Return to flip book view

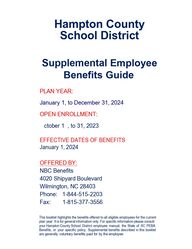

Hampton County School District Supplemental Employee Benefits Guide PLAN YEAR: January 1, to December 31, 2024 OPEN ENROLLMENT: October 17, to 31, 2023EFFECTIVE DATES OF BENEFITS January 1, 2024 OFFERED BY: NBC Benefits 4020 Shipyard Boulevard Wilmington, NC 28403 Phone: 1-844-515-2203 Fax: 1-815-377-3556 This booklet highlights the benefits offered to all eligible employees for the current plan year. It is for general information only. For specific information please consult your Hampton County School District employee manual, the State of SC PEBA Benefits, or your specific policy. Supplemental benefits described in this booklet are generally voluntary benefits paid for by the employee.

TABLE OF CONTENTS Description of Benefits Page Benefit & Plan Information 3 Enrollment Information 4 Accident Insurance 5 Critical Illness Insurance 9 Hospital Indemnity Insurance 18 Short Term Disability Income 24 Reliance Standard Educator Voluntary Group Term Life Insurance 29 Contact Information Back Page 2

Benefit & Plan Information Eligibility: Full-time employee working 30 hours or more per week. Benefit Plan Year: Hampton County School District January 1, 2024 through December 31, 2024 Cafeteria Plan Information: For 2024: Enrollment is required for all Cafeteria Plan benefits during each open enrollment. Changes may be made during open enrollment on all plans. Payroll Deductions Deductions will take place with each pay period beginning with your first pay period in January 2024 and continue through your last pay period in December 2024. Benefits Effective Insurance Products Benefits acquired in a prior year continue in force unless changed. Aflac – Critical Illness Aflac – Hospital Indemnity Aflac – Short-Term Disability Chubb – Accident Insurance Reliance Standard – Life Insurance Newly Hired EmployeesNew employees should enroll for benefits within 30 days following the date of hire. Benefits will generally be effective on the first day of the month following date of hire. New enrollees will be contacted by NBC Benefits for enrolling.Page 3

Enrollment InformationFace-to-Face enrollment Your benefit counselor meeting will provide an opportunity to have your questions answered while enrolling for the benefits you select for you and your family. The counselor will complete the submission for you assuring accurate and timely activation of benefits. Please review the information made available to you prior to your benefit counselor meeting. Family Information for Enrollment When enrolling your spouse and/or children please have their dates of birth and social security numbers available. Certificate and Policy Information Coverage provided by the various voluntary supplemental benefits may have limitations, and exclusions. Please refer to your policy or certificate for specific coverage. The Hampton County School District has applied for and been issued a Group Master Contract for each policy line. The policy is available for review in the Hampton County School District Office. Individual Certificates of Insurance are also available for review in the Hampton County School District Office. You are encouraged to request a link to a comprehensive copy of specific benefits, which is available online via PDF. You may print the document as a permanent record. Printed certificates may be numerous pages.If you should you leave employment in Hampton County School District, you may retain your policies through a portability provision in each Master Contract. You must request and complete a portability form and submit it to the appropriate carrier upon termination.IRS guidelines permit some policies to be deducted from your pay before taxes. Some benefit payments may be subject to federal and/or state tax. Please consult a tax advisor for specific guidelines.If you have questions about your benefits or the HCSD Benefit Program, please contact your Benefit Administrator. IMPORTANT NOTE & DISCLAIMER This is neither an insurance contract nor a Summary Plan Description; actual policy provisions app ly. All information in this booklet including premiums quoted are subject to change. Policy descriptions are for information purposes only. Your actual policies may be different from the policies described in this booklet. Page 4

Ú±® »³°´±§»»- ±ºØ¿³°¬±² ݱ«²¬§ ͽ¸±±´ Ü·-¬®·½¬ß½½·¼»²¬ ײ-«®¿²½»Ç±« ¼± »ª»®§¬¸·²¹ §±« ½¿² ¬± -¬¿§ ¿½¬·ª» ¿²¼ ¸»¿´¬¸§ô ¾«¬ ¿½½·¼»²¬- ¸¿°°»² »ª»®§ ¼¿§ô·²½´«¼·²¹ -°±®¬-ó®»´¿¬»¼ ¿½½·¼»²¬-ò ß² ·²¶«®§ ¬¸¿¬ ¸«®¬- ¿² ¿®³ ±® ¿ ´»¹ ½¿² ¸«®¬ §±«®¼»¼«½¬·¾´»-ô ½±°¿§-ô ¿²¼ ½±·²-«®¿²½»ò Ô»¬ ݸ«¾¾ ß½½·¼»²¬ ¸»´° ¬¿µ» ½¿®» ±º §±«® ¾·´´- -±§±« ½¿² ¬¿µ» ½¿®» ±º §±«®-»´º ¿²¼ §±«® º¿³·´§òß ¾®±µ»²´»¹ ½¿² ½±-¬üéôëððòïêðû ±º ß³»®·½¿²-½¿²¬ ½±ª»® ¿² «²»¨°»½¬»¼üïôðð𠻨°»²-»òîìî ³·´´·±² ÛΪ·-·¬- »¿½¸ §»¿®¿®» ¼«»¬± ·²¶«®·»-òíß¼¼ ß½½·¼»²¬ ײ-«®¿²½» ݱª»®¿¹»¬± DZ«® Ø»¿´¬¸ ײ-«®¿²½» д¿²Page 5

Ú·®-¬ ß½½·¼»²¬ ü ïððß³¾«´¿²½» ü íððÛÎ Ê·-·¬ ü îððü ìðÚ®¿½¬«®» ü ïôðððÓ»¼·½·²» ü îðÓ»¼·½¿´ Í«°°´·»- ü îðÝ®«¬½¸»- ü îððи§-·½¿´ ̸»®¿°§ ü ëððÚ±´´±©ó«° Ê·-·¬- ü îîëÍ«¾¬±¬¿´ ü îôêðëÐÔËÍ Í°±®¬- п½µ¿¹» ü êëï̱¬¿´ п§³»²¬ ü íôîëê̸» Í°±®¬- п½µ¿¹»·²½®»¿-»- ¬¸» ¬±¬¿´Ý¸«¾¾ ß½½·¼»²¬ ¸»´°- °¿§ º±®«²»¨°»½¬»¼ ½±-¬- ±º ¿½½·¼»²¬¿´ ·²¶«®§ò׺ §±«® ½¸·´¼ ¾®»¿µ- ¿ ´»¹ ¿¬ -±½½»®-¬¿½µ «°æ̸·- »¨¿³°´» ·- º±® ·´´«-¬®¿¬·ª» °«®°±-»- ±²´§ ¿²¼ -¸±«´¼ ²±¬ ¾» ½±³°¿®»¼ ¬± ¿² ¿½¬«¿´ ½´¿·³ò ɸ»¬¸»®¬»®³- ¿²¼ ½±²¼·¬·±²-òɸ»² DZ« Ò»»¼ ׬ Ó±-¬Ý¸«¾¾ ß½½·¼»²¬ °®±ª·¼»- ½±ª»®¿¹» ·º §±« ¿®» ¿½½·¼»²¬¿´´§ ·²¶«®»¼ ¿²¼ ²»»¼ ¬®»¿¬³»²¬ô¬»´»³»¼·½·²» -»®ª·½»-ò ̸»®» ¿®» ²± ®»-¬®·½¬·±²- ±² ¸±© §±«® ³±²»§ ½¿² ¾» «-»¼òÚ·®-¬ ß½½·¼»²¬·²¶«®»¼ô ©» ½¿² ¾»¹·² °®±½»--·²¹ §±«® ½´¿·³ ®·¹¸¬ ±ª»® ¬¸» °¸±²» -± §±« ½¿² ¹»¬ ½¿-¸º¿-¬òÍ°±®¬- п½µ¿¹»îëûô «° ¬± üïôððð °»® °»®-±² °»® §»¿®ô º±® ·²¶«®·»- ®»-«´¬·²¹ º®±³ °¿®¬·½·°¿¬·²¹ ·²±®¹¿²·¦»¼ -°±®¬-òª·¿ ¿«¼·± ±® ª·¼»± ½±³³«²·½¿¬·±²òλ¸¿¾·´·¬¿¬·±² п½µ¿¹»®»´»¿-»¼ ¬± ¿ λ¸¿¾·´·¬¿¬·±² Ý»²¬»® º±´´±©·²¹ ¿ ¸±-°·¬¿´ -¬¿§ ±® §±« ®»½±ª»® ¿¬ ¸±³»ô ©»«²¼»®¹±·²¹ ¿ ½±ª»®»¼ ¸»¿´¬¸ -½®»»²·²¹ ¬»-¬òß½½·¼»²¬ ײ-«®¿²½»Ù±±¼ ¬¸·²¹- ·² ´·º»¸¿°°»² »ª»®§ ¼¿§ô¿²¼ «²º±®¬«²¿¬»´§ô¿½½·¼»²¬- ¸¿°°»² ¬±±òɸ»² ¬¸»§ ¼±ô ©» ½¿²¸»´° °®±¬»½¬ §±«òر© ݸ«¾¾ ß½½·¼»²¬ ɱ®µß²¼ п§Page 6

