisor RepresentativePrimerica(513) 550-1683Ograves@primerica.comAs an Army officer, one of my roles was financial training for my soldiers, which caused me to learn it myself. A rule I was introduced to by my financial advisor was the Rule of 72, which I then used in all my training, and now as a financial professional myself. As I tell my clients, you cannot win in the financial game, if you don’t know the rules, and most bankers are not going to tell you the rules. Understanding the Rule of 72 is vital for navigating various aspects of personal finance, including investing, managing debt, and optimizing savings. The Rule of 72, attributed to Luca Pacioli, the 15th-century Italian mathematician and "Father of Accounting," is a simple formula that estimates the time it takes for an investment to double (Pacioli, 1494). Dividing 72 by the annual interest rate provides the doubling time in years. While invaluable for understanding growth, this principle also exposes the inadequacy of relying on traditional savings accounts.For Savings AccountsIn the context of savings, the Rule of 72 illustrates how long it will take for savings to double based on the interest rate. As of December 16, 2024, the national average interest rate for savings accounts is a mere 0.42% (FDIC, 2024). Using the Rule of 72, money in such an account would take approximately 171 years to double (72 ÷ 0.42 ≈ 171). Even savings in a bank or credit union that offers 2% or 5% annual interest rate, savings will double in 36 (72 ÷ 2 = 36) or 14.4 (72 ÷ 5 = 14.4) years respectively. This glaringly slow growth underscores why savings accounts, while secure, fail to build wealth effectively.For InvestorsThe Rule of 72 highlights the benefits of higher-yield investments like stocks or bonds, where annual returns can range from 6-8%. At these rates, money doubles in 9-12 years, demonstrating the exponential advantage of compounding over time.For Debt ManagementThe rule also warns of the rapid growth of high-interest debt. A credit card with a 20% annual rate will see the balance double in just 3.6 years (72 ÷ 20 = 3.6). This emphasizes the urgency of reducing debt to prevent financial strain.Understanding the Rule of 72 empowers smarter financial decisions, whether avoiding stagnant savings or managing investments and debt effectively.The 4th District Chronicle/Winter 202532

Ronald Jackson rjackson1@ft.newyorklife.com 937-416-9406For an overwhelming majority of retirees, Social Security represents more than just a monthly check. It serves as a financial foundation for those who can no longer provide for themselves.For more than two decades, Gallup has been conducting an annual poll that questions retirees regarding their reliance on Social Security. Between 80% and 90% of respondents -- including 88% in April 2024 -- have noted that theirSocial Security benefitis a "major" or "minor" source of income. In other words, close to 9 out of 10 seniors would financially struggle if this program didn't exist.But despite being vital to the financial well-being of our nation's aging workforce, this nearly 90-year-old program is in trouble. Every year since the first retired worker benefit check was mailed in January 1940, the Social Security Board of Trustees has issued a report that examines the current financial health of America's leading retirement program. More importantly, it takes into account changing demographic factors, as well as shifts in fiscal and monetary policy, to predict how financially sound Social Security will be over the long term, which encompasses the 75 years following the release of a report.By Brother Ronald JacksonSocial Security and What’s At StakeIn the 2024 Trustees Report, it was estimated that Social Security is facing a $23.2 trillion funding obligation shortfall through 2098. This was up $800 billion from the estimated long-term funding deficit in the 2023 report, and it's a figure that's been climbing fairly steadily since the mid-1980s.To make one thing clear, Social Security is inabsolutely no danger of disappearing or becoming insolvent. The lion's share of the income that funds this program comes from the 12.4% payroll tax on earned income (wages and salary, but not investment income). As long as people continue to work and pay their taxes, there will always be money to disburse to eligible beneficiaries.But what is at stake is the current payout schedule,including cost-of-living adjustments (COLAs), if these funding obligation shortfalls persist. According to the latest Trustees Report, the Old-Age and Survivor's Insurance Trust Fund (OASI) is projected to exhaust itsasset reserves -- the excess cash built up since inception that's invested, by law, into ultra-safe, interest-bearing government bonds -- by 2033. If the OASI's asset reserves deplete in nine years, as forecast,sweeping benefit cuts of up to 21% may be necessary for retired workers and survivor beneficiaries.In 1983, Social Security's asset reserves were rapidly headed for exhaustion, which would have necessitated benefit cuts. The Social Security Amendments of 1983, which represent the last major bipartisan overhaul of the program, thwarted the need to cut benefits. It gradually raised the payroll tax on working Americans, as well as increased thefull retirement age. Most importantly, it introduced the taxation of Social Security benefits.In conclusion, the future of Social Security poses significant challenges that demand attention and action. With nearly 90% of retirees relying on this program as a crucial source of income, the potential funding shortfall of $23.2 trillion through 2098 could lead to drastic benefit cuts if proactive measures are not taken. While the program itself is not in immediate danger of disappearing, preserving the current payout and ensuring that beneficiaries continue to receive the support they need is paramount. Historical precedents show that bipartisan cooperation can yield effective solutions, as demonstrated in the 1983 amendments. As we move forward, it will be essential for policymakers to address these looming issues with the urgency they deserve, protecting the financial security and dignity of millions of Americans who depend on Social Security for their well-being in retirement.The 4th District Chronicle/Winter 202533