Ü·¿³±²¼ д¿²×²·¬·¿´ Ý¿®»ß³¾«´¿²½»Ù®±«²¼ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíððß·® ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üîôðððÛ³»®¹»²½§ α±³ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üîððò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéëò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéëË®¹»²¬ Ý¿®»ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïëðÛ³»®¹»²½§ Ü»²¬¿´Ý®±©² ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üìððÛ¨¬®¿½¬·±² ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïððÜ»²¬«®»-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üìðð׳°´¿²¬-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üìððر-°·¬¿´ ¿²¼ λ¸¿¾·´·¬¿¬·±²Ø±-°·¬¿´ ß¼³·--·±²ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïôîëð×ÝË ß¼³·--·±² ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üîôëððλ¸¿¾·´·¬¿¬·±² ß¼³·--·±² ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïôîëðò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíððл® ¼¿§ô «° ¬± íêë ¼¿§-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üêððл® ¼¿§ô «° ¬± í𠼿§-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïèðл® ¼¿§ô «° ¬± í𠼿§-λ½±ª»®§ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéëл® ¼¿§ô «° ¬± -»ª»² ¼¿§-Ú±´´±©ó«° Ý¿®» ú Ì®»¿¬³»²¬ß¾¼±³·²¿´ô Ý®¿²·¿´ô ú ̸±®¿½·½ Í«®¹»®§ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò üïôëððØ»®²·¿ Í«®¹»®§ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò üîððß°°´·¿²½»-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò üîððÞ´±±¼ô д¿-³¿ô д¿¬»´»¬-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò üíððݸ·®±°®¿½¬·½ Ý¿®»ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò ò üëðл® ª·-·¬ô «° ¬± ¬¸®»» ª·-·¬- °»® ¿½½·¼»²¬å -·¨ °»® §»¿®Ú±´´±©ó«° Ì®»¿¬³»²¬ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò ò üéëл® ª·-·¬ô «° ¬± ¬¸®»» ª·-·¬-Ô±¼¹·²¹ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò òüïëðÚ±® ¬®»¿¬³»²¬ ïðð ³·´»- ±® ³±®» ¿©¿§å°»® ²·¹¸¬ô «° ¬± íð ²·¹¸¬-Ó¿¶±® Ü·¿¹²±-¬·½ Û¨¿³Ð¿§¿¾´» ±²½» °»® ݱª»®»¼ ß½½·¼»²¬ º±® ÝÌô ÓÎ×ô »¬½òò ò ò ò ò ò ò ò òüîëðÓ»¼·½¿´ Í«°°´·»-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò ò üîðÓ»¼·½·²»ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò ò üîðÑ®¹¿² Ô±--ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò üïôëððÑ«¬°¿¬·»²¬ Í«®¹»®§ Ú¿½·´·¬§ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò ò üîëи§-·½¿´ô ѽ½«°¿¬·±²¿´ô ±® Í°»»½¸ ̸»®¿°§ò òò ò ò ò ò ò ò ò ò ò ò ò ò üëðл® ª·-·¬ô «° ¬± ïð ª·-·¬-Ю±-¬¸»¬·½-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò üïôëððÌ»²¼±²ô Ô·¹¿³»²¬ ±® ન¬±®ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò üéëðÌ®¿²-°±®¬¿¬·±²ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò üêðð±® ³±®» ¿©¿§å °»® ¬®·°ô «° ¬± ¬¸®»» ¬®·°-È󮿧ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òò ò ò ò ò ò ò ò ò ò ò ò ò üìðײ¶«®·»-Þ«®²-î²¼ñí®¼ Ü»¹®»»ô «° ¬± ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïôðððüïîôððð͵·² Ù®¿º¬ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òݱ³¿ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïîôëððÜ·-´±½¿¬·±²-ô «° ¬± ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üìôèððÛ¿® ײ¶«®§ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíððÛ§» ײ¶«®§ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíððÚ®¿½¬«®»-ô «° ¬±ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéôðððØ»®²·¿¬»¼ Ü·-½ Í«®¹»®§ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéëðÕ²»» Ý¿®¬·´¿¹» ø̱®²÷ Í«®¹»®§ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéëðÔ¿½»®¿¬·±²- ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíðóüêððÔ±-- ±º Ø¿²¼-ô Ú»»¬ ±® Í·¹¸¬ô «° ¬±ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üîðôðððÔ±-- ±º Ú·²¹»®- ±® ̱»-ô «° ¬±ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üîôðððп®¿´§-·-Ì©± ´·³¾-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïðôðððÚ±«® ´·³¾- ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïëòðððÌ®¿«³¿¬·½ Þ®¿·² ײ¶«®§ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíððß½½·¼»²¬¿´ Ü»¿¬¸Û³°´±§»» ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üëðôðððÍ°±«-» ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üëðôðððݸ·´¼®»² ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïðôðððÚ·®-¬ ß½½·¼»²¬ øѲ½» °»® °±´·½§÷ ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïððÚ¿³·´§ Ý¿®» ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üíðÚ±® »¿½¸ ½¸·´¼ ·² ¿ ½¸·´¼ ½¿®» ½»²¬»®æ л® ¼¿§ô «° ¬± í𠼿§-Ö±·²¬ λ°´¿½»³»²¬Û´¾±© ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üéëðØ·° ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïôëððÕ²»» ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üïôððð͸±«´¼»® ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üçððб-¬óÌ®¿«³¿¬·½ ͬ®»-- Ü·-±®¼»®ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üëðл® ª·-·¬ô «° ¬± -·¨ ª·-·¬-ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò òüïôððð·² ±®¹¿²·¦»¼ -°±®¬-ò Ë° ¬± üïôððð °»® °»®-±² °»® §»¿®òÉ»´´²»-- ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò ò üëðѲ½» °»® °»®-±²ô °»® §»¿®å íð󼿧 ©¿·¬·²¹ °»®·±¼Í»³·óÓ±²¬¸´§ Ю»³·«³Û³°´±§»» ü ëòçèÛ³°´±§»» õ Í°±«-» ü ïðòçîÛ³°´±§»» õ ݸ·´¼ø®»²÷ ü ïïòïèÚ¿³·´§ ü ïêòïîÜ×ßÓÑÒÜPage 7

DZ« ¼± »ª»®§¬¸·²¹§±« ½¿² ¬± µ»»°§±«® º¿³·´§ -¿º»ô¾«¬ ¿½½·¼»²¬-¸¿°°»²ô ¿²¼ ©¸»²¬¸»§ ¼±ô ·¬ ¹±±¼ ¬± µ²±© ݸ«¾¾ ¸¿-§±« ½±ª»®»¼òײ·¬·¿´ Û´·¹·¾·´·¬§Û³°´±§»» ß½¬·ª»´§ »³°´±§»¼ ©±®µ·²¹ ¿¬ ´»¿¬ ïéòë ¸±«®- °»® ©»»µ ß¹» ïè ¿²¼ ±´¼»®Í°±«-» ß¹» ïè ¿²¼ ±´¼»® ײ½´«¼» ¼±³»¬·½ ¿²¼ ½·ª·´ «²·±² °¿®¬²»®-Ü»°»²¼»²¬ ½¸·´¼®»²ñ¹®¿²¼½¸·´¼®»² ß¹» 𠬸®±«¹¸ îê Ò± ¬«¼»²¬ ¬¿¬« ®»¯«·®»¼Û¨½´«-·±²- ú Ô·³·¬¿¬·±²-̸·- ·- ß½½·¼»²¬óѲ´§ ײ-«®¿²½»ò Ò±®»²¼»®»¼ ¾§ ¿ ³»³¾»® ±º ¬¸» ׳³»¼·¿¬»©·´´ ¾» °¿§¿¾´» º±® -·½µ²»-- ±® ·²º»½¬·±²·²½´«¼·²¹ °¸§-·½¿´ ±® ³»²¬¿´ ½±²¼·¬·±²¬¸¿¬ ·- ²±¬ ½¿«-»¼ -±´»´§ ¾§ ±® ¿- ¿ ¼·®»½¬®»-«´¬ ±º ¿ ݱª»®»¼ ß½½·¼»²¬ò¬¸¿¬ ·- ½¿«-»¼ ¾§ô ½±²¬®·¾«¬»¼ ¬±ô ±®±½½«® ¿ ¿ ®»«´¬ ±º ¿ ½±ª»®»¼ °»®±²æ Þ»·²¹ ·²¬±¨·½¿¬»¼ô ±® «²¼»® ¬¸» ±¬¸»® °®»-½®·°¬·±² ¼®«¹ «²´»--¿¼³·²·-¬»®»¼ ±² ¬¸» ¿¼ª·½» ±º ¿Ð¸§-·½·¿² ¿²¼ ¬¿µ»² ¿½½±®¼·²¹ ¬± ¬¸»Ð¸§·½·¿² ·²¬®«½¬·±² ø¬¸» ¬»®³ ·²¬±¨·½¿¬»¼ ³»¿² ¬¸» ³·²·³«³ ¾´±±¼ ¿´½±¸±´ ´»ª»´ ®»¯«·®»¼ ¬± ¾»½±²-·¼»®»¼ ±°»®¿¬·²¹ ¿² ¿«¬±³±¾·´»¶«®·-¼·½¬·±² ·² ©¸·½¸ ¬¸» ¿½½·¼»²¬±½½«®®»¼÷å ﮬ·½·°¿¬·²¹ ·² ¿² ·´´»¹¿´ ±½½«°¿¬·±² ±® ¿¬¬»³°¬·²¹ ¬± ½±³³·¬ ±® ¿½¬«¿´´§½±³³·¬¬·²¹ ¿ º»´±²§ øº»´±²§ · ¿ ·² ©¸·½¸ ¬¸» ¿½¬·ª·¬§ ¬¿µ»- °´¿½»÷å ݱ³³·¬¬·²¹ ±® ¿¬¬»³°¬·²¹ ¬± ½±³³·¬ -«·½·¼» ±® ·²¬»²¬·±²¿´´§ ·²¶«®·²¹¸·³-»´º ±® ¸»®-»´ºå Ø¿ª·²¹ ¼»²¬¿´ ¬®»¿¬³»²¬ô »¨½»°¬ º±® -«½¸ ½¿®» ±® ¬®»¿¬³»²¬ ¼«» ¬± ·²¶«®§ ¬±-±«²¼ ²¿¬«®¿´ ¬»»¬¸ ©·¬¸·² ¬©»´ª» øïî÷³±²¬¸- ±º ¬¸» ݱª»®»¼ ß½½·¼»²¬å Þ»·²¹ »¨°±»¼ ¬± ©¿® ±® ¿²§ ¿½¬ ±º ©¿®ô ¼»½´¿®»¼ ±® «²¼»½´¿®»¼ô ±®-»®ª·²¹ ·² ¿²§ ±º ¬¸» ¿®³»¼ º±®½»- ±®«²·¬- ¿«¨·´·¿®§ ¬¸»®»¬±å ±® ﮬ·½·°¿¬·±² ·² ¿²§ ½±²¬»¬ «·²¹ ¿²§ ¬§°» ±º ³±¬±®·¦»¼ ª»¸·½´»ò̸·- ·- ¿ -«°°´»³»²¬ ¬± ¸»¿´¬¸ ·²-«®¿²½» ¿²¼ ·- ²±¬ ¿ -«¾-¬·¬«¬» º±® Ó¿¶±® Ó»¼·½¿´ ±® ±¬¸»® ³·²·³¿´ »--»²¬·¿´ ½±ª»®¿¹»òÚ»¿¬«®»-Ù«¿®¿²¬»»¼ ×--«»Ò± ³»¼·½¿´ ¸·-¬±®§ ·- ®»¯«·®»¼ º±®½±ª»®¿¹» ¬± ¾» ·--«»¼òλ²»©¿¾´»Ý±ª»®¿¹» ·- ¿«¬±³¿¬·½¿´´§ ®»²»©»¼ ¿- ´±²¹¿- §±« ¿®» ¿² »´·¹·¾´» »³°´±§»»ô §±«®°®»³·«³- ¿®» °¿·¼ ¿- ¼«» ¿²¼ ¬¸» °±´·½§·- ·² º±®½»òᮬ¿¾´»Ç±« ½¿² µ»»° §±«® ½±ª»®¿¹» »ª»² ·º §±«½¸¿²¹» ¶±¾- ±® ®»¬·®»òÚ¿³·´§ ݱª»®¿¹»Ç±« ½¿² ·²-«®» §±«®-»´ºô §±«® -°±«-»ô ¿²¼§±«® µ·¼-ò DZ«® ½¸·´¼®»² ¿²¼ ¼»°»²¼»²¬¹®¿²¼½¸·´¼®»² ¬¸®±«¹¸ ¿¹» îê ½¿² ¾»·²½´«¼»¼òØÍß Ý±³°¿¬·¾´»Ç±« ½¿² ¸¿ª» ¬¸·- ½±ª»®¿¹» »ª»² ·º §±«¸¿ª» ¿ Ø»¿´¬¸ Í¿ª·²¹- ß½½±«²¬òïò ©©©ò¸»¿´¬¸½¿®»ò¹±ªå ¿½½»--»¼ Í»°¬ò îðïçîò ©©©ò¾¿²µ®¿¬»ò½±³å ¿½½»--»¼ Í»°¬ò îðïçíò ©©©ò½¼½ò¹±ªñ²½¸-å ¿½½»--»¼ Í»°¬ò îðïçݸ«¾¾ ·- ¬¸» ³¿®µ»¬·²¹ ²¿³» «-»¼ ¬± ®»º»® ¬± -«¾-·¼·¿®·»- ±º ݸ«¾¾ Ô·³·¬»¼ °®±ª·¼·²¹ ·²-«®¿²½» ¿²¼ ®»´¿¬»¼ -»®ª·½»-ò ̸·- ·²-«®¿²½»°®±¼«½¬ ·- «²¼»®©®·¬¬»² ¾§ ßÝÛ Ð®±°»®¬§ ú Ý¿-«¿´¬§ ײ-«®¿²½» ݱ³°¿²§òPage 8

EXP 8/23AGC2200997Group Critical IllnessInsurance You can count on Aflac to help ease the financial impact of surviving a critical illness.This plan does not contain comprehensive adult wellness benefits as defined by law.Page 9

AFLAC GROUP CRITICAL ILLNESSFor more information, ask your insurance agent/producer, call 1.800.433.3036, or visit aflacgroupinsurance.com.Aflac can help ease the financial stress of surviving a critical illness.Chances are you may know someone who’s been diagnosed with a critical illness. You can’t help notice the difference in the person’s life—both physically and emotionally. What’s not so obvious is the impact a critical illness may have on someone’s personal finances.That’s because while a major medical plan may pay for a good portion of the costs associated with a critical illness, there are a lot of expenses that may not be covered. And, during recovery, having to worry about out-of-pocket expenses is the last thing anyone needs. That’s the benefit of an Aflac Group Critical Illness plan.It can help with the treatment costs of covered critical illnesses, such as a heart attack or stroke.More importantly, the plan helps you focus on recuperation instead of the distraction of out-of-pocket costs. With the Critical Illness plan, you receive cash benefits directly (unless otherwise assigned)—giving you the flexibility to help pay bills related to treatment or to help with everyday living expenses. But it doesn’t stop there. Having group critical illness insurance from Aflac means that you may have added financial resources to help with medical costs or ongoing living expenses.Features:• Benefits are paid directly to you, unless otherwise assigned.• Coverage is available for you, your spouse, and dependent children.• Coverage may be continued (with certain stipulations). That means you can take it with you if you changejobs or retire.How It Works: Aflac Group Critical Illness coverage is selected.Aflac Group Critical Illness pays an Initial Diagnosis Benefit of:$10,000You experience chest pains and numbness in the left arm.You visit the emergency room.A physician determines that you have suffered a heart attack.Amount payable based on $10,000 Initial Diagnosis Benefit.Page 10

COVERED CRITICAL ILLNESS BENEFITS:CANCER (Internal or Invasive) 100%HEART ATTACK (Myocardial Infarction) 100%STROKE (Ischemic or Hemorrhagic) 100%KIDNEY FAILURE (End-Stage Renal Failure) 100%BONE MARROW TRANSPLANT (Stem Cell Transplant) 100%SUDDEN CARDIAC ARREST 100%MAJOR ORGAN TRANSPLANT (25% of this benet is payable for insureds placed on a transplant list for a major organ transplant) 100%TYPE I DIABETES 100%COMA 100%PARALYSIS 100%LOSS OF SIGHT 100%LOSS OF HEARING 100%LOSS OF SPEECH 100%CORONARY ARTERY BYPASS SURGERY 100%BENIGN BRAIN TUMOR 100%NON-INVASIVE CANCER 25% METASTATIC CANCER 25%INITIAL DIAGNOSIS BENEFITWe will pay a lump sum benefit upon initial diagnosis of a covered critical illness when such diagnoses is caused by or solely attributed to an underlying disease. Benefits will be based on the face amount in effect on the critical illness date of diagnosis.ADDITIONAL DIAGNOSIS BENEFITWe will pay benefits for each different critical illness after the first when the two dates of diagnoses are separated by at least 6 consecutive months. REOCCURRENCE BENEFITWe will pay benefits for the same critical illness after the first when the two dates of diagnoses are separated by at least 6 consecutive months. SKIN CANCER BENEFITWe will pay $1,000 for the diagnosis of skin cancer. We will pay this benefit once per calendar year. ACCIDENT BENEFITPayable if an insured sustains a covered accident and suffers any of the following, which is solely due to, caused by, and attributed to, the covered accident: Coma / Loss of Sight / Loss of Speech / Loss of Hearing / Severe Burn / Paralysis100%WAIVER OF PREMIUMIf you become totally disabled due to a covered critical illness prior to age 65, after 90 continuous days of total disability, we will waive premiums for you and any of your covered dependents. As long as you remain totally disabled, premiums will be waived up to 24 months, subject to the terms of the plan.SUCCESSOR INSURED BENEFIT (In Missouri, Conversion Privilege (Successor Insured))If spouse coverage is in force at the time of the primary insured’s death, the surviving spouse may elect to continue coverage. Coverage would continue at the existing spouse face amount and would also include any dependent child coverage in force at the time. See certificate for details.CHILD COVERAGE AT NO ADDITIONAL COSTEach dependent child is covered at 50 percent of the primary insured’s benefit amount at no additional charge. Children-only coverage is not available.HEALTH SCREENING BENEFIT / $50 PER CALENDAR YEARPayable for health screening tests performed while an insured’s coverage is in force. We will pay this benefit once per calendar year, per insured. This benefit is only payable for health screening tests performed as the result of preventive care, including tests and diagnostic procedures ordered in connection with routine examinations.Page 11

PROGRESSIVE BENEFITS RIDERPercentage of Face AmountAMYOTROPHIC LATERAL SCLEROSIS (ALS OR LOU GEHRIG’S DISEASE) 100% SUSTAINED MULTIPLE SCLEROSIS 100%ADVANCED ALZHEIMER'S DISEASE 25%ADVANCED PARKINSON'S DISEASE 25%CHRONIC OBSTRUCTIVE PULMONARY DISEASE (COPD) 25%CROHN'S DISEASE 25%These benets will be paid based on the face amount in eect on the critical illness date of diagnosis. We will pay the benet shown upon diagnosis of one of the covered diseases if the date of diagnosis is while the rider is in force.The Progressive Disease benet is payable only once per disease.For any subsequent Progressive Disease to be covered, the date of diagnosis of the subsequent Progressive Disease must satisfy the Additional Diagnosis separation period outlined in the brochure.SPECIFIED DISEASES RIDERTIER I SPECIFIED DISEASE BENEFIT Addison’s Disease, Cerebrospinal Meningitis, Diphtheria, Huntington’s Chorea, Legionnaire’s Disease, Malaria, Muscular Dystrophy, Myasthenia Gravis, Necrotizing Fasciitis, Osteomyelitis, Poliomyelitis (Polio), Rabies, Sickle Cell Anemia, Systemic Lupus, Systemic Sclerosis (Scleroderma), Tetanus, Tuberculosis We will pay the benefit shown if an insured is diagnosed with one of the Tier I Specified Diseases listed, and if the date of diagnosis is while the rider is in force.For any subsequent Tier I Specified Disease to be covered, the date of diagnosis of the subsequent Tier I Specified Disease must satisfy the Additional Diagnosis separation period outlined in the brochure.25%TIER II SPECIFIED DISEASE BENEFIT Covered Diseases: Human CoronavirusWe will pay the benefit shown if an insured is diagnosed with human coronavirus, and such diagnosis results in either a period of hospital confinement or hospital intensive care unit confinement as a direct result of human coronavirus.Furthermore, the date of diagnosis must be while the rider is in force.In addition, the insured must be receiving treatment for human coronavirus for the minimum number of days shown. Only the highest eligible benefit amount will be payable under these benefits. In the event a lower benefit amount was previously paid under these benefits for any period of hospital confinement and that confinement is extended or the insured is moved to an intensive care unit triggering a higher payment, the difference between the previous paid benefit amount and the new benefit amount will be provided.For any subsequent human coronavirus diagnosis to be covered, the date of diagnosis must satisfy the Additional Diagnosis separation period outlined in the brochure.10% if confined to a hospital for 4-9 days25% if confined to a hospital for 10 or more days40% if confined to an intensive care unitPage 12