34

In today’s housing market, the age-old question of whether to buy or rent has taken center stage. is decision is not merely about nances; it encompasses lifestyle choices, stability, and long-term goals. Let’s delve into the pros and cons of both options to help you make an informed decision.To Buy or Not to Buy e Renting vs. Buying DilemmaBy Brother Dannel ShepardWhen you buy a home, you’re investing in your future. Every mortgage payment builds equity, setting you on a path to nancial security. Owning a home also provides stability; you have the freedom to personalize your living space without landlord restrictions. Plus, as property values rise, so does your investment.Yet, buying a home comes with its own set of responsibilities. From maintenance costs to property taxes and market uctuations, potential homeowners must assess their readiness. A good rule of thumb is to ensure housing costs don’t exceed 30% of your monthly income.For more information contact Brother Dannel Shepard (513) 703-0370Renting offers a level of exibility that homeownership simply can’t match. Whether you’re starting a new job, moving for personal reasons, or just not ready to commit, renting allows you to adapt without the burdens of a mortgage. Maintenance costs typically fall to the landlord, relieving renters of unexpected expenses when appliances break down or roofs leak.However, renting has its drawbacks. Monthly rent payments can increase, and most importantly, these payments do not build equity. Instead, they contribute to someone else’s investment. If you’re looking to secure a stable nancial future, this is a critical consideration.Consider your lifestyle when deciding between renting and buying. Renting often allows you to live in desirable neighborhoods without the hefty price tag of homeownership. If you seek a transient lifestyle or aren’t ready to settle down, renting could be the best option for you.Conversely, if you envision starting a family or planting roots, buying may provide the stability you desire. ink about your long-term goals: do you want a garden, a space for family gatherings, or the freedom to renovate?Ultimately, the decision to buy or rent is deeply personal and should align with your nancial and lifestyle aspirations. Whether you choose to rent or purchase, ensure that you fully understand the implications of your choice. As your local expert, I’m here to help you navigate this process and nd the best solution for your needs.If you have any questions or want to explore your options further, don’t hesitate to reach out. Together, we can unlock the secrets to your next home.e Case For RentingWeighing Lifestyle Factorse Advantages of BuyingThe 4th District Chronicle/Winter 2025Brother Dannel Shepard Realtor/ Broker(513) 703-0370drs@yourhouseiskey.com35

Understanding Closing Costs A Key Step in the Home-Buying JourneyWHAT ARE CLOSING COST?What Do Closing Costs Typically Include?HOW MUCH SHOULD YOU BUDGET FOR CLOSING COSTS?PREPARING FOR CLOSING COSTS?Why Work with a Local Real Estate Expert?Final ThoughtsWhen you’re ready to buy a home, you've probably heard about the importance of saving for a down payment. However, there’s another crucial cost you’ll need to consider: closing costs. Understanding these fees is essential for a smooth transaction and to avoid any last-minute surprises. Let’s break down what closing costs entail, how they’re calculated, and why having a real estate professional by your side can make all the difference.As explained by Bankrate, “Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo, or townhome.” In simple terms, they are additional charges associated with finalizing your home purchase. These costs are unavoidable and vary based on the property’s purchase price and your financing terms. Closing costs often feel like the last hurdle before you can officially call a place "home," so being well-prepared is essential.Closing costs usually range between 2% and 5% of your home’s total purchase price. For example, on a median-priced home of $384,500, you might expect to pay between $7,690 and $19,225 in closing costs. While these numbers provide a general range, your closing fees could be higher or lower based on the home price and specifics of your loan.Freddie Mac advises homebuyers to get a complete picture of all expected expenses, from the down payment to closing fees. Partnering with an experienced team of real estate professionals is an excellent way to stay prepared and get the insights you need. Working with a trusted realtor ensures you know exactly what to expect every step of the way, from budget planning to negotiating the best terms on your closing costs.Navigating closing costs and the entire home-buying process becomes much simpler with an experienced guide by your side. As your dedicated Cincinnati and Northern Kentucky realtor, I’m committed to providing expert guidance to every client, helping you stay informed and confident from day one to closing day.When buying a home, closing costs are a significant part of the equation. By planning ahead and working with a knowledgeable realtor, you can ensure that these costs won’t be a surprise. Remember, with the right support, your dream home is closer than you think.If you have any questions or are ready to start your home-buying journey, feel free to reach out. Together, we can turn the key to your future.• According to Freddie Mac, while specific costs can vary, typical closing expenses may cover:• Government Recording Costs: Fees for legally recording the property sale.• Appraisal Fees: Charges for assessing the home’s value to ensure it aligns with the loan amount.• Credit Report Fees: Paid for pulling your credit report, which lenders review as part of your application.• Lender Origination Fees: Charges by your lender for processing your loan application.• Title Services: Fees related to verifying the title’s legal ownership and ensuring it's free of liens.• Tax Service Fees: Costs associated with managing and verifying property tax information.• Survey Fees: In some cases, fees for a property survey to confirm boundary lines.• Attorney Fees: Some states require an attorney to review closing documents, which can incur additional costs.• Underwriting Fees: Charges for the lender’s final loan approval process.By: Brother Danell ShepardThe 4th District Chronicle/Winter 2025Brother Dannel Shepard Realtor/ Broker(513) 703-0370drs@yourhouseiskey.com36

Renancing Your MortgageBy Brother Dannel ShepardRefinancing your mortgage can be a powerful tool to lower monthly payments, reduce long-term interest, or access funds for major life goals. But how do you know when it’s the right time? Here’s a look at key factors to help you decide if refinancing is the best move for your financial future.1. Interest Rates: Keep an Eye on the MarketInterest rates are one of the primary drivers for refinancing. If current rates are significantly lower than the rate you’re paying on your mortgage, refinancing could help you save on your monthly payment and reduce overall interest costs. Lowering your interest rate is like getting a pay raise for your home budget—it frees up money each month that you can use for other expenses or savings.2. Improved Credit Score? You May Qualify for Better RatesYour credit score plays a big role in your refinancing rate. If your credit score has improved since you took out your original mortgage, it might make sense to refinance to take advantage of better terms. Think of it as getting a chance to renegotiate based on a stronger financial standing. A higher credit score can 3. Home Equity: Tapping into Your InvestmentBuilding equity in your home can open up options for cash-out refinancing. With a cash-out refinance, you can access part of your home’s equity, turning it into funds you can use now. This approach is especially useful if you’re planning home renovations, like putting in a pool, finishing your basement, or making other improvements that increase your home’s value and enjoyment. Renovations funded by home equity can be a smart way to reinvest in your property while benefiting from mortgage-level interest rates, which are often lower than other financing options.4. Consolidate High-Interest DebtRefinancing can also help you tackle high-interest debts like credit cards or installment loans. By using your home’s equity to pay off these debts, you can roll them into your mortgage, benefiting from lower interest rates. This consolidation can make your financial life simpler with a single monthly payment, 5. Adjusting Loan Terms to Match Your GoalsSometimes, it’s worth refinancing just to adjust your loan term. Refinancing to a shorter term, like switching from a 30-year mortgage to a 15-year, can help you pay off your home faster and save thousands on interest, though monthly payments may increase. On the other hand, if you’re looking to reduce monthly expenses, you could extend your term, lowering your payment to give you more flexibility in your budget.6. Major Life Changes: Stability MattersA stable income and future plans are essential for refinancing. If you’ve recently experienced a big life change, like a new job, marriage, or children, consider how this change affects your finances. Refinancing can be a great option to stabilize or improve your financial standing, but it’s important to ensure it aligns with your long-term goals.7. The Break-Even Point: When Savings Outweigh CostsFinally, consider the break-even point—the time it takes for the savings from your lower interest rate to cover the costs of refinancing. If you plan to stay in your home beyond this point, refinancing is often a smart choice. Make sure to calculate all costs, including appraisal fees, closing costs, and other fees associated with refinancing.The Bottom Line: Is Refinancing Right for You?Refinancing can be a powerful tool for homeowners, but timing is everything. By assessing your interest rate, credit score, home equity, and long-term goals, you can decide if it’s right for you. Consulting with a real estate professional or financial advisor can provide personalized advice and ensure that your refinancing decision aligns with your unique financial situation.If you have any questions or would like to discuss your refinancing options, I’m here to help. Reach out anytime to explore how refinancing could be a smart step toward achieving your financial goals.The 4th District Chronicle/Winter 2025Brother Dannel Shepard Realtor/ Broker(513) 703-0370drs@yourhouseiskey.com37