State references refer to the state of your group and not your resident state. If your plan includes attained age rates, that means your plan is age-banded and your rates may increase on the policy anniversary date. All limitations and exclusions that apply to the critical illness plan also apply to all riders, if applicable, unless amended by the riders.EXCLUSIONSWe will not pay for loss due to any of the following:• Self-Inflicted Injuries – injuring or attempting to injure oneself intentionally ortaking action that causes oneself to become injured.− In Alaska and Nevada, injuring or attempting to injure oneself intentionally.− In Vermont, injuring or attempting to injure oneself intentionally or takingaction that causes oneself to become injured while sane.• Suicide – committing or attempting to commit suicide, while sane or insane.− In Missouri, committing or attempting to commit suicide while sane.− In Pennsylvania and Vermont, committing or attempting to commit suicide.− In Illinois and Minnesota, this exclusion does not apply.• Illegal Acts – participating or attempting to participate in an illegal activity, orworking at an illegal job.− In Maryland, this exclusion does not apply.− In Illinois and Pennsylvania, Illegal Occupation - committing or attemptingto commit a felony or being engaged in an illegal occupation.− In Nebraska, being engaged in an illegal occupation, or commission of orattempting to commit a felony.− In Nevada, being convicted of participating in a felony, or working at anillegal job that could result in a financial gain for the member obtainedthrough illicit means. This exclusion does not apply to acts or victims ofdomestic violence, regardless of whether the insured contributed to anyloss or injury.− In Ohio, committing or attempting to commit a felony, or working at anillegal job.− In Utah, voluntarily participating in an illegal activity or voluntary workingat an illegal job;− In Vermont, participating or attempting to participate in a felony, or workingat an illegal job.• Participation (in Utah, Voluntary participation) in aggressive conflict of any kind(in Nevada, conflict of the following types), including: − War (declared or undeclared) or military conflicts- In Florida and North Carolina, war does not include acts of terrorism.- In Oklahoma war, or act of war, declared or undeclared, when servingin the military service or an auxiliary unit thereto;− Insurrection or riot− Civil commotion or civil state of belligerence− In D.C., participation in aggressive conflict of any kind, including:- War (declared or undeclared) or military conflicts;- Insurrection or riot (Riot means a public disturbance involving anassemblage of 5 or more persons which by tumultuous and violentconduct or the threat thereof creates grave danger of damage or injuryto property or persons. An exclusion for riot shall apply only whena person willfully engages in a riot or willfully incites or urges otherpersons to engage in a riot.− In Maryland, participation in aggressive conflict of any kind, including war(declared or undeclared) or military conflicts.• Illegal substance abuse which includes the following:− Abuse of legally-obtained prescription medication− Illegal use of non-prescription drugs− In Kentucky, Illegal substance abuse which includes the following: - Any loss sustained or contracted in consequence of the insured beingintoxicated or under the influence of any drug unless administeredon the advice of a doctor and taken in accordance with the doctor’sinstructions.− In Louisiana, Illegal substance abuse which includes the following:- Illegal intoxication or- Being under the influence of narcotics unless administered on theadvice of a doctor.− In Massachusetts, Illegal substance abuse which includes the following:- Abuse of legally-obtained prescription medication- Illegal use of non-prescription drugs- Services provided for alcohol and drug detoxification− In Maryland, Nevada, South Dakota and Vermont, this exclusion does notapply.• An error, mishap, or malpractice during medical, diagnostic, or surgicaltreatment or procedure.− In Pennsylvania and Utah, this exclusion does not apply.• In Texas, diagnosis of a critical illness made by a family member.• In Maryland, any claim that the appropriate regulatory board determines wereprovided as a result of a prohibited referral as defined in §1-302 of the HealthOccupations Article.Diagnosis must be made and treatment must be received in the United States or its territories. All benefits under the plan, including benefits for diagnoses, treatment, confinement and covered tests, are payable only while coverage is in force.TERMS YOU NEED TO KNOWThe Bone Marrow Transplant (Stem Cell Transplant) benefit is not payable if the transplant results from a covered critical illness for which a benefit has been paid under this plan.The following are not considered internal or invasive cancers:• Pre-malignant tumors or polyps• Carcinomas in Situ• Any superficial, non-invasive skin cancers including basal cell and squamouscell carcinoma of the skin (In Maryland, this exclusion will not apply when theskin cancer metastasizes and leads to internal cancer.)• Melanoma in Situ• Melanoma that is diagnosed as− Clark’s Level I or II,− Breslow depth less than 0.77mm, or− Stage 1A melanomas under TNM Staging• Metastatic CancerA Non-Invasive Cancer is:• Internal Carcinoma in Situ• Myelodysplastic Syndrome - RA (refractory anemia)• Myelodysplastic Syndrome - RARS (refractory anemia with ring sideroblasts)• Myeloproliferative Blood DisorderPremalignant conditions or conditions with malignant potential, other than those specifically named above, are not considered non-invasive cancerSkin cancers are not payable under the Cancer (internal or invasive) Benefit or the Non-Invasive Cancer Benefit. The following are considered skin cancers:Page 13

• Basal cell carcinoma• Squamous cell carcinoma of the skin• Melanoma in Situ• Melanoma that is diagnosed as− Clark’s Level I or II,− Breslow depth less than 0.77mm, or− Stage 1A melanomas under TNM StagingComa means a state of continuous, profound unconsciousness, lasting at least seven consecutive days (In Pennsylvania, three consecutive days), and characterized by the absence of:• Spontaneous eye movements,• Response to painful stimuli, and• Vocalization.Coma does not include a medically-induced coma.To be payable as an accident benefit, the coma must be caused solely by or be solely attributed to a covered accident. To be considered a critical illness, the coma must be caused solely by or be solely attributed to one of the following diseases:• Brain Aneurysm• Diabetes• Encephalitis• Epilepsy• Hyperglycemia• Hypoglycemia• MeningitisCritical Illness is a disease or a sickness as defined in the plan that first manifests (In Maryland and South Dakota, that manifests; In Illinois, began) while your coverage is in force. In Pennsylvania, a disease or sickness as defined in the plan that is diagnosed or first treated while your coverage is in force.Date of Diagnosis is defined as follows:• Cancer: The day tissue specimens, blood samples, or titer(s) are taken(diagnosis of cancer and/or carcinoma in situ is based on such specimens).− In North Carolina, the day tissue specimens, biopsy, culture, bloodsamples, or titer(s) are taken upon which the positive medical diagnosisis the date the diagnosis is communicated to the insured. (Diagnosis ofCancer and/or Carcinoma in Situ is based on such specimens).• Non-Invasive Cancer: The day tissue specimens, blood samples, or titer(s)are taken (diagnosis of cancer and/or carcinoma in situ is based on suchspecimens).− In North Carolina, the day tissue specimens, biopsy, culture, bloodsamples, or titer(s) are taken upon which the positive medical diagnosisis the date the diagnosis is communicated to the insured. (Diagnosis ofCancer and/or Carcinoma in Situ is based on such specimens).• Skin Cancer: The date the skin biopsy samples are taken for microscopicexamination.• Bone Marrow Transplant (Stem Cell Transplant): The date the surgery occurs.• Coma: The first day of the period for which a doctor confirms a coma that isdue to one of the underlying diseases and that has lasted for at least sevenconsecutive days.• Coronary Artery Bypass Surgery: The date the surgery occurs.• Heart Attack (Myocardial Infarction): The date the infarction (death) of a portionof the heart muscle occurs. This is based on the criteria listed under the heartattack (myocardial Infarction) definition.• Benign Brain Tumor: The date a doctor determines a benign brain tumor ispresent based on examination of tissue (biopsy or surgical excision) or specificneuroradiological examination.• Kidney Failure (End-Stage Renal Failure): The date a doctor recommends thatan insured begin renal dialysis.• Loss of Hearing: The date the loss due to one of the underlying diseases isobjectively determined by a Doctor to be total and irreversible.• Loss of Sight: The date the loss due to one of the underlying diseases isobjectively determined by a Doctor to be total and irreversible.• Loss of Speech: The date the loss due to one of the underlying diseases isobjectively determined by a Doctor to be total and irreversible.• Major Organ Transplant: The date the surgery occurs.• Metastatic Cancer: The date a doctor determines cancer has metastasized toother parts of the body from the original site.• Paralysis: The date a doctor diagnoses an insured with paralysis due to one ofthe underlying diseases as specified in this plan, where such diagnosis is basedon clinical and/or laboratory findings as supported by the insured’s medicalrecords.• Severe Burn: The date the burn takes place.• Stroke: The date the stroke occurs (based on documented neurological deficitsand neuroimaging studies).• Sudden Cardiac Arrest: The date the pumping action of the heart fails (based onthe sudden cardiac arrest definition).• Type I Diabetes: The date a doctor diagnoses an insured as having type Idiabetes based on clinical and/or laboratory findings as supported by medicalrecords.Dependent children are your or your spouse’s natural children, step-children, grandchildren who are in your legal custody and residing with you, foster children, children subject to legal guardianship, legally adopted children, or children placed for adoption, who are younger than age 26. Newborn children are automatically covered from the moment of birth. Definition may vary by state. Read your certificate carefully for details.Spouse is your legal wife or husband, including a legally-recognized same-sex Spouse, or a person of either gender who is in a legally recognized and registered domestic partnership, civil union, reciprocal beneficiary relationship, or similar relationship with you, who is listed on your application. Definition may vary by state. Read your certificate carefully for details.A doctor does not include you or any of your family members. For the purposes of this definition, family member includes your spouse as well as the following members of your immediate family:• Son• Daughter• Mother• Father• Sister• BrotherThis includes step-family members and family-members-in-law. (In Pennsylvania, reference to family-members-in-law is not applicable.)In South Dakota, A doctor who is your family member may treat you if that doctor:• Is the only doctor in the area; and,• Acts within the scope of his or her practice.In Arizona and Texas, the above definition of doctor is not applicable.Employee is a person who meets eligibility requirements and who is covered under the plan. The employee is the primary insured under the plan.Page 14

Heart Attack (Myocardial Infarction) does not include:• Any other disease or injury involving the cardiovascular system.• Cardiac Arrest not caused by a Heart Attack (Myocardial Infarction).Diagnosis of a Heart Attack (Myocardial Infarction) must include the following:• New and serial electrocardiographic (ECG) findings consistent with heart attack(myocardial infarction), and• Elevation of cardiac enzymes above generally accepted laboratory levels ofnormal. (In the case of creatine physphokinase (CPK) a CPKMB measurementmust be used.) Confirmatory imaging studies, such as thallium scans, MUGAscans, or stress echocardiograms may also be used.Kidney Failure (End-Stage Renal Failure) is covered only under the following conditions:• A doctor advises that regular renal dialysis, hemo-dialysis, or peritoneal dialysis(at least weekly) is necessary to treat the kidney failure (endstage renal failure);or• The kidney failure (end-stage renal failure) results in kidney transplantation. Loss of Hearing means the total and irreversible loss of hearing in both ears. Loss of hearing does not include hearing loss that can be corrected by the use of a hearing aid or device. To be payable as an accident benefit, loss of hearing must be caused solely by or be solely attributed to a covered accident.To be considered a critical illness, loss of hearing must be caused solely by or be solely attributed to one of the following diseases:• Alport syndrome• Autoimmune inner ear disease• Chicken pox• Diabetes• Goldenhar syndrome• Meniere’s disease• Meningitis• MumpsLoss of Sight means the total and irreversible loss of all sight in both eyes. To be payable as an accident benefit, loss of sight must be caused solely by or be solely attributed to a covered accident. To be considered a critical illness, loss of sight must be caused solely by or be solely attributed to one of the following diseases:• Retinal disease• Optic nerve disease• HypoxiaLoss of Speech means the total and permanent loss of the ability to speak. To be payable as an accident benefit, loss of speech must be caused solely by or be solely attributed to a covered accident. To be considered a critical illness, loss of speech must be caused solely by or be solely attributable to one of the following diseases:• Alzheimer’s disease• Arteriovenous malformationMaintenance Drug Therapy is meant to decrease the risk of cancer recurrence; it is not meant to treat a cancer that is still present.A Major Organ Transplant benefit is not payable if the major organ transplant results from a covered critical illness for which a benefit has been paid.Paralysis or Paralyzed means the permanent, total, and irreversible loss of muscle function to the whole of at least two limbs. To be payable as an accident benefit, the paralysis must be caused solely by or be solely attributed to a covered accident. To be considered a critical illness, paralysis must be caused solely by or be solely attributed to one or more of the following diseases:• Amyotrophic lateral sclerosis• Cerebral palsy• Parkinson’s disease,• PoliomyelitisThe diagnosis of paralysis must be supported by neurological evidence.Severe Burn or Severely Burned means a burn resulting from fire, heat, caustics, electricity, or radiation. The burn must:• Be a full-thickness or third-degree burn, as determined by a doctor. A Full-Thickness Burn or Third-Degree Burn is the destruction of the skin through theentire thickness or depth of the dermis (or possibly into underlying tissues). Thisresults in loss of fluid and sometimes shock.• Cause cosmetic disfigurement to the body’s surface area of at least 35 squareinches.• Be caused solely by or be solely attributed to a covered accident.Stroke does not include:• Transient Ischemic Attacks (TIAs)• Head injury• Chronic cerebrovascular insufficiency• Reversible ischemic neurological deficits unless brain tissue damage isconfirmed by neurological imagingSudden Cardiac Arrest is not a heart attack (myocardial infarction). A sudden cardiac arrest benefit is not payable if the sudden cardiac arrest is caused by or contributed to by a heart attack (myocardial infarction). (In Illinois, contributed to by language does not apply.)Treatment does not include maintenance drug therapy or routine follow-up visits to verify whether cancer or carcinoma in situ has returned.Type I Diabetes excludes gestational diabetes and prediabetes.Benign Brain Tumor must be caused by Multiple Endocrine Neoplasia, Neurofibromatosis, or Von Hippel-Lindau Syndrome.PROGRESSIVE DISEASES RIDERDate of Diagnosis is defined for each specified critical illness as follows:• Amyotrophic Lateral Sclerosis (ALS or Lou Gehrig’s Disease): The date a doctordiagnoses an insured as having ALS and where such diagnosis is supported bymedical records.• Sustained Multiple Sclerosis: The date a doctor diagnoses an Insured as havingMultiple Sclerosis and where such diagnosis is supported by medical records.• Advanced Alzheimer’s Disease: The date a doctor diagnoses the insured asincapacitated due to Alzheimer’s disease.• Advanced Parkinson’s Disease: The date a doctor diagnoses the insured asincapacitated due to Parkinson’s disease.• Chronic Obstructive Pulmonary Disease (COPD): The date a doctor diagnosesan insured as having COPD based onclinical and/or laboratory findings assupported by medical records.• Crohn’s Disease: The date a doctor diagnoses an insured as having Crohn’sDisease based on clinical and/or laboratory findings as supported by medicalrecords.SPECIFIED DISEASES RIDERThese benefits will be paid based on the face amount in effect on the specified disease date of diagnosis. All limitations and exclusions that apply to the critical illness plan also apply to the rider unless amended by the rider.No benefits will be paid for loss which occurred prior to the effective date of the plan.Page 15

Date of diagnosis is defined for each specified disease as follows: Adrenal Hypofunction (Addison’s Disease): The date a Doctor Diagnoses an Insured as having Adrenal Hypofunction and where such Diagnosis is supported by medical records.Cerebrospinal Meningitis: The date a Doctor Diagnoses an Insured as having Cerebrospinal Meningitis and where such Diagnosis is supported by medical records.Diphtheria: The date a Doctor Diagnoses an Insured as having Diphtheria based on clinical and/or laboratory findings as supported by medical records.Human Coronavirus: The date a doctor diagnoses an insured as having Human Coronavirus based on laboratory findings as supported by viral testing or a blood test. Huntington’s Chorea: The date a Doctor Diagnoses an Insured as having Huntington’s Chorea based on clinical findings as supported by medical records.Legionnaire’s Disease: The date a Doctor Diagnoses an Insured as having Legionnaire’s Disease by finding Legionella bacteria in a clinical specimen taken from the Insured.Malaria: The date a Doctor Diagnoses an Insured as having Malaria and where such Diagnosis is supported by medical records.Muscular Dystrophy: The date a Doctor Diagnoses an Insured as having Muscular Dystrophy and where such Diagnosis is supported by medical records.Myasthenia Gravis: The date a Doctor Diagnoses an Insured as having Myasthenia Gravis and where such Diagnosis is supported by medical records.Necrotizing Fasciitis: The date a Doctor Diagnoses an Insured as having Necrotizing Fasciitis and where such Diagnosis is supported by medical records.Osteomyelitis: The date a Doctor Diagnoses an Insured as having Osteomyelitis and where such Diagnosis is supported by medical records.Poliomyelitis: The date a Doctor Diagnoses an Insured as having Poliomyelitis and where such Diagnosis is supported by medical records.Rabies: The date a Doctor Diagnoses an Insured as having Rabies and where such Diagnosis is supported by medical records.Sickle Cell Anemia: The date a Doctor Diagnoses an Insured as having Sickle Cell Anemia and where such Diagnosis is supported by medical records.Systemic Lupus: The date a Doctor Diagnoses an Insured as having Systemic Lupus and where such Diagnosis is supported by medical records.Systemic Sclerosis (Scleroderma): The date a Doctor Diagnoses an Insured as having Systemic Sclerosis and where such Diagnosis is supported by medical records.Tetanus: The date a Doctor Diagnoses an Insured as having Tetanus by finding Clostridium tetani bacteria in a clinical specimen taken from the Insured.Tuberculosis: The date a Doctor Diagnoses an Insured as having Tuberculosis by finding Mycobacterium tuberculosis bacteria in a clinical specimen taken from the Insured.The term Hospital Intensive Care Unit specifically excludes any type of facility not meeting the definition of Hospital Intensive Care Unit as defined in the plan, including but not limited to private monitored rooms, surgical recovery rooms, observation units, and the following step-down units:• A progressive care unit,• A sub-acute intensive care unit, or• An intermediate care unit.The term Hospital specifically excludes any facility not meeting the definition of Hospital as defined in the plan, including but not limited to:• A nursing home,• An extended-care facility,• A skilled nursing facility,• A rest home or home for the aged,• A rehabilitation facility, Human Coronavirus does not include the following Human Coronaviruses: 229E, NL63, OC43, and HKU1.Adrenal Hypofunction does not include secondary and tertiary adrenal insufficiency. YOU MAY CONTINUE YOUR COVERAGEYour coverage may be continued with certain stipulations. See certificate for details.TERMINATION OF COVERAGEYour insurance may terminate when the plan is terminated; the 31st day (In Nevada, the 60th day) after the premium due date if the premium has not been paid; or the date you no longer belong to an eligible class. If your coverage terminates, we will provide benefits for valid claims that arose while your coverage was in force. See certificate for details.NOTICESIf this coverage will replace any existing individual policy, please be aware that it may be in your best interest to maintain your individual guaranteed-renewable policy.Notice to Consumer: The coverages provided by Continental American Insurance Company (CAIC) represent supplemental benefits only. They do not constitute comprehensive health insurance coverage and do not satisfy the requirement of minimum essential coverage under the Affordable Care Act. CAIC coverage is not intended to replace or be issued in lieu of major medical coverage. It is designed to supplement a major medical program.aflacgroupinsurance.com | 1.800.433.3036Continental American Insurance Company (CAIC), a proud member of the Aflac family of insurers, is a wholly-owned subsidiary of Aflac Incorporated and underwrites group coverage. CAIC is not licensed to solicit business in New York, Guam, Puerto Rico, or the Virgin Islands.Continental American Insurance Company • Columbia, South Carolina The certificate to which this sales material pertains may be written only in English; the certificate prevails if interpretation of this material varies.This brochure is a brief description of coverage and is not a contract. Read your certificate carefully for exact terms and conditions. You’re welcome to request a full copy of the plan certificate through your employer or by reaching out to our Customer Service Center.This brochure is subject to the terms, conditions, and limitations of Policy Series C22000. In Arkansas, policy form C22100AR. In Oklahoma, policy form C22100OK. In Pennsylvania, policy form C22100PA. In Texas, policy form C22100TX. In Virginia, policy form C22100VA.Page 16