Thinking of Buying ACAR?Purchasing an automobile is one of the most fundamental and significant decisions we make in our lives. Transportation plays a vital role in our daily routines, facilitating travel to work, school, recreational activities, and various other responsibilities. When it comes to selecting the right vehicle, the process often involves extensive research and multiple test drives at various dealerships, online sellers, or through private listings.Before making a purchase, it is crucial to conduct detailed research on potential car models. This includes examining online reviews that assess the quality and performance of vehicles from different manufacturers. When evaluating cars, consider factors such as brand reputation, specific features, reliability ratings, safety scores, and the overall cost of ownership, which encompasses fuel efficiency, maintenance costs, and insurance premiums. It’s also important to assess how well the vehicle aligns with your personal needs, lifestyle, and budget, including any potential family planning that may influence your vehicle choice in the coming years.Financing is another critical aspect of the car-buying process for most individuals. Many people opt to finance their vehicles, with numerous sources available for obtaining loans. Generally, interest rates tend to be lower for new cars compared to used ones. Manufacturers frequently offer enticing financing options, including lower interest rates or rebates to encourage buyers to purchase new vehicles. Additionally, some manufacturers may provide incentives such as military discounts, loyalty programs, or special financing for first-time buyers or recent college graduates, which can lead to substantial savings. Researching these financial incentives and understanding their applicability can greatly impact your final purchase decision, as taking advantage of these offers can save you a significant amount of money over the life of the loan.In today’s financial landscape, credit unions have emerged as a favorable option for financing due to their typically competitive interest rates, especially for new and slightly used vehicles. It is essential to compare rates and loan terms from different lending institutions to ensure you secure the best possible deal, as even small differences in interest rates can add up to considerable savings over time.Another vital element to consider is your credit and how you manage it. A strong credit score can facilitate access to lower interest rates, which, in turn, can reduce your overall financial burden. Conversely, a lower credit score may not only lead to higher interest rates but could also prevent you from qualifying for a loan altogether. Financial institutions evaluate several factors before approving a loan. These factors include your credit score, income stability, length of employment, duration of residence, debt-to-income ratio, and your history with financial obligations. Each loan application is assessed individually, and lenders typically base their decisions on your creditworthiness and ability to make payments on time.If necessary, a bank may allow you to secure a loan with a co-signer. A co-signer—often a close family member, relative, or trusted friend—agrees to share the responsibility of the loan, providing the lender with added security. This can be especially beneficial for individuals with lower credit scores, as the co-signer's more robust credit profile can improve the likelihood of loan approval and possibly secure a better interest rate. When purchasing a vehicle, it's also wise to consider whether to invest in an extended warranty or additional financial products. These offerings can provide considerable peace of mind during the ownership period, especially if unexpected breakdowns or issues arise when the manufacturer’s warranty expires. Extended warranties can cover essential repairs, helping to mitigate the potential for costly out-of-pocket expenses in the future. In conclusion, buying a car is a multifaceted decision that requires careful consideration and research. By taking the time to evaluate your options—whether regarding the types of vehicles, financing choices, or additional protections like warranties—you can ensure that you make an informed decision that aligns with your needs and financial goals.The 4th District Chronicle/Winter 2025By Brother Floyd HowellBrother Floyd Howell Car Salesman(937) 219-5425Floydq1@icloud.com38

ZETA OMEGABy Brother Damon ScottAn Impressive Career in Financial Services: Zeta Omega Brother Rufus HeardCONTINUED ON NEXT PAGECONTINUED ON NEXT PAGE39His father rose to a managerial position which required the family move to Columbus when Rufus was 11 years old. He spent the next seven years there before graduating from high school and being accepted as a freshman at Kent State University. In 1968, during his undergraduate matriculation, Rufus was one of nine young men who became charter members of Psi Gamma Chapter of Omega Psi Phi Fraternity, Inc. The chapter officially received its charter on April 1, 1969.Upon his graduation from Kent State in 1970, Brother Heard’s father introduced him to a gentleman who was the first Black vice president of a major bank in Cleveland. The gentleman was hired after the riots that took place in the Glenville neighborhood of the city in the late 1960s. One of his responsibilities