Rates Table For:Hampton County School DistrictGroup Critical Illness 22000GP-36518PLAN-238302----------------------------------------Deduction Frequency :Semimonthly (24pp / yr)Employee - Non-Tobacco$10,000 $15,000 $20,000 $25,000 $30,00018-29 $2.86 $4.28 $5.71 $7.14 $8.5730-39 $4.88 $7.32 $9.76 $12.21 $14.6540-49 $8.96 $13.44 $17.92 $22.40 $26.8850-59 $15.11 $22.67 $30.22 $37.78 $45.3460+ $26.79 $40.18 $53.58 $66.97 $80.37Employee - Tobacco$10,000 $15,000 $20,000 $25,000 $30,00018-29 $3.66 $5.49 $7.32 $9.15 $10.9830-39 $7.46 $11.19 $14.92 $18.65 $22.3840-49 $14.75 $22.13 $29.50 $36.88 $44.2650-59 $27.92 $41.88 $55.85 $69.81 $83.7760+ $49.06 $73.59 $98.12 $122.65 $147.18Spouse - Non-Tobacco$5,000 $7,500 $10,000 $12,500 $15,00018-29 $1.43 $2.14 $2.86 $3.57 $4.2830-39 $2.44 $3.66 $4.88 $6.10 $7.3240-49 $4.48 $6.72 $8.96 $11.20 $13.4450-59 $7.56 $11.33 $15.11 $18.89 $22.6760+ $13.39 $20.09 $26.79 $33.49 $40.18Spouse - Tobacco$5,000 $7,500 $10,000 $12,500 $15,00018-29 $1.83 $2.74 $3.66 $4.57 $5.4930-39 $3.73 $5.60 $7.46 $9.33 $11.1940-49 $7.38 $11.06 $14.75 $18.44 $22.1350-59 $13.96 $20.94 $27.92 $34.90 $41.8860+ $24.53 $36.80 $49.06 $61.33 $73.59Page 17

IV (12/19)AG80075M R7Aflac Group Hospital Indemnity INSURANCEEven a small trip to the hospital can have a major impact on your finances.Here’s a way to help make your visit a little more affordable.® Page 18

The plan that can help with expenses and protect your savings.Does your major medical insurance cover all of your bills? Even a minor trip to the hospital can present you with unexpected expenses and medical bills. And even with major medical insurance, your plan may only pay a portion of your entire stay.That’s how the Aflac Group Hospital Indemnity plan can help. It provides financial assistance to enhance your current coverage. It may help avoid dipping into savings or having to borrow to address out-of-pocket-expenses major medical insurance was never intended to cover. Like transportation and meals for family members, help with child care, or time away from work, for instance.The Aflac Group Hospital Indemnity plan benefits include the following:• Hospital Confinement Benefit• Hospital Admission Benefit• Hospital Intensive Care Benefit• Intermediate Intensive Care Step-Down Unit• Successor Insured BenefitAFLAC GROUP HOSPITAL INDEMNITY HIGPolicy Series C80000How it worksThe plan has limitations and exclusions that may affect benefits payable. This brochure is for illustrative purposes only. Refer to your certificate for complete details, definitions, limitations, and exclusions. The Aflac Group Hospital Indemnity plan is selected. The insured has a high fever and goes to the emergency room.The physician admits the insured into the hospital.The insured is released after two days.The Aflac Group Hospital Indemnity plan pays $1,300Amount payable was generated based on benefit amounts for: Hospital Admission ($1,000), and Hospital Confinement ($150 per day). Page 19

BENEFIT AMOUNTHOSPITAL ADMISSION BENEFIT per confinement (once per covered sickness or accident per calendar year foreach insured)Payable when an insured is admitted to a hospital and confined as an inpatient because of a covered accidental injury or covered sickness. We will not pay benefits for confinement to an observation unit, or for emergency room treatment or outpatient treatment.We will not pay benefits for admission of a newborn child following his birth; however, we will pay for a newborn’s admission to a Hospital Intensive Care Unit if, following birth, he is confined as an inpatient as a result of a covered accidental injury or covered sickness (including congenital defects, birth abnormalities, and/or premature birth).$1,000HOSPITAL CONFINEMENT per day (maximum of 31 days per confinement for each covered sickness or accident foreach insured)Payable for each day that an insured is confined to a hospital as an inpatient as the result of a covered accidental injury or covered sickness. If we pay benefits for confinement and the insured becomes confined again within six months because of the same or related condition, we will treat this confinement as the same period of confinement. This benefit is payable for only one hospital confinement at a time even if caused by more than one covered accidental injury, more than one covered sickness, or a covered accidental injury and a covered sickness. $150HOSPITAL INTENSIVE CARE BENEFIT per day (maximum of 10 days per confinement for each covered sicknessor accident for each insured) Payable for each day when an insured is confined in a Hospital Intensive Care Unit because of a covered accidental injury or covered sickness. We will pay benefits for only one confinement in a Hospital's Intensive Care Unit at a time. Once benefits are paid, if an insured becomes confined to a Hospital's Intensive Care Unit again within six months because of the same or related condition, we will treat this confinement as the same period of confinement.This benefit is payable in addition to the Hospital Confinement Benefit. $150INTERMEDIATE INTENSIVE CARE STEP-DOWN UNIT per day (maximum of 10 days per confinement for eachcovered sickness or accident for each insured)Payable for each day when an insured is confined in an Intermediate Intensive Care Step-Down Unit because of a covered accidental injury or covered sickness. We will pay benefits for only one confinement in an Intermediate Intensive Care Step-Down Unit at a time.Once benefits are paid, if an insured becomes confined to a Hospital's Intermediate Intensive Care Step-Down Unit again within six months because of the same or related condition, we will treat this confinement as the same period of confinement.This benefit is payable in addition to the Hospital Confinement Benefit. $75SUCCESSOR INSURED BENEFITIf spouse coverage is in force at the time of the employee’s death, the surviving spouse may elect to continue coverage. Coverage would continue according to the existing plan and would also include any dependent child coverage in force at the time.Benefits OverviewLIMITATIONS AND EXCLUSIONSEXCLUSIONS We will not pay for loss due to: • War – voluntarily participating in war, any act of war, or military conflicts, declared orundeclared, or voluntarily participating or serving in the military, armed forces, or anauxiliary unit thereto, or contracting with any country or international authority. (Wewill return the prorated premium for any period not covered by the certificate whenthe insured is in such service.) War also includes voluntary participation (In NorthCarolina, active participation) in an insurrection, riot, civil commotion or civil state ofbelligerence. War does not include acts of terrorism (except in Illinois). − In Connecticut: a riot is not excluded. − In Oklahoma: War, or any act of war, declared or undeclared, when serving in themilitary, armed forces, or an auxiliary unit thereto. (We will return the prorated premium for any period not covered by the certificate when the insured is in such service.) War does not include acts of terrorism. • Suicide – committing or attempting to commit suicide, while sane or insane. − In Missouri, Montana, and Vermont: committing or attempting to commit suicide, while sane. − In Minnesota: this exclusion does not apply. • Self-Inflicted Injuries – injuring or attempting to injure oneself intentionally. − In Missouri: injuring or attempting to injure oneself intentionally which isobviously not an attempted suicide. − In Vermont: injuring or attempting to injure oneself intentionally, while sane.HIGIn order to receive benefits for accidental injuries due to a covered accident, an insured must be admitted within six months of the date of the covered accident (in Washington, twelve months).Page 20

Continental American Insurance Company (CAIC ), a proud member of the Aflac family of insurers, is a wholly-owned subsidiary of Aflac Incorporated and underwrites group coverage. CAIC is not licensed to solicit business in New York, Guam, Puerto Rico, or the Virgin Islands.Continental American Insurance Company • Columbia, South CarolinaThe certificate to which this sales material pertains may be written only in English; the certificate prevails if interpretation of this material varies. Read your certificate carefully for exact terms and conditions. You’re welcome to request a full copy of the plan certificate through your employer or by reaching out to our Customer Service Center. Benefits, terms, and conditions may vary by state.This brochure is subject to the terms, conditions, and limitations of Policy Series C80000. In Arkansas, C80100AR. In Oklahoma, C80100OK. In Oregon, C80100OR. In Pennsylvania, C80100PA. In Texas, C80100TX. In Virginia, C80100VA. • Racing – riding in or driving any motor-driven vehicle in a race, stunt show or speedtest in a professional or semi-professional capacity. • Illegal Occupation – voluntarily participating in, committing, or attempting to commita felony or illegal act or activity, or voluntarily working at, or being engaged in, anillegal occupation or job. − In Connecticut: voluntarily participating in, committing, or attempting to commita felony. − In Illinois: committing or attempting to commit a felony or being engaged in an illegal occupation. − In Nebraska and Tennessee: voluntarily participating in, committing, or attempting to commit a felony or voluntarily working at, or being engaged in, an illegal occupation or job. − In Pennsylvania: committing or attempting to commit a felony, or being engaged in an illegal occupation. − In South Dakota: voluntarily committing a felony. • Sports – participating in any organized sport in a professional or semi-professionalcapacity. • Custodial Care – this is non-medical care that helps individuals with the basic tasksof everyday life, the preparation of special diets, and the self-administration ofmedication which does not require the constant attention of medical personnel. • Treatment for being overweight, gastric bypass or stapling, intestinal bypass, and anyrelated procedures, including any resulting complications. • Services performed by a family member. − In Arizona: this exclusion does not apply. − In South Dakota: this exclusion does not apply. • Services related to sex or gender change, sterilization, in vitro fertilization, vasectomyor reversal of a vasectomy, or tubal ligation. − In Washington D.C. and Washington: Services related to sterilization, in vitrofertilization, vasectomy or reversal of a vasectomy, or tubal ligation. • Elective Abortion – an abortion for any reason other than to preserve the life of theperson upon whom the abortion is performed. − In Tennessee, or if the pregnancy was the result of rape or incest, or ifthe fetus is non-viable. • Dental Services or Treatment. • Cosmetic Surgery, except when due to: − Reconstructive surgery, when the service is related to or follows surgeryresulting from a Covered Accidental Injury or a Covered Sickness, or is related to or results from a congenital disease or anomaly of a covered dependent child. − Congenital defects in newborns.TERMS YOU NEED TO KNOWA Covered Accident is an accident that occurs on or after an insured’s effective date while coverage is in force, and that is not specifically excluded by the plan.Dependent means your spouse or dependent children, as defined in the applicable rider, who have been accepted for coverage. Spouse is your legal wife, husband, or partner in a legally recognized union. Refer to your certificate for details. Dependent Children are your or your spouse’s natural children, step-children, grandchildren who are in your legal custody and residing with you, foster children, children subject to legal guardianship, legally adopted children (in Texas, adopted children), or children placed for adoption. (In Florida, coverage may be provided for the children of custodial and non-custodial parents.) Newborn children are automatically covered from the moment of birth for 60 days. Newly adopted children (and foster children in North Carolina) are automatically covered for 60 days also. See certificate for details. Dependent children must be younger than age 26 (In Arizona, on the effictive date of coverage and in Louisiana and Illinois, unmarried). See certificate for details. Doctor is a person who is duly qualified as a practitioner of the healing arts acting within the scope of his license, and: is licensed to practice medicine; prescribe and administer drugs; or to perform surgery, or is a duly qualified medical practitioner according to the laws and regulations in the state in which treatment is made.In Montana: For purposes of treatment, the insured has full freedom of choice in the selection of any licensed physician, physician assistant, dentist, osteopath, chiropractor, optometrist, podiatrist, licensed social worker, psychologist, licensed professional counselor, acupuncturist, naturopathic physician, physical therapist, or advanced practice registered nurse.A Doctor does not include you or any of your Family Members. For the purposes of this definition, Family Member includes your spouse as well as the following members of your immediate family: son, daughter, mother, father, sister, or brother. In Arizona, however, a doctor who is your family member may treat you. In South Dakota, however, a doctor who is your family member may treat you if that doctor is the only doctor in the area and acts within the scope of his or her practice.A Hospital is not a nursing home; an extended care facility; a skilled nursing facility; a rest home or home for the aged; a rehabilitation facility; a facility for the treatment of alcoholism or drug addiction (except in Vermont); an assisted living facility; or any facility not meeting the definition of a Hospital as defined in the certificate.A Hospital Intensive Care Unit is not any of the following step-down units: a progressive care unit; a sub-acute intensive care unit; an intermediate care unit; a private monitored room; a surgical recovery room; an observation unit; or any facility not meeting the definition of a Hospital Intensive Care Unit as defined in the certificateSickness means an illness, infection, disease, or any other abnormal physical condition or pregnancy that is not caused solely by, or the result of, any injury (In Maine, illness or disease of an insured). A Covered Sickness is one that is not excluded by name, specific description, or any other provision in this plan. For a benefit to be payable, loss arising from the covered sickness must occur while the applicable insured’s coverage is in force (except in Montana).Treatment is the consultation, care, or services provided by a doctor. This includes receiving any diagnostic measures and taking prescribed drugs and medicines. Treatment does not include telemedicine services (except in Kansas).You May Continue Your CoverageYour coverage may be continued with certain stipulations. See certificate for details.Termination of CoverageYour insurance may terminate when the plan is terminated; the 31st day after the premium due date if the premium has not been paid; or the date you no longer belong to an eligible class. If your coverage terminates, we will provide benefits for valid claims that arose while your coverage was in force. See certificate for details.NOTICESIf this coverage will replace any existing individual policy, please be aware that it may be in your best interest to maintain your individual guaranteed-renewable policy.Notice to Consumer: The coverages provided by Continental American Insurance Company (CAIC) represent supplemental benefits only. They do not constitute comprehensive health insurance coverage and do not satisfy the requirement of minimum essential coverage under the Affordable Care Act. CAIC coverage is not intended to replace or be issued in lieu of major medical coverage. It is designed to supplement a major medical program.For more information, ask your insurance agent/producer, call 1.800.433.3036, or visit aflacgroupinsurance.com.Page 21

AFLAC GROUP HOSPITAL INDEMNITY INSURANCEPolicy Series C80000HIGAG80075HSB R2 IV (1/19)In Wyoming, the plan does not contain comprehensive adult wellness benefits as defined by law. For a complete list of limitations and exclusions please refer to the brochure. Continental American Insurance Company (CAIC), a proud member of the Aflac family of insurers, is a wholly-owned subsidiary of Aflac Incorporated and underwrites group coverage. CAIC is not licensed to solicit business in New York, Guam, Puerto Rico, or the Virgin Islands.This piece is intended to be used in conjunction with the product brochure for Policy Series C80000 and is subject to the terms, conditions, and limitations of the plan. Continental American Insurance Company • Columbia, South CarolinaThe Health Screening Benefit is payable once per calendar year for health screening tests performed as the result of preventive care, including tests and diagnostic procedures ordered in connection with routine examinations.This benefit is payable for each insured.HEALTH SCREENING BENEFIT / $50 PER CALENDAR YEARResidents of Massachusetts are not eligible for the Health Screening Benefit.Page 22

Rates Table For:Hampton County School DistrictGroup Hospital IndemnityGP-36518PLAN-233768Deduction FrequencySemimonthly (24pp / yr)Employee$11.22Employee & Dependent Spouse$21.41Employee & Dependent Child(ren)$17.27Family$27.46Page 23

EXP 8/23AGC2200995Group DisabilityInsurance INSURANCE PLAN — NON-OCCUPATIONAL A disabling illness or injury may be unpredictable.We’ll help make sure they don’t aect your financial plans, too.Page 24

Aflac can help you protect one of your most important assets. Your income.All too often when we hear the words disability and insurance together, it conjures up an image of a catastrophic condition that has left an individual in an incapacitated state. Be it an accident or a sickness, that’s the stereotype of a disabling injury that most of us have come to expect.What most of us don’t realize is that in addition to accidental injuries, conditions such as arthritis, heart disease, diabetes, and even pregnancy are some of the leading causes of disability that can keep you out of work and aect your income. That’s where Aflac group disability insurance can help. Our Aac group disability plan can help protect your income by oering disability benets to help you make ends meet when you are out of work. Our plan was created with you in mind and includes:• O-jobonlycoverage.• Benetsthathelpyoumaintainyourstandardofliving.The Aflac group disability plan benefits:• Benefitsarepaidwhenyouaresickorhurtandunabletowork,upto60percentofyoursalary(upto40%instateswithstatedisability).• MinimumandMaximumTotalMonthlyBenefit–$300to$3,000.• Premiumpaymentsarewaivedafter90daysoftotaldisability(notavailableon3monthbenefitperiod).• PartialDisabilityBenefit.Features:• Benetsarepaiddirectlytoyouunlessotherwiseassigned.• Coverageisportable.Thatmeansyoucantakeitwithyouifyouchangejobs(withcertainstipulations).• PayrollDeduction–Premiumsarepaidthroughconvenientpayrolldeduction.But it doesn’t stop there, having group short-term disability insurance from Aac means that you will have added nancial resources to help with medical costs or ongoing living expenses such as rent, mortgage or car payments. AFLAC GROUP DISABILITYPage 25

BENEFITS OVERVIEW:TOTAL DISABILITYThis convenient, aordable disability income plan will help provide needed income if you become Totally Disabled and are unable to work due to a covered injury or illness. Total disability benets will be payable monthly once the elimination period has been satised.PARTIAL DISABILITYThe Partial Disability Benet helps you transition back into full-time work after suering a disability. If you remain partially disabled and are only able to work earning less than 80 percent of your pre-disability income at any job, this plan will still pay you 50 percent of your selected monthly benet for up to the maximum partial disability benet period of 3 months after the elimination period. You do not have to have received the Total Disability benet to receive the Partial Disability benet.WAIVER OF PREMIUM Premiums are waived after 90 days of Total Disability. After Total Disability benets end, any premiums which become due must be paid in order to keep your insurance in force. This benet is not available on plans with a 3-month benet period.PORTABILITY If you cease employment with your employer, you may elect to continue your coverage. In order to continue your coverage you must meet all of the requirements listed below.• You must work full-time for another employer.• You must make a written application and pay the required premium to us within 31 days after the date your insurancewould otherwise terminate.• You must continue to pay any required premiums.The coverage you may continue is that which you had on the date your employment terminated. If you qualify for this portability privilege as described, then the same benets, plan provisions, and premium rate shown in your certicate as previously issued will apply. Coverage may not be continued if you fail to pay any required premium or if the master policy terminates. Instructions for continuing coverage will be provided within your certicate of coverage.How It Works: Aflac Group Disability Non-occupational coverage is selected with a 60% of salary benefit.Aflac Group Disability pays the certificate holder60%of his salary for the length of disability after the elimination period.The certificate holder hurts his back helping his friend move over the weekend.The certificate holder hurts his back helping his friend move over the weekend.A physician determines the certificateholder will be out of work for 1 month while recovering.The plan has limitations and exclusions that may aect benets payable. This brochure is for illustrative purposes only. Refer to your certicate for complete details, denitions, limitations, and exclusions. For more information, ask your insurance agent/producer, call 1.800.433.3036, or visit aacgroupinsurance.com.Page 26