was to find qualified people of color for management, so he hired Brother Heard into the management trainee program. That decision, to accept the offer of employment, led to a career in financial services for Brother Heard, which included tenure at the Cleveland Trust Company, Ameritrust, Society Bank, Key Bank, Fifth Third Bank, and Citizens Bank.Brother Rufus Dennis Heard is known in Omega for saying that “my friends call me ‘Fus’” when introducing himself. He is originally from Dayton, Ohio, where he was born and reared by his parents, Wilson and Mamie Dee Heard. His father worked in the insurance industry, for Supreme Life Insurance Company. And he did so in the 1950s and 1960s, back when insurance companies did not sell insurance to people of color. Young Rufus observed that his father wore a suit and tie to work every day, while every other father in his neighborhood wore some type of uniform. As a result, Mr. Wilson Heard was his son’s first hero.The 4th District Chronicle/Winter 2025CONTINUED ON NEXT PAGE

An Impressive Career in Financial Services: Zeta Omega Brother Rufus HeardOnce he relocated to Cleveland, Brother Heard decided to transfer his membership in Omega to Phi Sigma Chapter. In the 1970s, Omega still designated some chapters as intermediate; they were typically populated by younger brothers who had just graduated from undergraduate school, or were enrolled in graduate or professional school. One feature of intermediate chapters was their dues were usually less than those in a traditional graduate chapter. This was an effort to help younger brothers remain active with Omega after graduation, as they were just starting their professional careers and most likely had less disposable income.Three years later, Brother Heard then joined Zeta Omega Chapter, where he has maintained active membership ever since. There, he has served as chairman of the Achievement Week, Mardi Gras, and Boatride committees. He also was elected Keeper of Finance, Vice Basileus, and Basileus. Developing his organizational and leadership skills at the chapter level prepared Brother Heard for serving Omega at the District and International levels. He was appointed District Marshall on three separate occasions, elected Keeper of Finance for four terms, then First Vice District Representative, and ultimately elected as the 29th Fourth District Representative, from 2009-2011. Brother Heard served as the Deputy Grand Marshall and on the Registration Committee in 1994 when Zeta Omega hosted the 68th Grand Conclave in Cleveland. He also lent his finance skills to Omega as International Chairman of the Fiscal Management Committee.Brother Heard has been married twice, each time being blessed with a wonderful bride. He is the father of four daughters and also a grandfather of three. When not working hard for Omega, Brother Heard’s civic engagement has included serving on the board of directors for the Boy Scouts of America, and local community organizations such as the Eliza Bryant Village, and the Murtis H. Taylor Multi-Services Center. He also was a founding member and the first treasurer of the Black Professional Association of Greater Cleveland, and was even named Citizen of the Year during Black History Month by his hometown Cleveland Cavaliers!After his retirement from the banking industry, Brother Heard then managed a chain of nursing home care facilities in the local Cleveland area. And his final retirement was from the United States Army Reserves with the rank of Captain.Omega, the Fourth District, and Psi Gamma, Phi Sigma, and Zeta Omega Chapters all have benefited from the service, and particularly the financial expertise, of Brother Rufus Heard, known to his Friends, simply as “Fus.”The 4th District Chronicle/Winter 202540

010203Term life insuranceWhole life insurance Indexed universal life insurance Choosing the right type of life insurance depends on your nancial goals, budget, and risk tolerance. A young professional with dependents might lean toward term life for its affordability, while someone seeking both protection and investment potential may opt for IUL. Regardless of the type, having life insurance is a crucial step toward building a smart nancial foundation, and safeguarding your family’s future against uncertainty. Seek assistance from a licensed nancial professional or life insurance agent to identify the best option for you.Term life insurance is the simplest and most affordable option, offering coverage for a specic period, typically 10 to 30 years; 35 in the case of my company. It’s ideal for young families or individuals with temporary nancial obligations, like a mortgage or children’s education costs. e downside? Term policies have no cash value, so if you outlive the term, the premiums paid don’t result in any nancial returnWhole life insurance, on the other hand, provides lifetime coverage and includes a cash value component that grows over time. e premiums are higher than term life, but they remain xed, and the policy builds equity you can borrow against or use in later years. Whole life insurance is often chosen for its stability and the forced savings mechanism it offers, making it suitable for those seeking a lifelong nancial safety net.Indexed universal life insurance (IUL) combines the best of both worlds, offering lifetime coverage and cash value growth tied to a stock market index, such as the S&P 500. IUL policies provide the potential for higher returns compared to whole life, with the added benet of a oor to protect against market losses. is exibility