LIMITATIONS AND EXCLUSIONSIf this coverage will replace any existing individual policy please be aware that it may be in your best interest to maintain their individual guaranteed-renewable policy.We will not pay benefits whenever coverage provided by this Policy is in violation of any U.S. economic or trade sanctions. If the coverage violates U.S. economic or trade sanctions, such coverage shall be null and void.We will not pay benefits whenever fraud is committed in making a claim under this coverage or any prior claim under any other Aflac coverage for which you received benefits that were not lawfully due and that fraudulently induced payment.We will not pay benefits for a Disability that is caused by or occurs as a result of: 1. Any act of war, declared or undeclared; insurrection; rebellion; or act of participation in a riot; 2. Actively serving in any of the armed forces, or units auxiliary thereto, including the National Guard or Reserve; 3. An intentionally self-inflicted Injury; 4. A commission of a crime for which the Insured has been convicted; we will not pay a benefit for any Period of Disability during which the Insured is incarcerated; 5. Travel in, or jumping or descent from any aircraft, except when a fare-paying passenger in a licensed passenger aircraft; 6. Mental Illness as defined; 7. Alcoholism or drug addiction; 8. An Injury thatarises from any employment; 9. Injury or Sickness that is covered by Worker’sCompensation.TERMS YOU NEED TO KNOWActively at Work refers to your ability to perform your regular employment duties for a full normal workday. You may perform these activities either at your employer’s regular place of business or at a location where you may be required to travel to perform the regular duties of your employment.Benefit Period is the maximum number of days after the Elimination Period, if any, for which you can be paid benefits for any period of disability. Each new Benefit Period is subject to a new Elimination Period.Effective Date is the date shown on the Certificate Schedule, provided you are actively at work, or if not, it is the date you are actively at work as an eligible employeeElimination Period is the number of continuous days at the beginning of your Period of Disability for which no benefits are payable. Each new Benefit Period is subject to a new Elimination Period. Injury refers to a bodily injury not otherwise excluded that is directly caused by a covered accident, is not caused by Sickness, disease, bodily infirmity, or any other cause, and occurs while coverage is in force.Mental Illness is defined as a Total Disability resulting from psychiatric or psychological conditions, regardless of cause. Mental Illnesses and Emotional Disorders includes but are not limited to the following: bipolar affective disorder (manic-depressive syndrome), delusional (paranoid) disorders, psychotic disorders, somatoform disorders (psychosomatic illness), eating disorders, schizophrenia, anxiety disorders, depression, stress, post-partum depression, personality disorders and adjustment disorders or other condition usually treated by a mental health provider or other qualified provider using psychotherapy, psychotropic drugs or other similar modalities used in the treatment of the above conditions.Partial Disability refers to your being under the care and attendance of a Doctor due to a condition that causes your inability to perform the material and substantial duties of your Full-Time Job. To qualify as Partial Disability, you are able to work at any job earning less than 80 percent of the Annual Income of your Full-Time Job at the time you became disabled.Sickness refers to a covered illness, disease, infection, or any other abnormal physical condition that is not caused by an Injury, first manifested and first treated after the Effective Date of coverage, and occurs while coverage is in force. Termination Coverage will terminate on the earliest of: (1) the date the master policy is terminated, (2) the 31st day after the premium due date if the required premium has not been paid, (3) the date you cease to meet the definition of an employee as defined in the master policy, (4) the date you no longer belong to an eligible class, (5) age 75.Total Disability refers to your being under the care and attendance of a Doctor due to a condition that causes your inability to perform the material and substantial duties of your Full-Time Job. To qualify as Total Disability, you may not be working at any job. You and Your refers to an employee as defined in the Plan.Continental American Insurance Company (CAIC), a proud member of the Aflac family of insurers, is a wholly-owned subsidiary of Aflac Incorporated and underwrites group coverage. CAIC is not licensed to solicit business in New York, Guam, Puerto Rico, or the Virgin Islands. Continental American Insurance Company • Columbia, South CarolinaThe certificate to which this sales material pertains may be written only in English; the certificate prevails if interpretation of this material varies.This brochure is a brief description of coverage and is not a contract. Read your certificate carefully for exact terms and conditions. You’re welcome to request a full copy of the plan certificate through your employer or by reaching out to our Customer Service Center. This brochure is subject to the terms, conditions, and limitations of Policy Form Series CC50000SC.Page 27

18 - 4950 - 6465 - 741.331351.465561.18901Annual Salary RangeMonthly Benefit18 - 49 50 - 64 65 - 74$9,000 or more$300 $4.00 $4.40 $5.46$9,000 to $9,999$400 $5.32 $5.87 $7.27$10,000 to $11,999$500 $6.65 $7.33 $9.10$12,000 to $13,999$600 $7.99 $8.80 $10.91$14,000 to $15,999$700 $9.32 $10.25 $12.74$16,000 to $17,999$800 $10.65 $11.72 $14.55$18,000 to $19,999$900 $11.99 $13.19 $16.37$20,000 to $21,999$1,000 $13.31 $14.65 $18.19$22,000 to $23,999$1,100 $14.64 $16.12 $20.01$24,000 to $25,999$1,200 $15.98 $17.59 $21.82$26,000 to $27,999$1,300 $17.31 $19.05 $23.65$28,000 to $29,999$1,400 $18.64 $20.52 $25.46$30,000 to $31,999$1,500 $19.97 $21.99 $27.29$32,000 to $33,999$1,600 $21.30 $23.45 $29.11$34,000 to $35,999$1,700 $22.63 $24.92 $30.92$36,000 to $37,999$1,800 $23.96 $26.38 $32.75$38,000 to $39,999$1,900 $25.30 $27.85 $34.56$40,000 to $41,999$2,000 $26.63 $29.31 $36.38$42,000 to $43,999$2,100 $27.96 $30.77 $38.20$44,000 to $45,999$2,200 $29.29 $32.24 $40.02$46,000 to $47,999$2,300 $30.62 $33.71 $41.83$48,000 to $49,999$2,400 $31.95 $35.17 $43.66$50,000 to $51,999$2,500 $33.28 $36.64 $45.47$52,000 to $53,999$2,600 $34.62 $38.10 $47.30$54,000 to $55,999$2,700 $35.95 $39.57 $49.11$56,000 to $57,999$2,800 $37.27 $41.04 $50.93$58,000 to $59,999$2,900 $38.61 $42.50 $52.75$60,000 or more$3,000 $39.94 $43.97 $54.57Enrollment RatesHampton County School DistrictGroup Disability Rate TableDeduction Frequency Semi-monthly (24 PP / Year)Age BandPremium Rate / $100 BenefitGP-36518 - Plan 238301Page 28

www.reliancestandard.com This Plan Highlight is not a complete description of the insurance coverage. Insurance is provided under group policy form LRS-8349, et al. This is not a binding contract. Should there be a difference between this Plan Highlight and the contract, the contract will govern. The Certificate of Coverage will be made available to you that describes the benefits in greater detail; however a benefit will not be paid if caused or contributed by an exclusion listed in the Certificate. Reliance Standard Life Insurance Company is licensed in all states (except New York), the District of Columbia, Puerto Rico, the U.S. Virgin Islands and Guam. In New York, insurance products and services are provided through First Reliance Standard Life Insurance Company, Home Office: New York, NY. Product features and availability may vary by state. Plan Highlights Educator Life Insurance Plan for Hampton County School District GUARANTEED ISSUE Initial eligibility period only Employee: Under age 60: $200,000 Age 60 but less than age 70: $200,000 Age 70 and over: $200,000 Spouse: Under age 60: $50,000 Age 60 but less than age 70: none Age 70 and over: none Child(ren): $10,000 CONTRIBUTION REQUIREMENTS Coverage is 100% Employee Paid. BENEFIT REDUCTION DUE TO AGE (Applicable to employee / spouse coverage) At Age Face Amount Reduces To Voluntary Group Term Life ELIGIBILITY All Active Full-Time Employees working 30 hours or more per week, except for any person working on a temporary or seasonal basis. Dependents: You must be insured for your Dependents to be covered. Dependents are: f Your legal spouse who is not legally separated or divorced fromyo u, under age 70 on application date.f Your legally-recognized domestic or civil union partnerf Your unmarried financially dependent children birth to 20 years(to 26 years if full-time student).f A person may not have coverage as both an Employee andDependent.f Only one insured spouse may cover dependent children.BENEFIT AMOUNT Voluntary Life: Choose from a minimum of $10,000 to a maximum of$500,000 in $10,000 increments; subject to a salary cap of 10 times base annual earnings. Spouse: Choose from a minimum of $10,000 to a maximum of$500,000 in $10,000 increments. Child(ren): Birth but less than 6 months: $1,000; 6 months through age 20: A choice of $2,500, $5,000, $7,500, or $10,000 (up to age 26 if a full-time student). 75-79 60% of available or in force amount at age 7480-84 35% of available or in force amount at age 7485-89 27.5% of available or in force amount at age 7490-94 20% of available or in force amount at age 7495-99 7.5% of available or in force amount at age 74100 + 5% of available or in force amount at age 74RATES PER $10,00018-39: $0.8040-59: $1.8060+: $2.50Child(ren) per month:$2,500: $0.42$5,000: $0.82$7,500: $1.22$10,000: $1.62FEATURESPortabilityWaiver of PremiumPage 29