makes IUL an attractive choice for those looking to build wealth while ensuring long-term nancial security.By Brother Dr Odell GravesBrother Dr. Odell A. GravesInvestment Advisor RepresentativePrimerica(513) 550-1683 Ograves@primerica.comWhen it comes to nancial planning, many people often think of investments and retirement accounts but fail to recognize the importance of life insurance. Or when times get hard nancially, it is the rst thing they may consider cancelling. However, life insurance is a cornerstone of any sound nancial plan, providing security and peace of mind for you and your loved ones. It ensures that nancial obligations are met in the event of unexpected loss, supporting everything from daily living expenses to long-term goals like education or retirement. Without it, the deceased is leaving the burial costs, averaging $8 - $10K in this area, more in other areas, as well as other debts and obligations to their surviving loved ones. Being a burden in death is not a memory anyone should want their loved ones to have of them. Among the various types of life insurance, whole life, term life, and indexed universal life (IUL) stand out as popular options, each serving unique needs and circumstances.The 4th District Chronicle/Winter 202541

By Brother Ronald JacksonWhy Is Insurance Planning Necessary to Close the Wealth GapWorking individuals or those deemed less wealthy need to understand that life insurance is a bridge to closing the wealth gap. “I find that in the Black community, there is a disproportionate amount of life insurance purchased than in the White community, states Ronal Jackson Financial Services Professional with NYLife Securities LLC and New York Life.” He states that, when I was young in the business, a White colleague stated to me, “Your people look at life insurance differently than most of us. Your people look at life insurance as “death insurance”, we look at life insurance as “wealth insurance”. My colleague then stated to me that they don’t look at insurance as benefiting from someone’s death, but as a normal way to build generational wealth. He said that y’all just get enough to bury others. That was an eye-opener for me.Whatever the reason for not purchasing insurance should be the reason to purchase life insurance. You don’t want to leave your family destitute. You should want to leave a legacy to not only make them hold but to have an abundance so that their standard of living stays the same or they are put in an even better financial position. Whatever the goals and objectives for the family kids don’t have to get dismissed because there wasn’t enough. They should still be able to reach their goals and objectives with more left over.Life insurance is one tool that can help to close the “wealth gap”, you just need to know what type is needed. Look into the coverage that you have and then determine if more coverage is needed. Secondly, get help in determining whether a Term of Cash Value policy is for you or not.Since that time, I along with my Black colleagues have been on a mission to educate our community about the importance of life insurance and the many ways it can benefit a person and their family. For example, when you think of insurance planning, we look at a term called, “Human Life Value!” That is looking at how much a person makes and starting there to determine how much insurance is needed. Let’s say a husband makes an annual salary of $50,000 and is 40 years old. He plans on retiring at age 65 and has a wife and two(2) kids. Take the income of $50,000 and then multiply it by the number of years to retirement (65 – 40 = 20). That would be $50,000 (x) 20 which equals a $1,000,000 life insurance death benefit. Why is that? Because if the husband were to die at age 40, his family would be missing out on $50,000 worth of income for the next 20 years until he retired. There would be other costs to add to this that would increase the amount of coverage, but this is to get to the point. Most people are underinsuring themselves and not leaving enough for the ones they leave behind.A lot has been written in recent years about America’s so-called “wealth gap” and what can be done to narrow it. But new research indicates that when it comes to life insurance, the gap is even more significant.In a July 2021 paper for the National Bureau of Economic Research, two economists from the University of North Carolina took a deep dive into the economics of life insurance and reached a startling conclusion: wealthier people,even after adjusting for many variables, made more use of life insurance than the less wealthy.The duo looked at administrative data for more than 63,000 individuals over a four-year period. Just under half of those people had life insurance. Their working theory—which was contradicted by the research—was that wealthier people could be expected to buylessinsurance, simply because they could self-insure through savings instead.In fact, the opposite was true. The economists, Michael Gropper and Camelia Kuhnen, wrote that “Whether we measure wealth by the value of financial assets, or by the value of the homes individuals own, we find that life insurance coverage as well as property insurance coverage increases with wealth, controlling for the value of the insured asset.”2 By their estimate, for every $1 increase in someone’s financial wealth, there was a 68-cent increase in the amount of their term life insurance coverage limit.Ronald Jackson rjackson1@ft.newyorklife.com 937-416-9406The 4th District Chronicle/Winter 202542